U.S. Initial Claims and Q2 GDP revision details mostly constructive

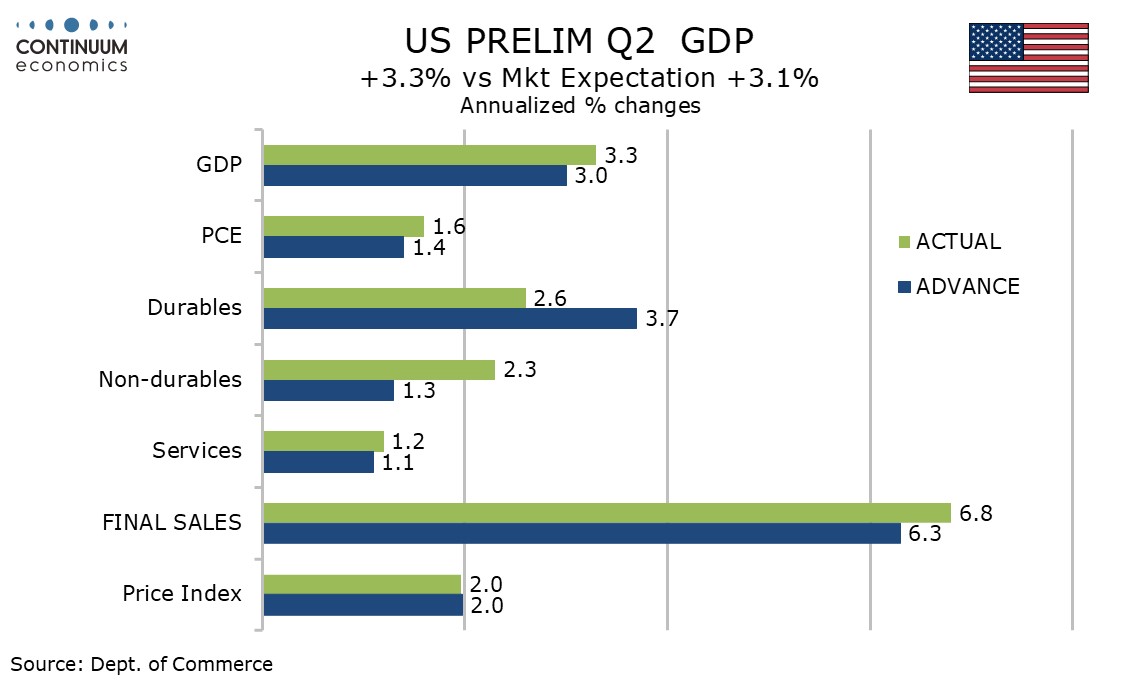

The latest data makes fairly encouraging reading for the US economy. The upward revision to Q2 GDP to 3.3% from 3.0% is stronger than expected and the detail is positive with the revision led by private sector domestic demand. Lower initial and continued claims also suggest the labor market, while having slowed, is not sending any recessionary signals.

