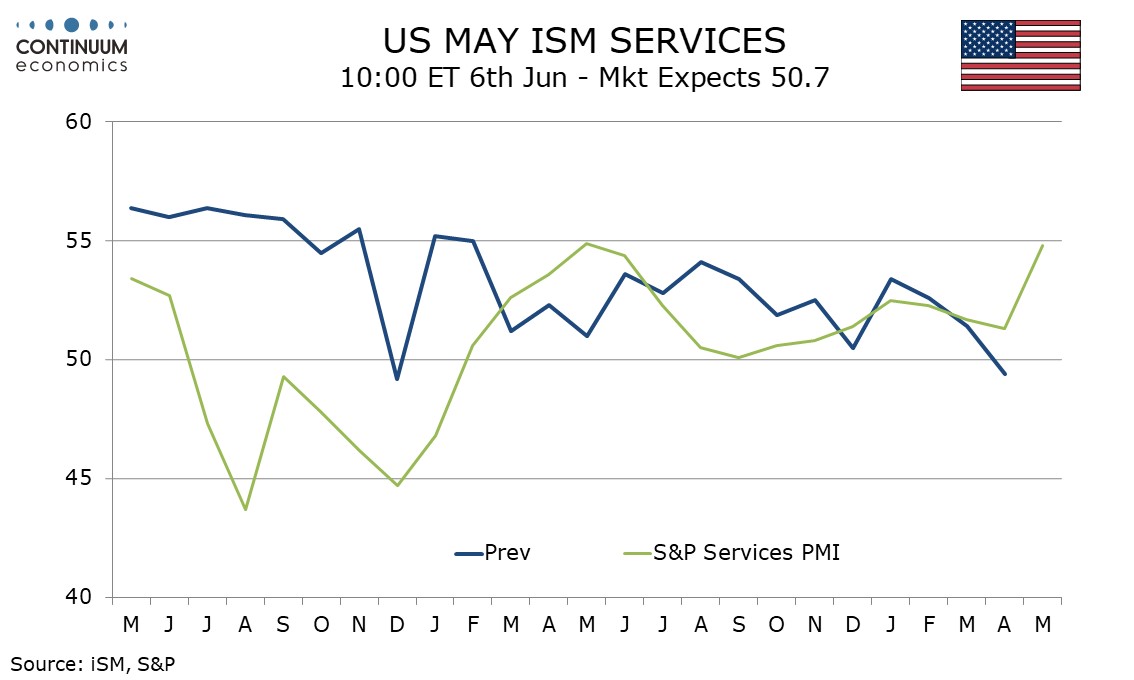

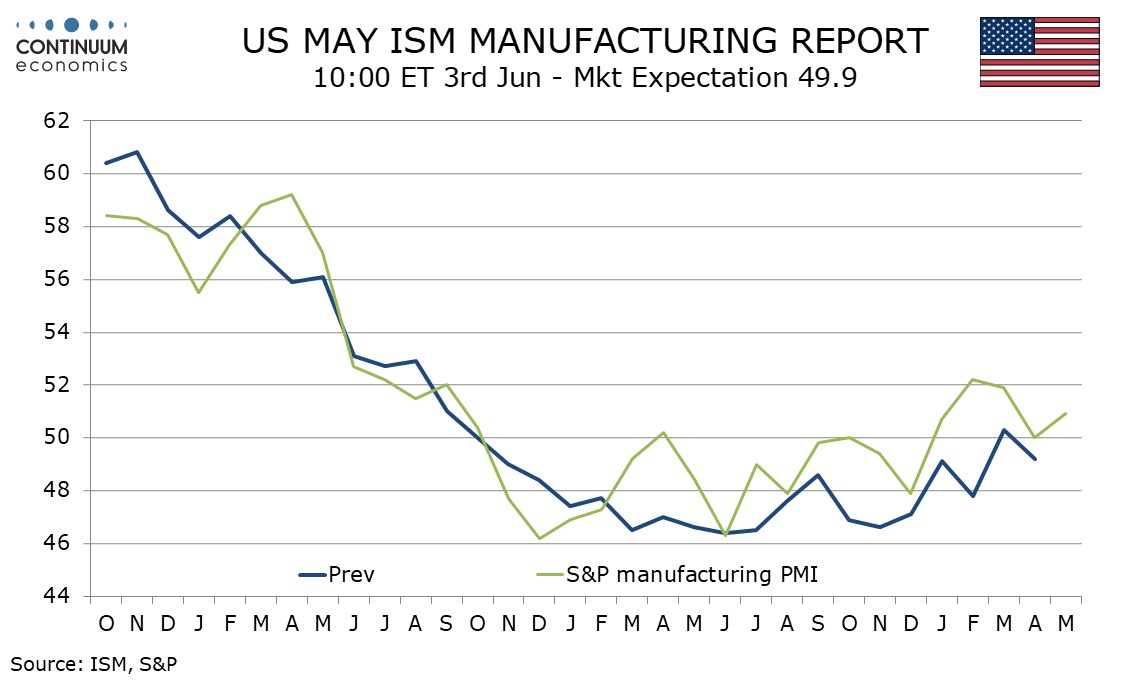

U.S. May S&P PMIs - Rebounding from weaker April, Services to a 12-month high

May’s stronger preliminary S and P PMIs contrast April data which suggested a loss of momentum in the economy entering Q2, with manufacturing rising to 50.9 from 50.0 and services seeing quite a sharp bounce to 54.8 from 51.3, more than fully reversing three straight declines.

The manufacturing index restores a positive picture after a return to neutral in April and means each month in 2024 to date has been neutral or positive. This suggests the ISM manufacturing index will sustain a recent improvement to near neutral even if the Empire State index remained negative and the Philly Fed’s was less positive in May.

The S and P services index appears responsive to moves in bond yields given improvement as bond yields fell in late 2023 and slippage as bond yields increased in early 2024. While there has been some recent slippage in bond yields for the S and P services index to fully reverse the slippage of the last three months and more is a surprisingly strong bounce. The index is at a 12-month high.