U.S. Initial Claims up sharply, May PPI corrects April strength

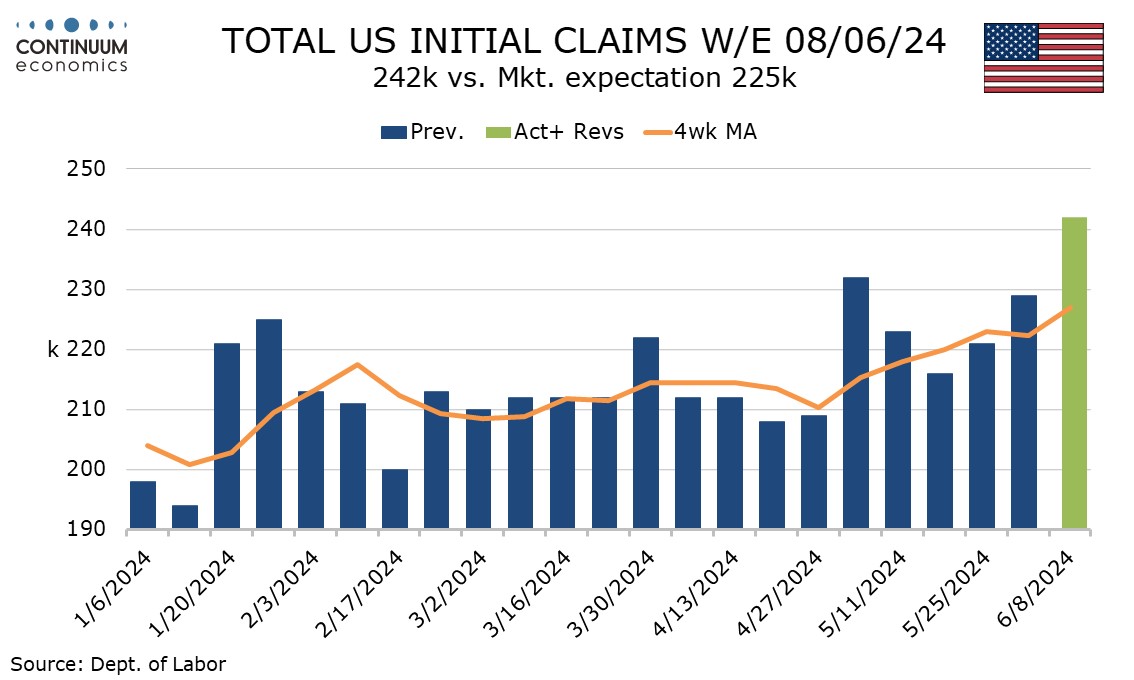

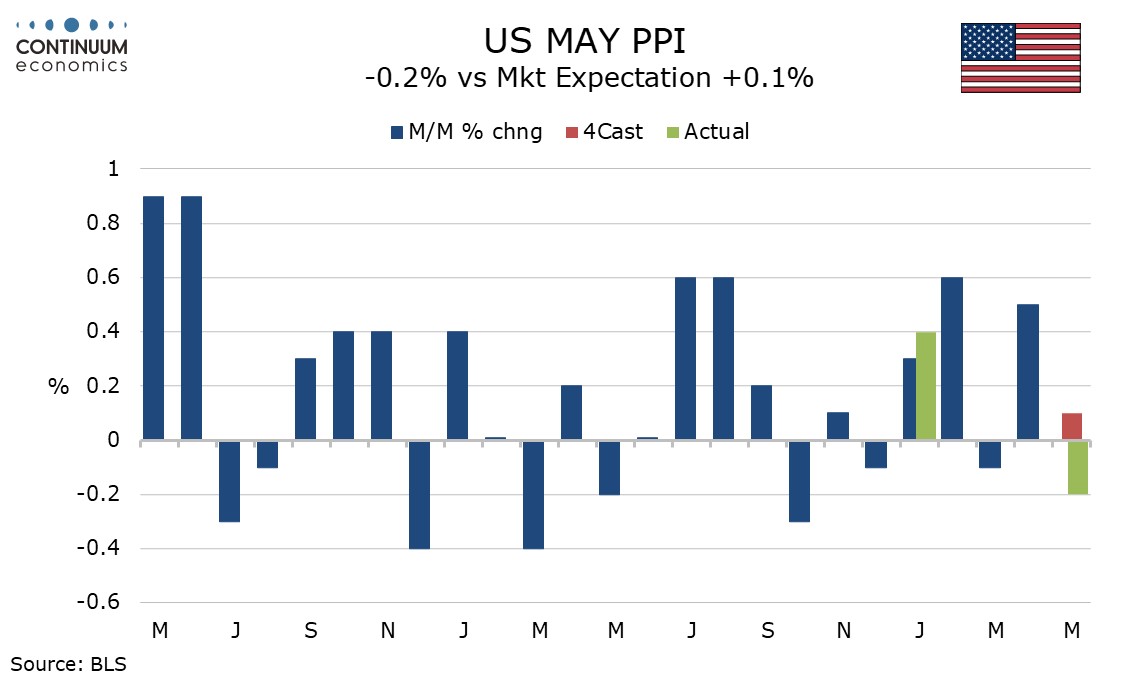

May PPI with a 0.2% decline, and flat core rates ex food and energy and ex food, energy and trade, surprised on the downside and offsets the disappointment on a stronger than expected April increase. More significant however is a sharp increase in initial claims to 242k from 229k, hinting that the labor market’s continued momentum in May is fading in early June.

