Banxico Preview: Continuing at 25bps

Banxico will convene on May 9 to decide on the policy rate, having initiated a possible cutting cycle. Despite concerns, the MXN remains stable. The 25bps adjustment aims to maintain tight monetary policy while mitigating inflation. The board may split over this decision, but Banxico is likely to continue cautious cuts. Future actions will depend on data and market conditions.

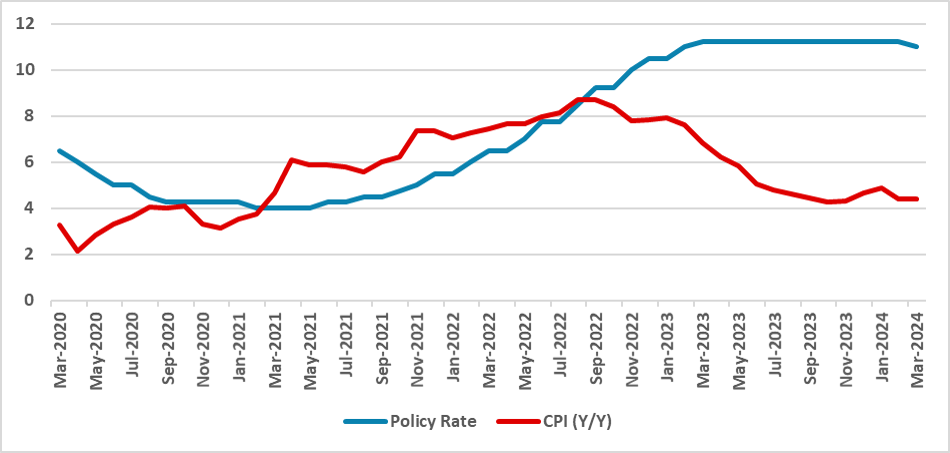

Figure 1: Mexico Policy Rate and CPI (%)

Source: Banxico and INEGI

The Mexico Central Bank (Banxico) will convene on May 9 to decide on the policy rate (Overnight). In their last meeting, Banxico cut rates for the first time since they started hiking, indicating the beginning of a possible cutting cycle. However, they were clear that the next hikes would be data-dependent. Although year-over-year (Y/Y) CPI was stable at 4.4% in March, forecasts point to a marginal growth of the CPI to 4.6% in April, due to an uptick in Food Prices. Additionally, Q1 GDP data has shown a 0.2% growth, which is a clear deceleration from the numbers registered during 2023.

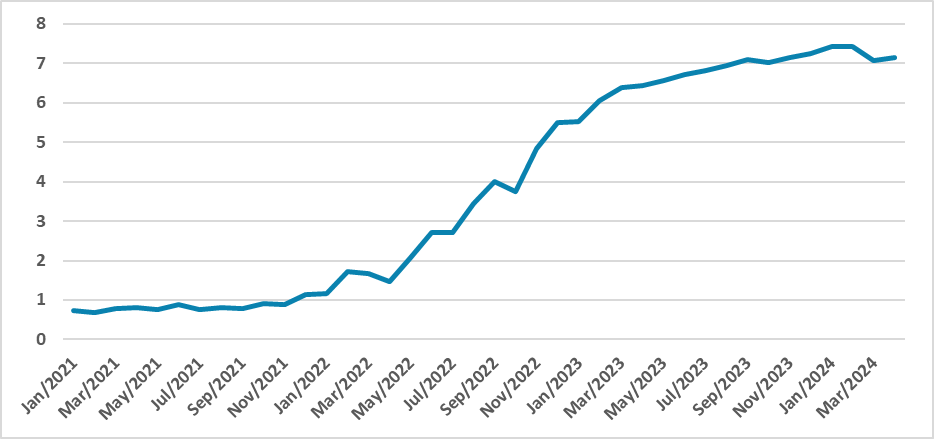

Figure 2: Real Ex-Ante Policy Rate (%)

Source: Banxico, INEGI and Continuum Economics

Despite concerns over a pause in the hiking cycle, especially due to an expected delay in FED cuts, the MXN is performing relatively well, and it will likely not be impacted by a 25bps cut, providing no reason for concern. Markets are being somewhat hawkish, expecting Banxico to pause over these concerns, but we believe this will not be the case within the Banxico board. The 25bps adjustment will still keep monetary policy tight and will only diminish the degree of tightening, which should help mitigate the rise in inflation. A 25bps pause would only ensure that the policy rate remains as tight as it was six months ago.

We believe the board will be split over the 25bps cut, with some members voting against hiking due to external risks (delay of FED cuts) and internal risks (looser fiscal policy), but the view of continuing cuts tends to prevail. Communication will likely maintain the same tone as the past communiqué, stating that the next cuts will be data-dependent. We maintain our view that Banxico will likely continue to cautiously cut the overnight rate at a 25bps pace. However, we see a modest chance of Banxico pausing the cutting cycle in case there is some inflationary surprise due to the looser fiscal policy and the tight labor market.