CAD flows: CAD weakens on soft CPI

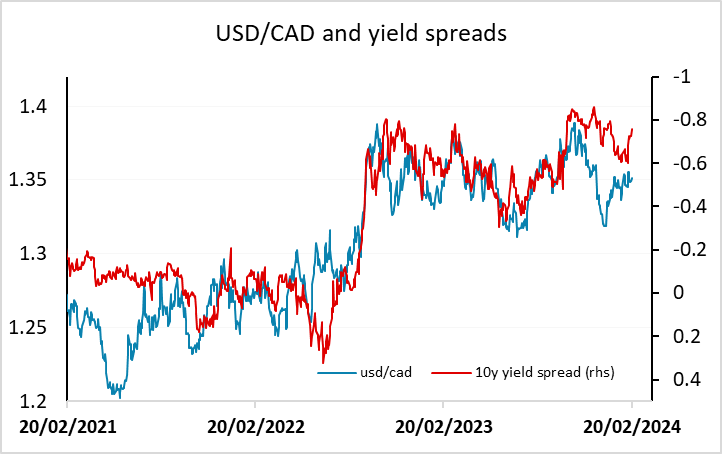

Canadian January CPI weak across the board, suggesting USD/CAD has scope to 1.3550

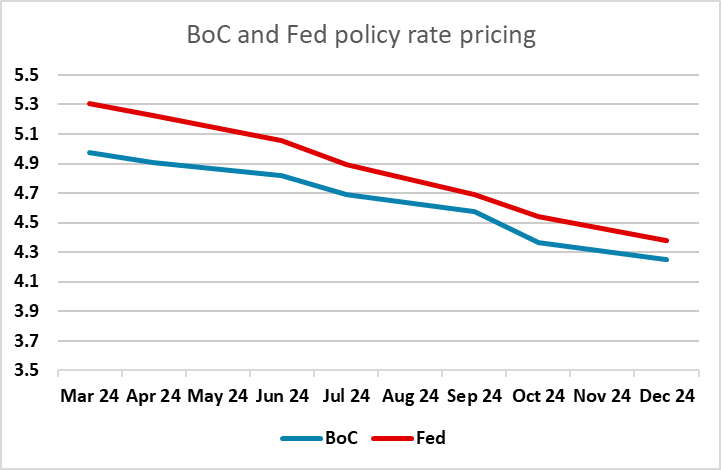

Canadian January CPI is notably weaker than expected in all the main measures. Headline came in at 2.9% y/y against the consensus of 3.3% y/y, and the three measures the BoC looks at as core – common, median, and trimmed – were also 0.2%-0.4% lower than expected on a y/y basis, ranging from 3.3% to 3.4%. Canadian 2 year yields are down around 13bps in response, and the CAD has fallen in response, although the 30 pip rise in USD/CAD is quite modest given the move in yields. There should be further potential upside for USD/CAD, as it is starting from a position that looks a little low relative to yield spreads, and the BoC is currently priced to ease somewhat less than the Fed this year – a little over 3 cuts compared to a little under 4. This data should dispel some of the concerns about the persistence of Canadian inflation and should persuade the BoC to move in line with the Fed. There should be USD/CAD scope to at least 1.3550.