RBNZ Review: No More Cut Signaled

RBNZ cut its cash rate by 50bp to 2.25%

Signals no more cut

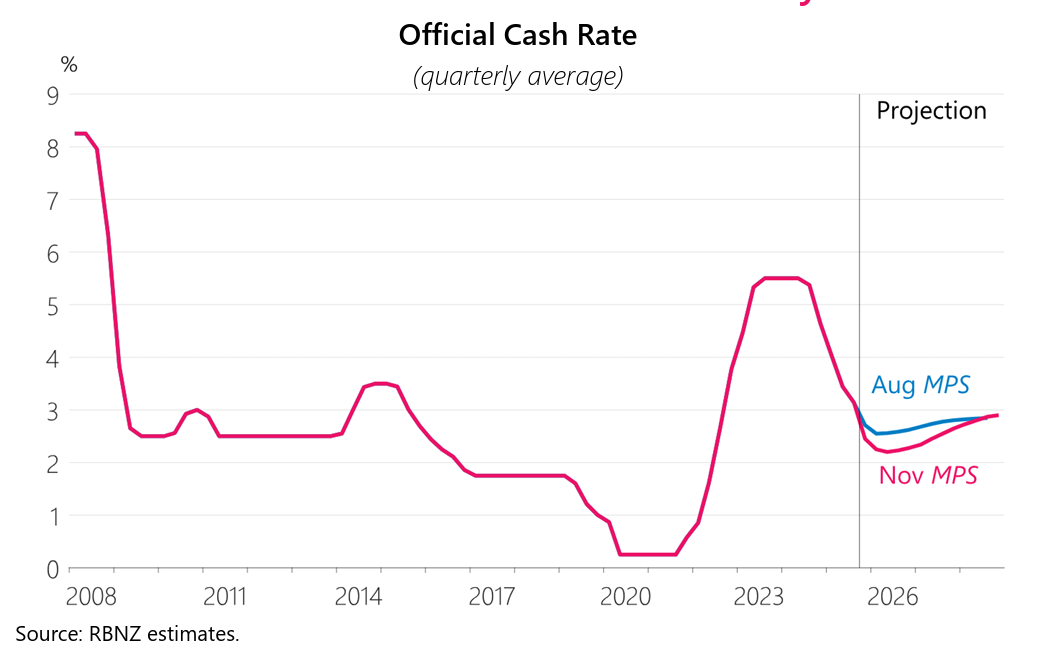

The RBNZ cut its cash rate by 25bp to 2.25% in the November meeting and signal there will be no more rate cut. The RBNZ downplayed the spike of Q3 CPI by transitory factors and expect inflationary pressure to ease back towards mid point of target range in 2026. The OCR forecast is seeing no more rate cut from the current 2.25% and first rate hike in late 2026, a pace slightly sharper than August OCR forecast. The reason for RBNZ's 25bps cut seems to be slow economic recovery from U.S. tariffs and geopolitical uncertainty.

Some key takeaways:

Inflation Expectation: As previewed in the October meeting, Q3 CPI is at the top band of target range but is not bothering the RBNZ. They attributed the spike in inflation to "higher tradables inflation along with high inflation in household energy costs and local council rates", factors that are deemed to ease in 2026. Their forecast see inflation to moderate towards the mid point of target range in 2026.

Spare Capacity & Economic Recovery: The RBNZ highlight "spare capacity" in their statement again. They continue to see economic activity in New Zealand being weak. While tariffs and broad geopolitical uncertainty curbed economic recovery, the RBNZ believes the weakness has been overstated from seasonal adjustment.

Slowing Outlook: The RBNZ believe the global economic outlook will slow in 2026 after the AI boom in 2025. Thus, the risk to outlook has tilted towards balance.