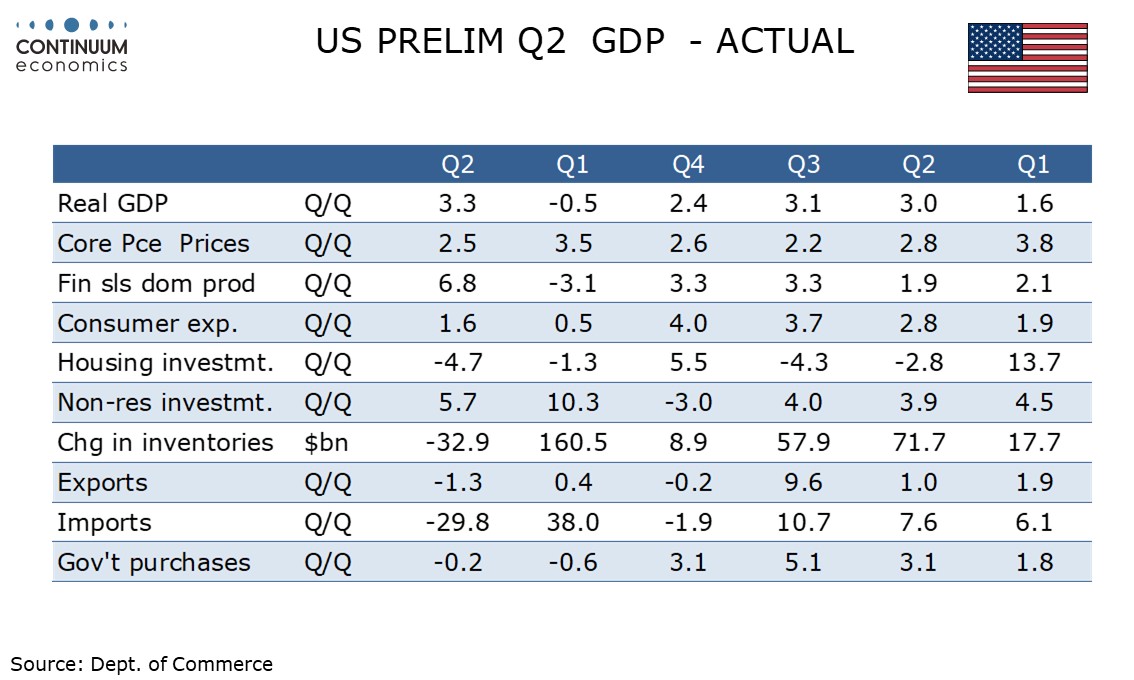

The GDP detail showed upward revisions to consumer spending to 1.6% from 1.4% and fixed investment to 2.8% from 0.4%. The consumer data saw modest upward revisions to both goods and services though within goods durables were revised lower and non-durables revised higher.

