GBP flows: GBP firmer as CPI surprises on the upside

June CPI higher than expected, driven by transport costs. Detail less strong but GBP should find support as market is likely to slightly reduce chances of aggressive BoE easing.

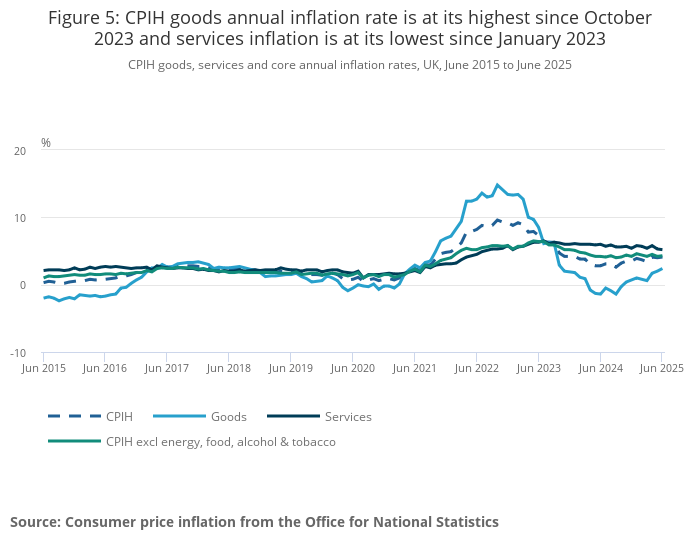

UK June CPI data has come in well above expectations at 3.6% y/y headline and 3.7% y/y core. Transport costs were the biggest positive contributor on the month, and the detail is a little less worrying than the headline, with services inflation falling to 5.2% y/y from 5.3% in May. Much of the rise in inflation looks to be supply rather than demand related, and is thus less of a reason for tight policy. But the data will nevertheless make it a little less likely that the BoE will cut rates aggressively. The market was pricing an August rate cut as an 85% chance ahead of the data, and this is unlikely to change much. There is also still likely to be one further cut priced in for the year. The scope for bigger cuts looks more likely to be in 2026, where there was only one cut priced ahead of the data.

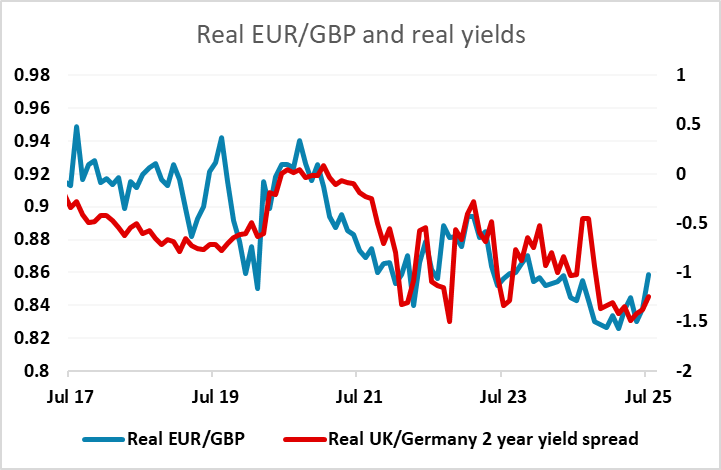

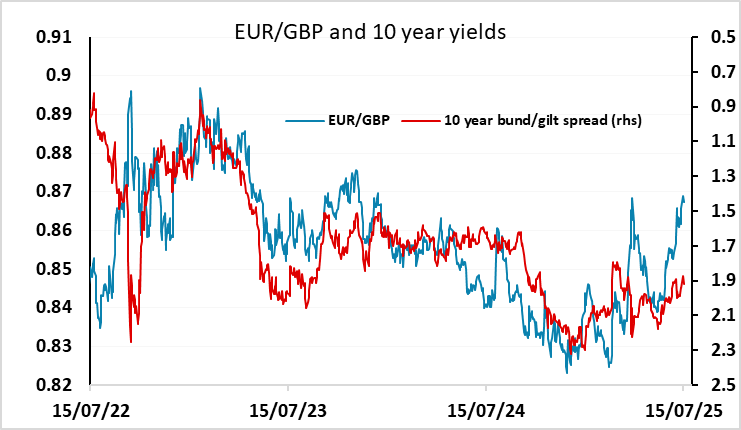

GBP has rallied modestly on the data., with EUR/GBP dropping 10 pips to 0.8665. As it stands, EUR/GBP has moved a little ahead of yield spreads in recent weeks, so there may be scope for a further modest decline, but we continue to see longer term downside for GBP as in real terms EUR/GBP remains cheap and has scope for a move above 0.90 if real rates converge with the Eurozone.