GBP, SEK flows: GBP and SEK slightly firmer after data

UK employment data a little stronger than expected. Swedish CPI in line with consensus. Limited upside for both GBP and SEK

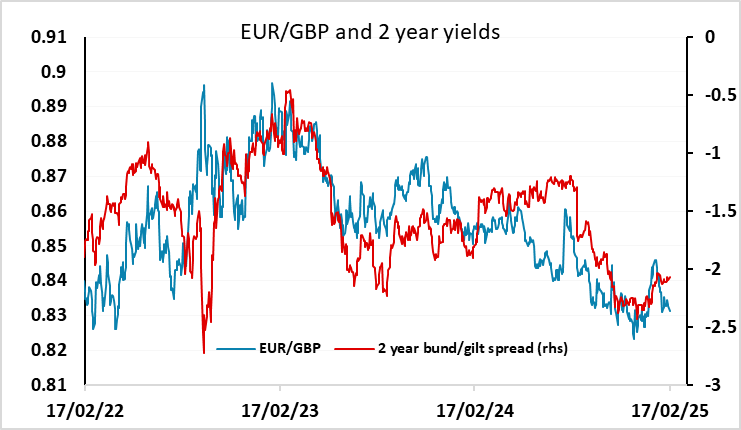

UK labour market data was slightly on the strong side of expectations, with employment stronger than expected on both the ONS and HMRC measures and average earnings growth in line with consensus and still strong at 5.9% y/y. EUR/GBP has dropped 10 pips in response to trade below 0.83, but progress beyond here is likely to be tough. While there is a little scope for the market to reduce expectations of BoE easing from the current 2 ½ cuts this year, current yield spreads already suggest EUR/GBP is a little stretched on the downside.

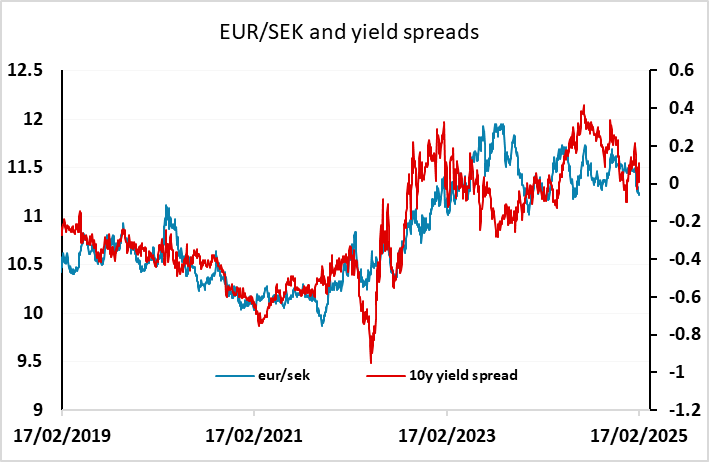

We have also had Swedish CPI data for January, which is in line with expectations at 2.2% y/y for the targeted CPIF measure, up from 1.5% in December due in large part to base effects. The SEK has edged higher in response but with no further rate cuts from the Riksbank priced in this year we see the risks as slightly to the SEK downside after yesterday’s sharp rise in unemployment.