EUR, USD flows: EUR continues to find support below 1.12

Strong European equity market performance underpins the EUR for now

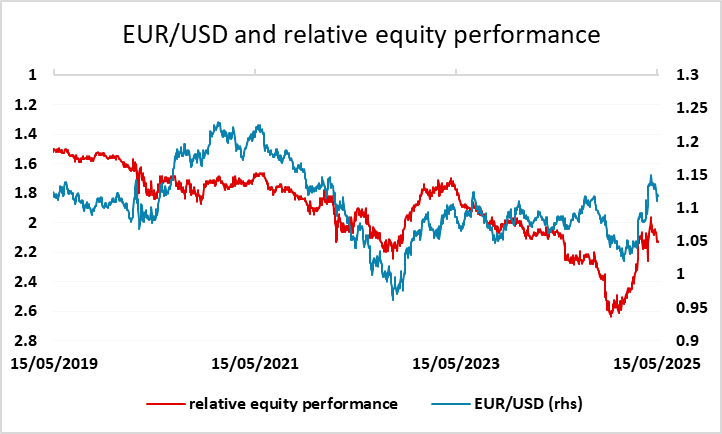

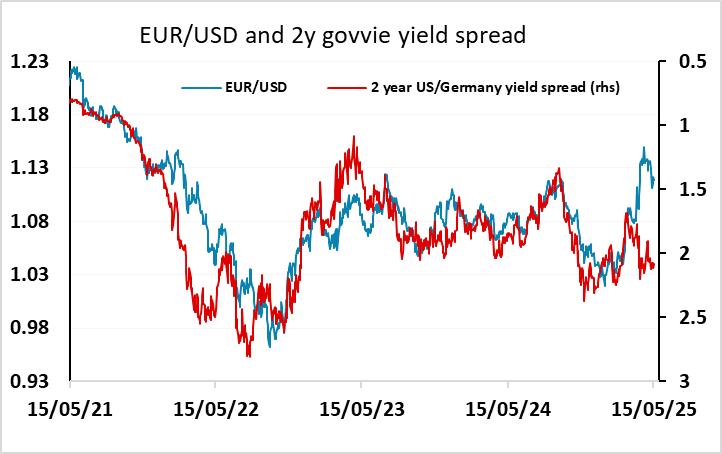

The USD is a little softer in a relatively quiet overnight session, and there isn’t a great deal on the calendar to move the markets in Europe this morning. The US data this afternoon is also second tier, so a fairly rangy day seems likely. EUR/USD continues to find support on dips below 1.12, even though yield spreads continue to suggest downside risks. One of the reasons may be the continued demand for European equities. Bank of America report inflows into European equities for the 5 straight week, and the outperformance of European equities this year is a significant factor in the strength of the EUR. However, the last week saw inflows into US equities for the first time in 5 weeks, so this is now a less clear-cut reason for EUR strength. European equity outperformance would likely see further EUR gains, but this is likely to require better European data and/or weakness in the US. Even though valuations in Europe look more reasonable, it is rare to see European outperformance in a rising equity market. As long as we see equities hold below the late February/early March highs, the EUR should hold its own, but any break higher would likely favour the USD.