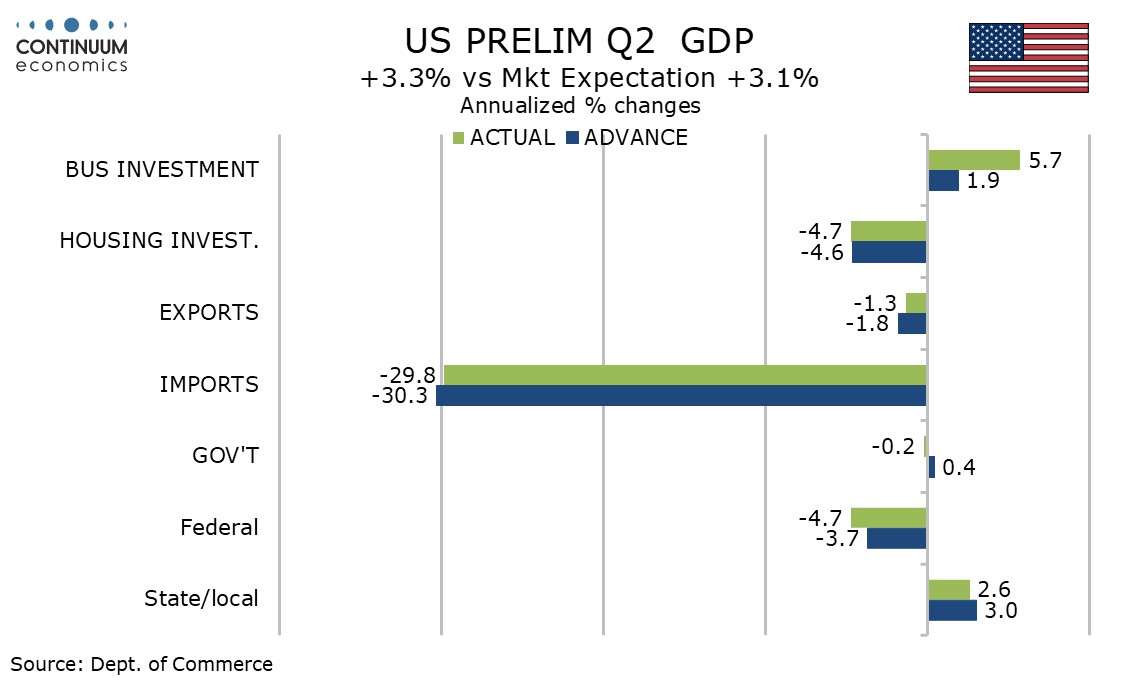

Business investment was revised up to 5.7% from 1.9% in a broad based revision with intellectual property particularly strong at 12.8% from 6.4%. Housing was revised marginally lower to -4.7% from -4.6%.

Final sales to private domestic purchasers were revised up to 1.9% from 1.2% and that leaves the pace the same as in Q1 and can be seen as suggesting respectable underlying growth. Government was revised to a 0.2% decline from a 0.4% increase.

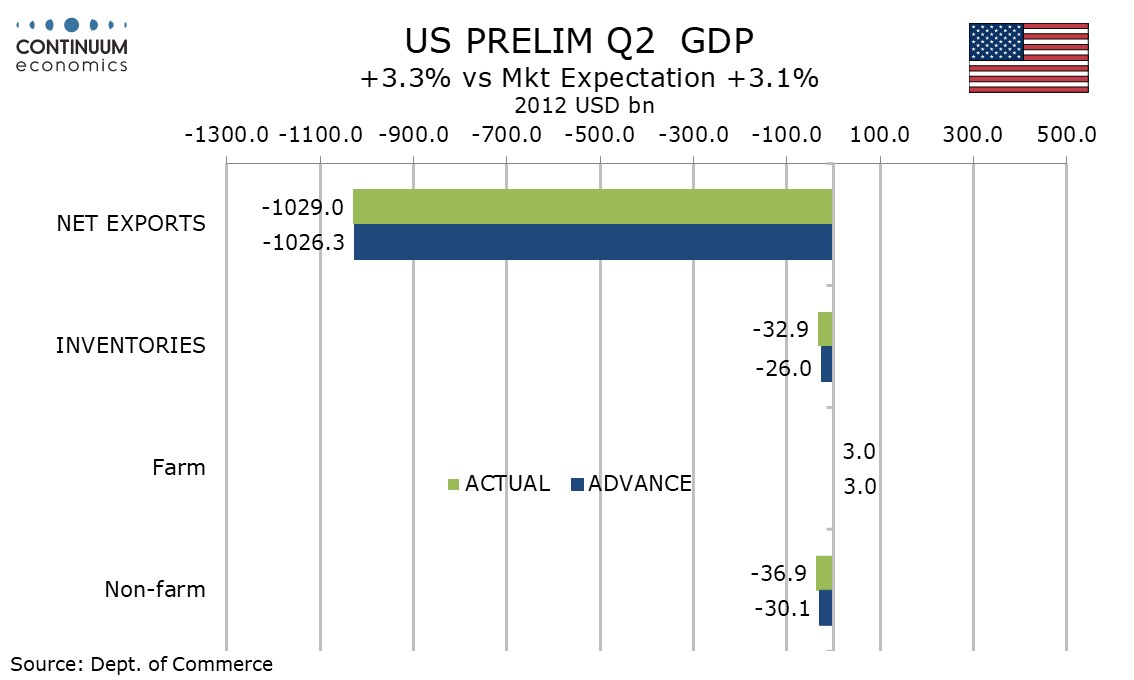

Net exports were revised slightly higher with exports and imports both less negative while inventories were revised more significantly lower, reducing downside risk to Q3. Final sales were revised up to 6.8% from 6.3%, this following a 3.1% decline in Q1 that was due to pre-tariff weakness in net exports.

