NOK flows: NOK recovered slighty on stronger CPI

July CPI slightly on the strong side, but NOK remains weak

Norway CPI

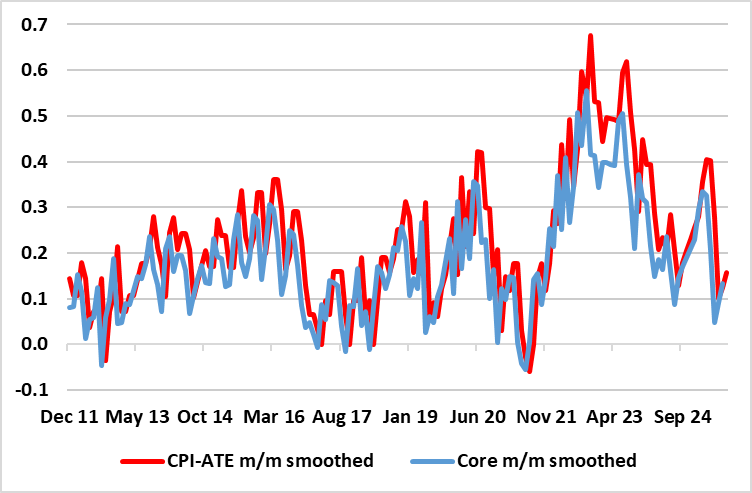

The week kicks off with Norwegian CPI data, which has come in on the strong side of consensus, with the core rate unchanged at 3.1% and the headline rate up to 3.3% y/y. EUR/NOK has edged a little lower, although the underlying picture remains quite subdued, and the market expectation of another Norges Bank rate cut in September – priced at almost a 90% chance – is unlikely to be much affected.

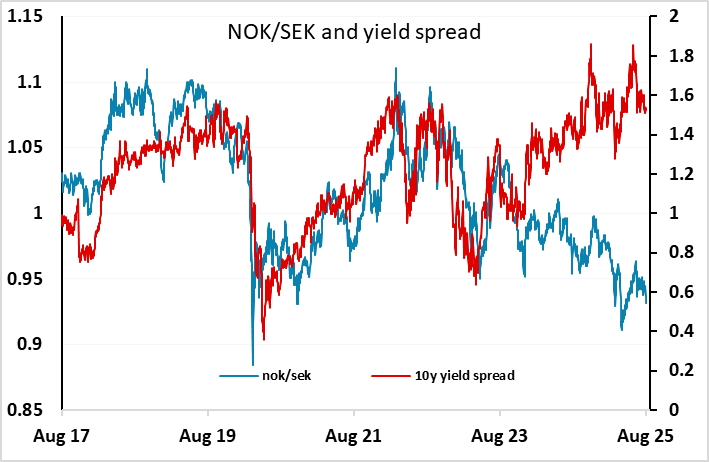

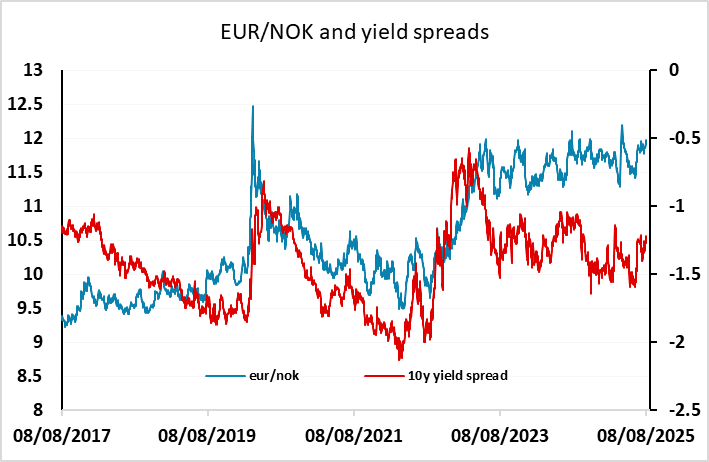

Even so, the weakness of the NOK remains something of a puzzle, with EUR/NOK pressing near the all time highs and NOK/SEK also continuing to trade well below the levels suggested by yield spreads, with the correlation with yield spreads having been broken in late 2023. The Norwegian economy remains comparatively healthy and a safe haven given the huge budget and current account surpluses, so the weakness of the NOK remains hard to explain, especially since current yields still offer a pick-up over the EUR and SEK. Still, recent experience suggests we are unlikely to see a rapid NOK recovery. But EUR/NOK levels near 12 are nevertheless likely to represent a good longer term selling opportunity, while NOK/SEK should find strong support near 0.93.