RBNZ Review: Keeping Their Cool

RBNZ keeps rate unchanged 2.25%

Inflation Outlook Seems Dovish

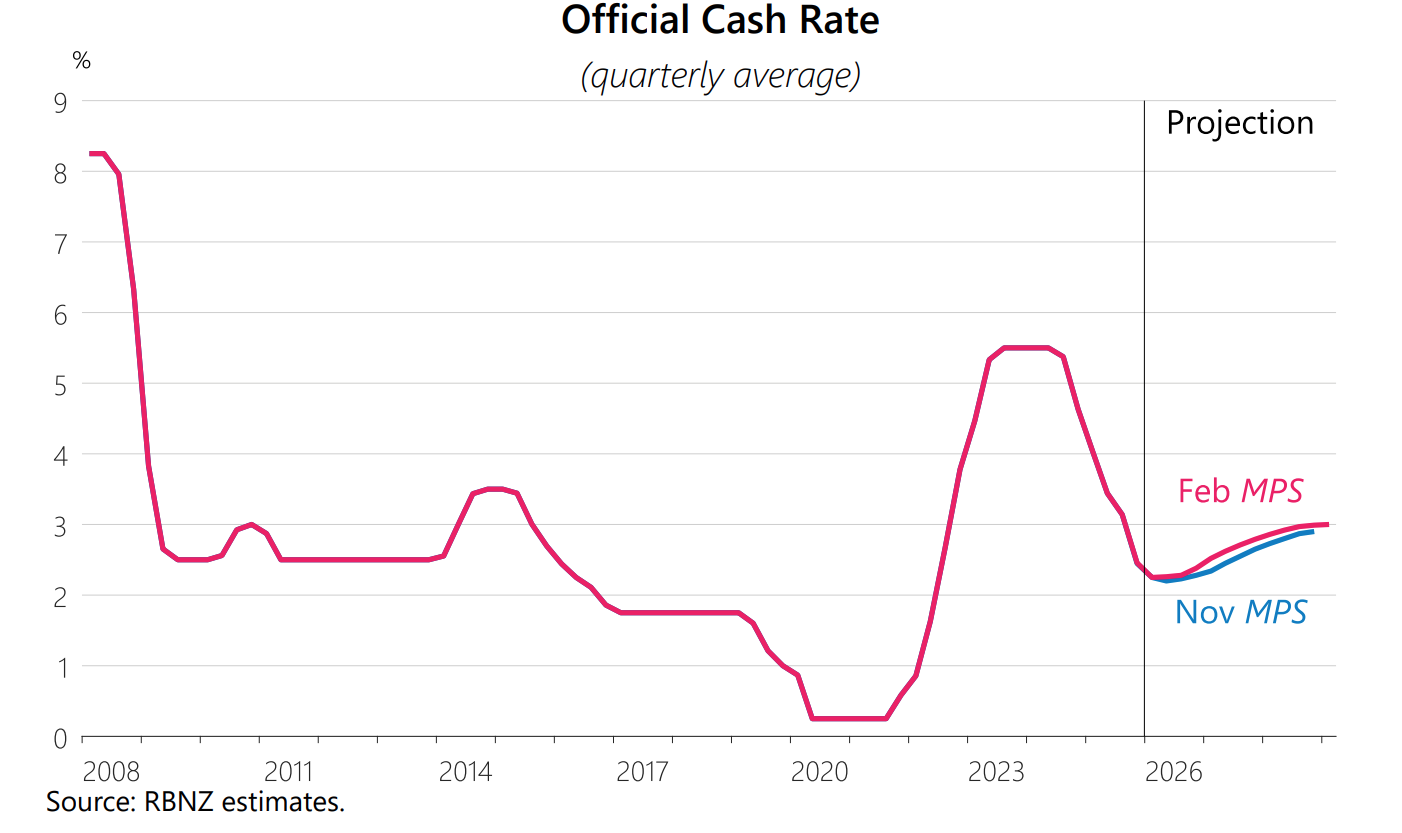

The RBNZ kept rates unchanged at 2.25% in the February meeting and signal they will be on hold for a while. The RBNZ continue to see current overshooting inflation transitory from food, international airfares, and overseas accommodation. They believe inflation will return to target range in Q1 2026 and reach mid point in Q1 2027. The February OCR forecast is little changed from the November forecast, pointing towards the first hike in Q4 2026.

Some key takeaways:

Balance Inflation Outlook: Despite the current overshoot, the RBNZ see inflation risk to be balanced. Both underlying and transitory pressure are considered, so as domestic and global demand. The forecast is suggesting all sides are balanced.

Spare Capacity: The RBNZ highlight "spare capacity" in their statement while signaling economic activity has recovered. They see spare capacity remains as unemployment rate increases but partial caused by increasing labor forces. Yet, "The economic recovery has been uneven across sectors and regions. Stronger activity has been observed in the rural economy and in the primary sector." suggest economic activity still need some more traction.

Global Outlook Uncertain: The RBNZ believe the global economic outlook to be highly uncertain, especially regarding trade policies, AI valuations and geopolitical tension. They also highlighted China's weak domestic demand and excess upply could be disinflationary.