This release sees the first estimate of Q2 Gross Domestic Income and that was stronger than GDP at 4.8%, following a 0.2% increase in Q1 that also outperformed GDP, which fell by 0.5% in Q1. Disposable personal income was unrevised at 3.0%, though this in following a 2.5% rise in Q1 means disposable personal income has outperformed consumer spending in both Q1 and Q2, suggesting consumers have support entering Q3.

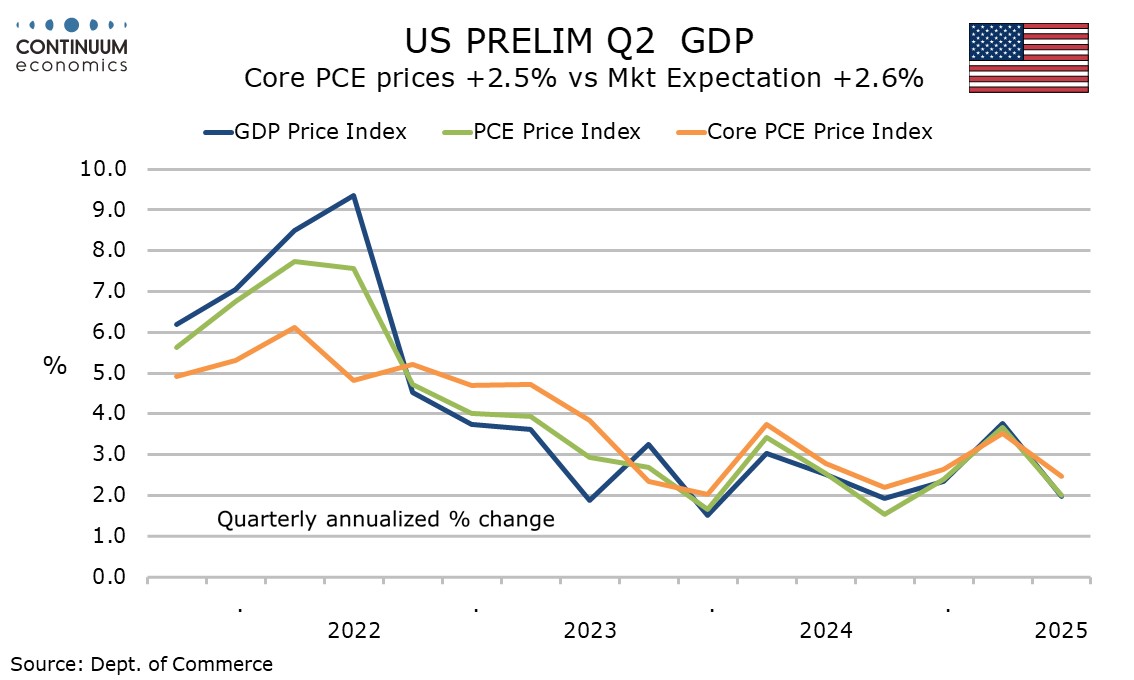

The core PCE price index was unrevised at 2.5% though overall PCE prices were revised marginally lower to 2.0% from 2.1%, while the GDP price index was unrevised at 2.0%. The Fed’s 2.0% target is for core PCE prices.

