GBP flows: GBP steady after spring statement

UK yields lower but GBP steady after spring statement, implying a positive market response, but GBP risks are still on the downside

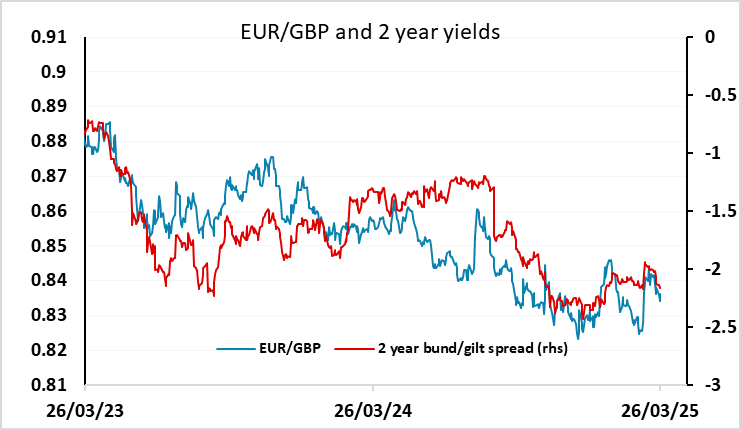

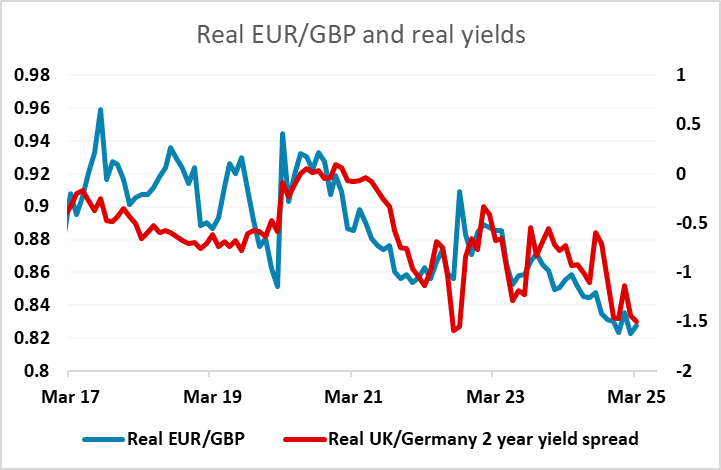

The UK spring statement has had little impact on GBP, with EUR/GBP holding near the 0.8365 level that it rose to after the weaker than expected inflation data earlier. However, gilt yield are a little lower, which should be seen as a positive market response, suggesting that the market sees the further planned spending cuts (rather than tax increases) from Chancellor Reeves as the correct response to deal with the lower growth and higher debt interest problems that she faced relative to October. That GBP has held steady despite the yield decline is a positive sign, but we would nevertheless see downside risks to the pound from here, with the UK not matching the fiscal expansion being seen in the Eurozone in the coming years (primarily from Germany).