NOK flows: Softer CPI but NOK still excellent value

Softer Norway CPI increases chance of March easng but NOK remains excellent value

Norwegian December CPI has come in on the weak side of expectations, following similar weakness sin Swedish CPI seen earlier this week. Core CPI fell to 2.7% y/y against a consensus of 2.8%, while headline was down to 2.2% against a 2.5% consensus. Norges Bank don’t typically react quickly to data, so it remains unlikely that we will see a rate cut at the January meeting, but the chances of a cut in March have increased. A 25bp cut in March is currently priced as around a 75% chance, but looks likely to move towards a higher probability unless we see stronger data in the next month.

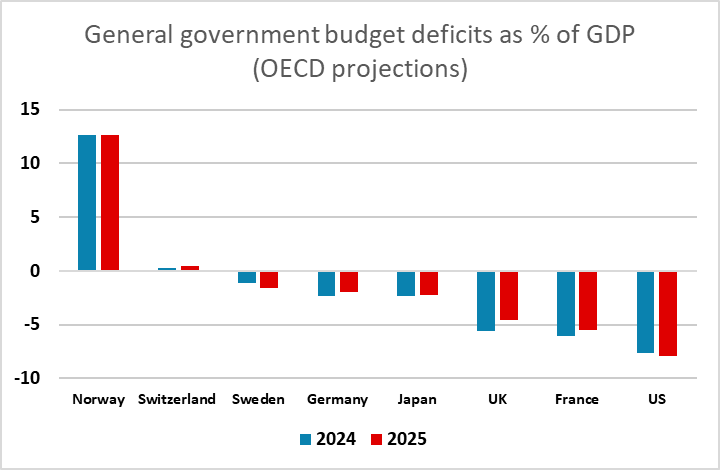

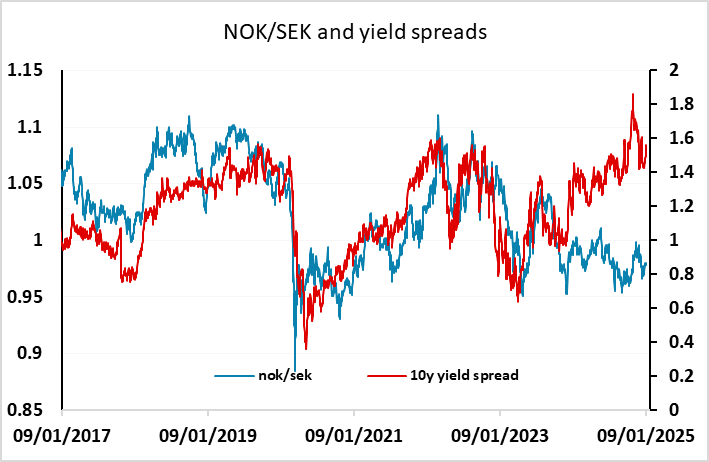

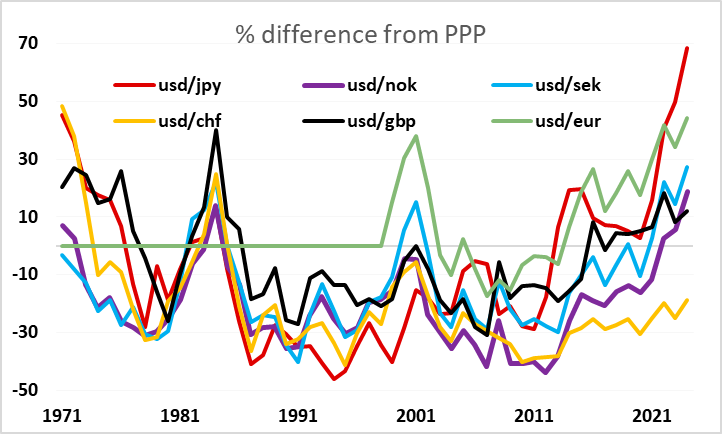

Even so, with the Swedish CPI data also soft earlier this week, we remain bullish on NOK/SEK, with the Riksbank currently priced as around a 50-50 chance to cut 25 or 50bps on January 29. Yield spreads are already supportive for NOK/SEK, and although the NOK underperformed spreads all through last year, a new year often means a new start. Valuewise, the NOK has weakened dramatically in recent years, but retains the attraction of a country with very solid public finances and a huge current account surplus. In a world where budget deficits are increasingly being seen as a concern, the NOK looks like both a safe haven and a positive yield and value play.