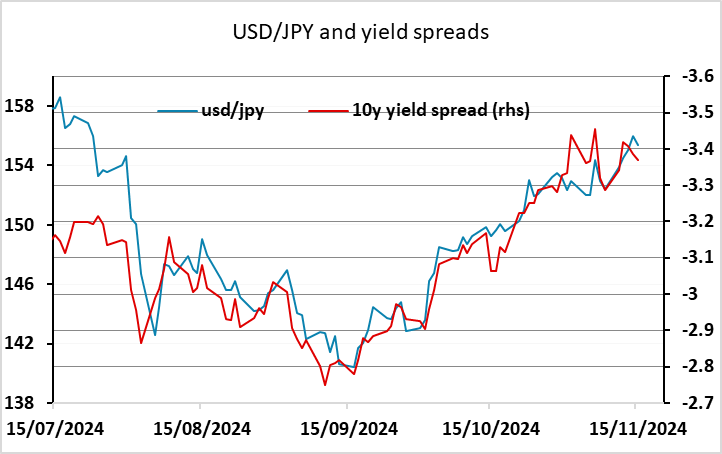

JPY flows: Turning lower helped by yield spreads

USD/JPY has bounced off a Fibnacci retracement level at 156.66 and has moved more than a figure lower helped by rising JGB yields and speculation of BoJ tightening in december.

USD/JPY is coming under pressure after hitting the Fibonacci retracement level at 156.66 overnight. Yield spreads have also moved in the JPY’s favour, with JGB yields edging higher and US 10 year treasury yields a touch lower. There is also some market speculation about Ueda’s speech scheduled for Monday. The market has increases its expectations of a December rate hike, with 13bps of tightening now priced in, suggesting a 10 bp move is more than fully priced and there is now seen to be a better than 50% chance of a 25bp hike. While movements in US yields are still likely to dominate short term moves, the hiking cycle form the BoJ combined with the easing cycle form the Fed suggest the downside risks dominate for USD/JPY, even if the Fed eases a little less than as expected before the Trump victory.