U.S. Q2 Employment Cost Index - Slower but still above pre-pandemic trend

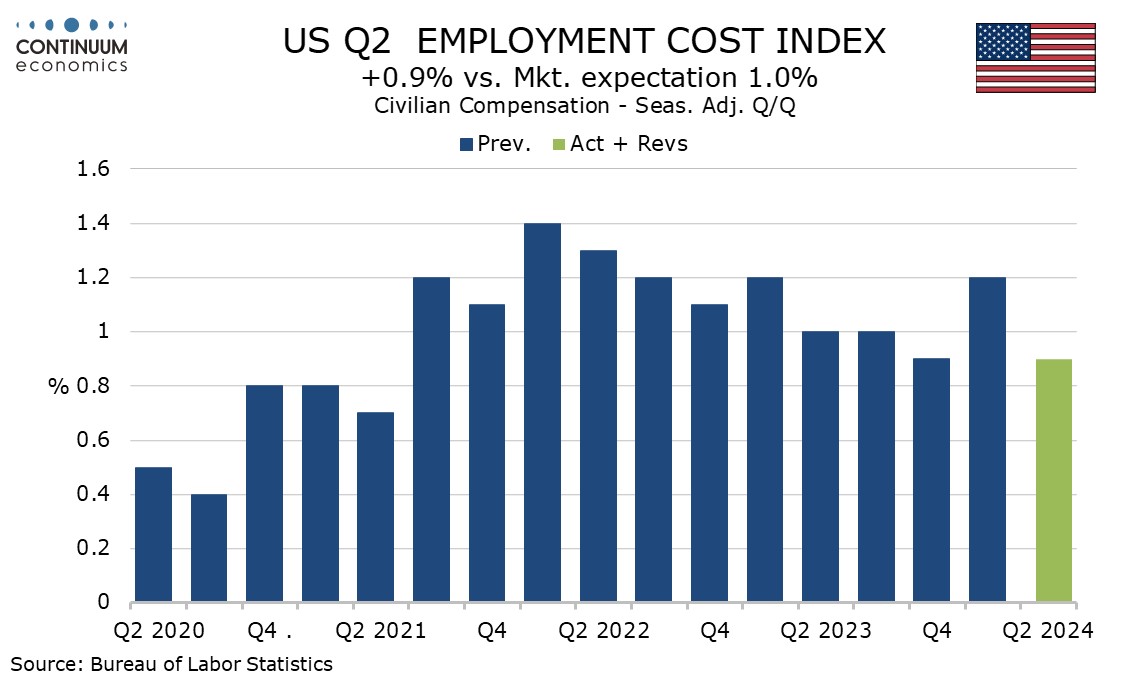

The Q2 Employment Cost Index with a 0.9% increase is slightly softer than expected and while still stronger than the pre-pandemic trend of around 0.7% per quarter supports views that the labor market is becoming less tight.

The gain follows an above trend 1.2% rise in Q1 which corrected a below trend 0.9% in Q4 2023.

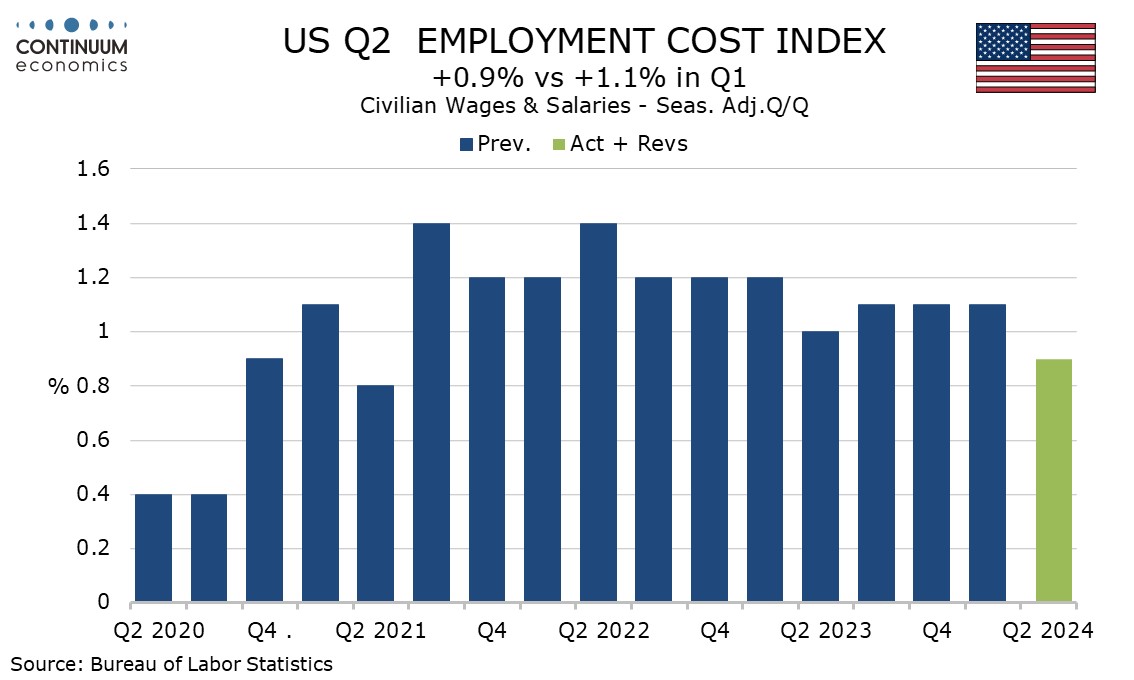

This 0.9% is a little more persuasive as a signal for slowing than the Q4 2023 data, with wages and salaries up by only 0.9%, the slowest since Q2 2021, after three straight quarters at 1.1%.