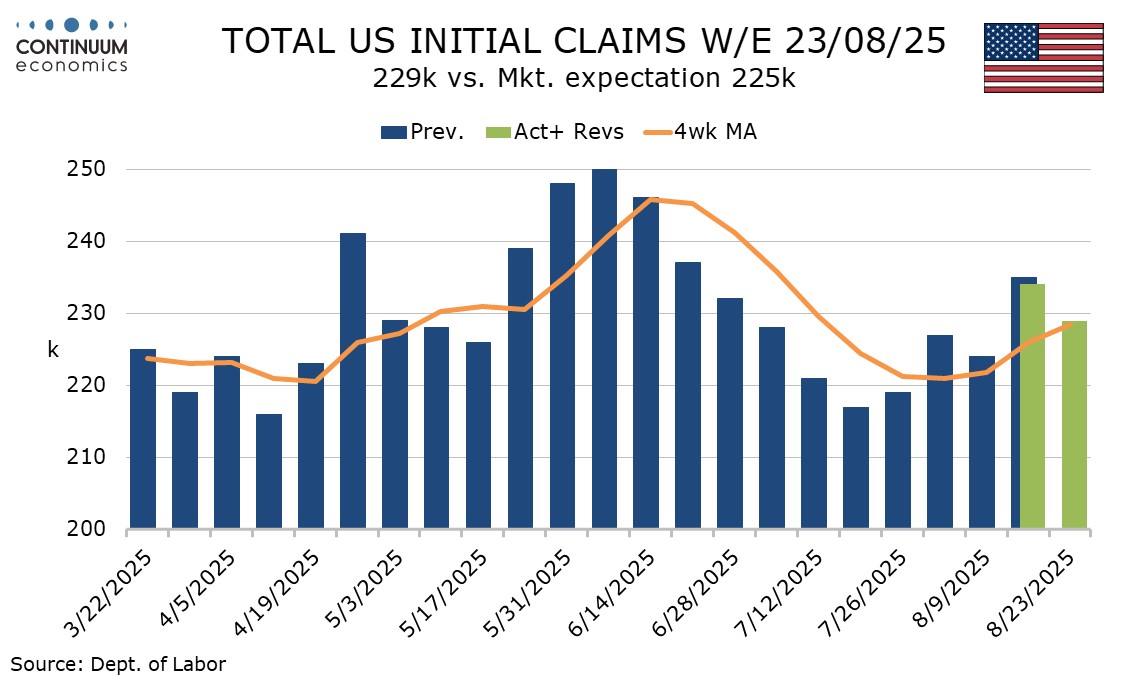

Initial claims at 229k corrected last week’s bounce to an 8-week high of 234k though remain above the 224k seen two weeks ago. Before seasonal adjustment however claims have seen two straight declines, to 191k this week from 194k last week and 199k two weeks ago.