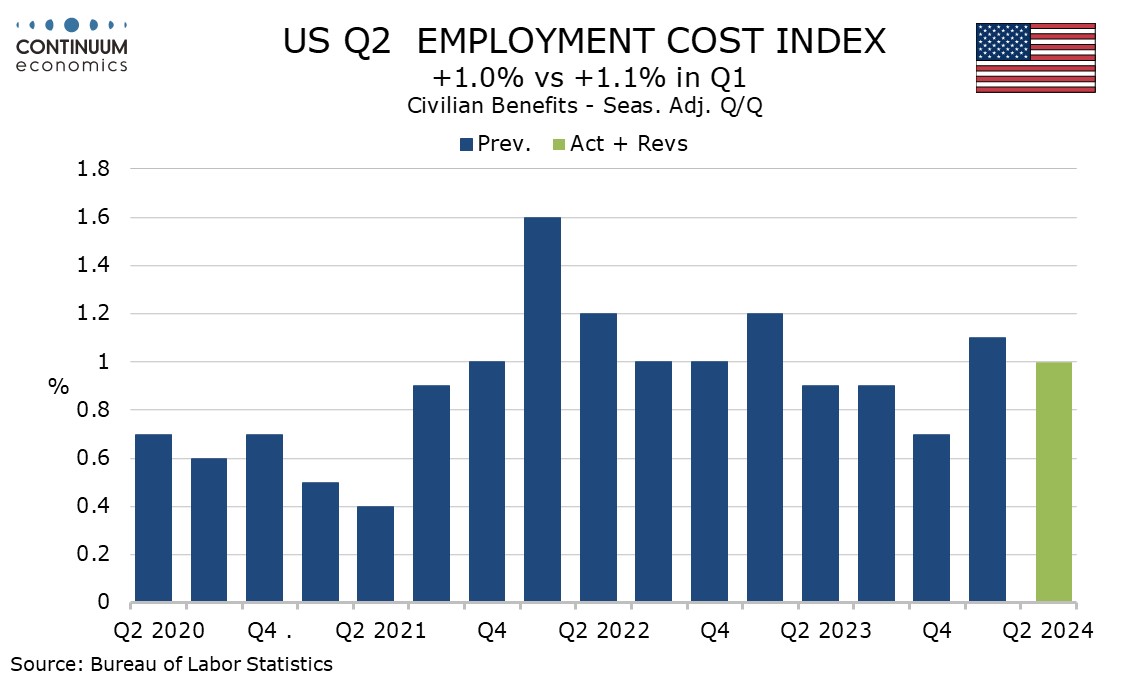

Benefits rose by 1.0% and have been stronger in the last two quarters than in the final three quarters of 2022. This corresponds with an increase in medical care inflation in the CPI.

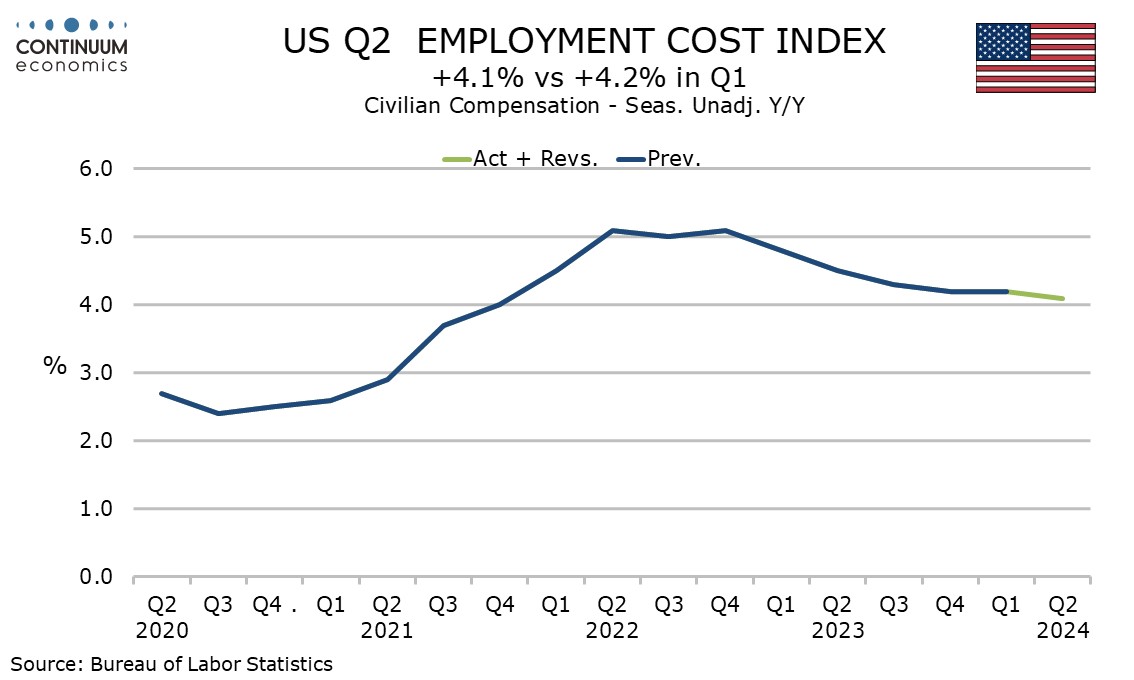

Yr/yr growth of 4.2% for wages and salaries is still above the 3.8% seen for benefit costs. The overall Employment Cost index is up 4.1% yr/yr, down from 4.2% in Q1 and a peak of 5.1% seen in Q2 and Q2 of 2022, but still well above the pre-pandemic trend that was a little below 3.0%.