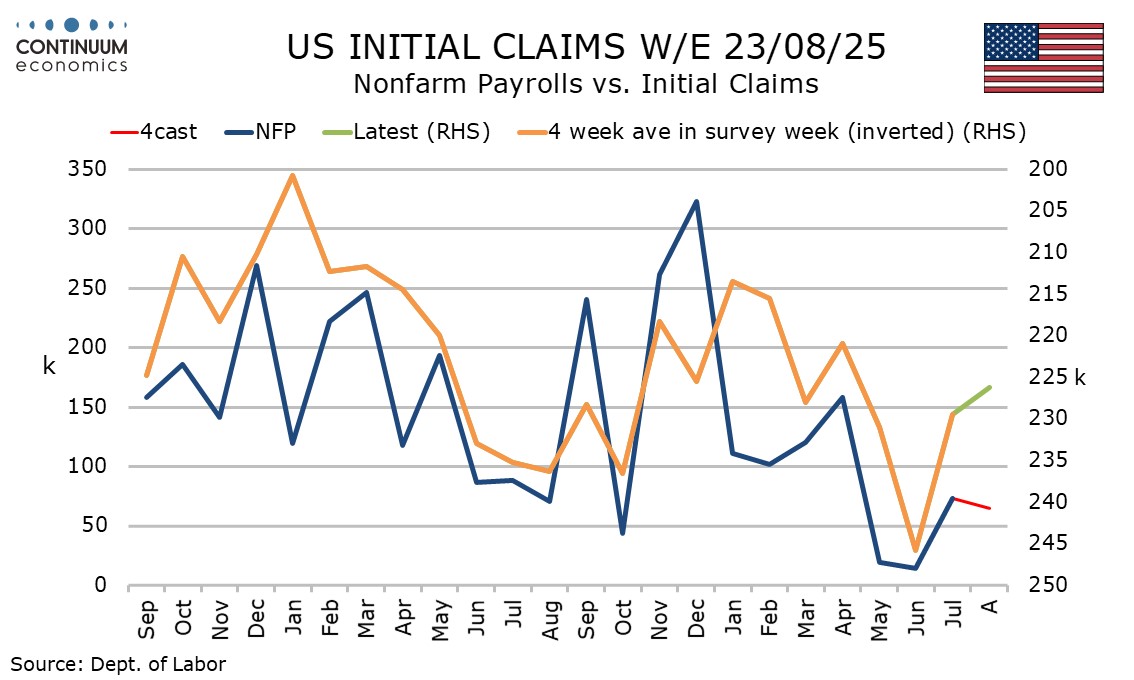

The latest initial claims data covers the week after August’s payroll survey week. The 4-week average of 228.5k has seen three straight gains but is still below the 229.5k seen in July’s payroll survey week.

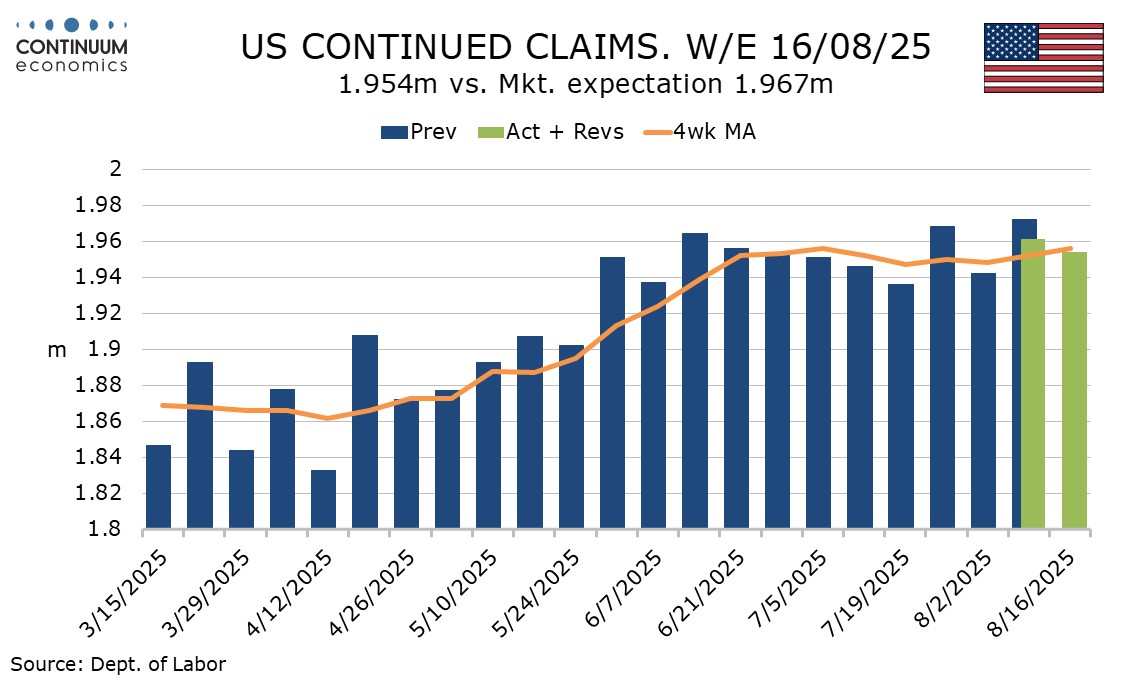

The latest continued claims data does cover the August payroll survey week, and fell by 7k to 1.956m. The 4-week average is fairly flat after having risen in May and June when payroll growth was minimal (after revisions seen in July data). The latest data suggests August payrolls will be similar to July’s 73k rise. Our forecast is 65k.