The latest initial claims level is the highest since August 2023. Last week’s 229k outcome, up from 221k, was seen as surprisingly high but easily downplayed given the fact before seasonal adjustment claims were unchanged and the week contained the Memorial Day holiday. This week saw unadjusted claims also increase, to 235k from 196k, making the rise harder to downplay. Next week is the survey week for June’s non-farm payroll.

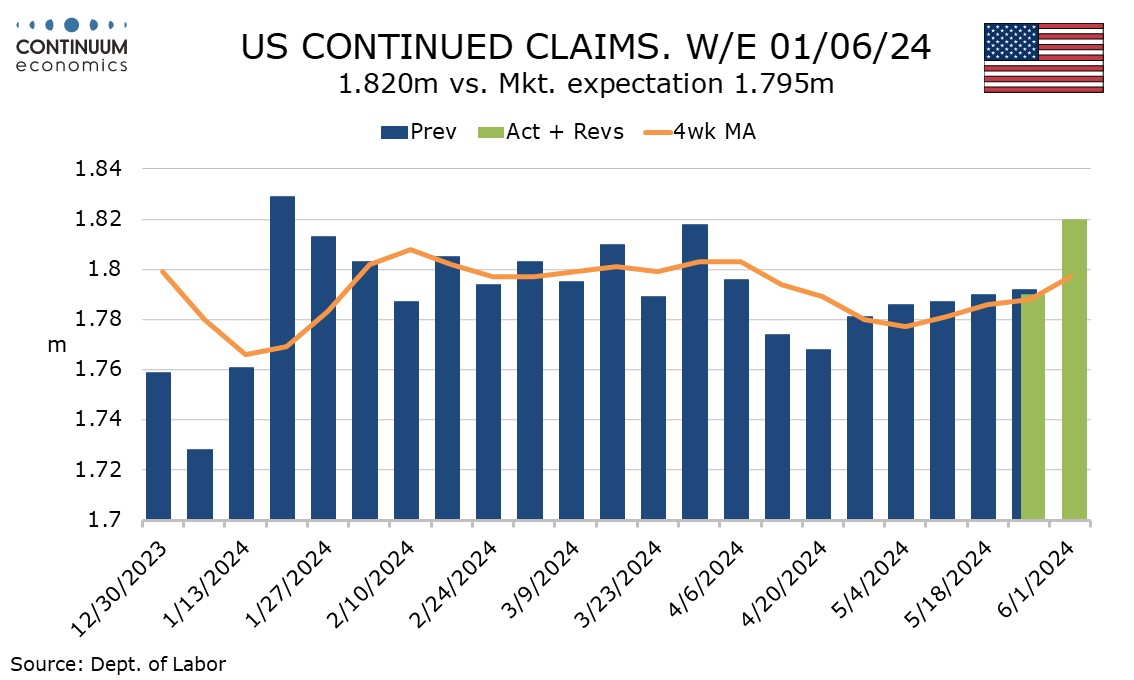

Continued claims cover the week before initial claims and are also higher than expected, up by 30k to 1.82. While the rise is still quite modest the level is the highest since January 20.

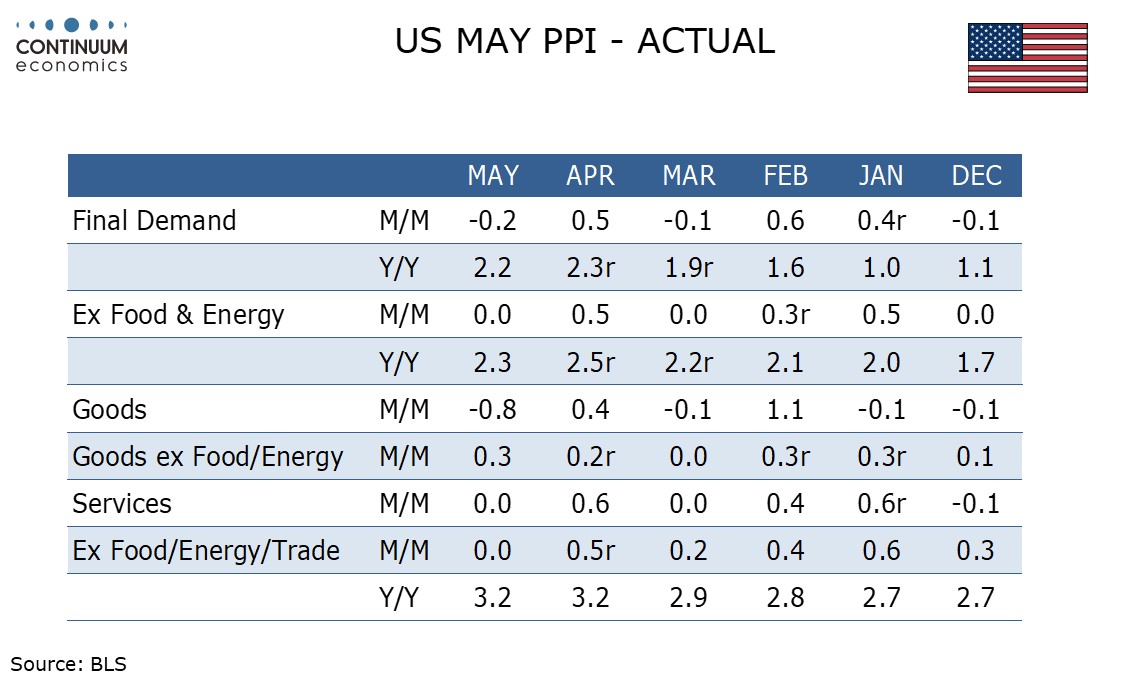

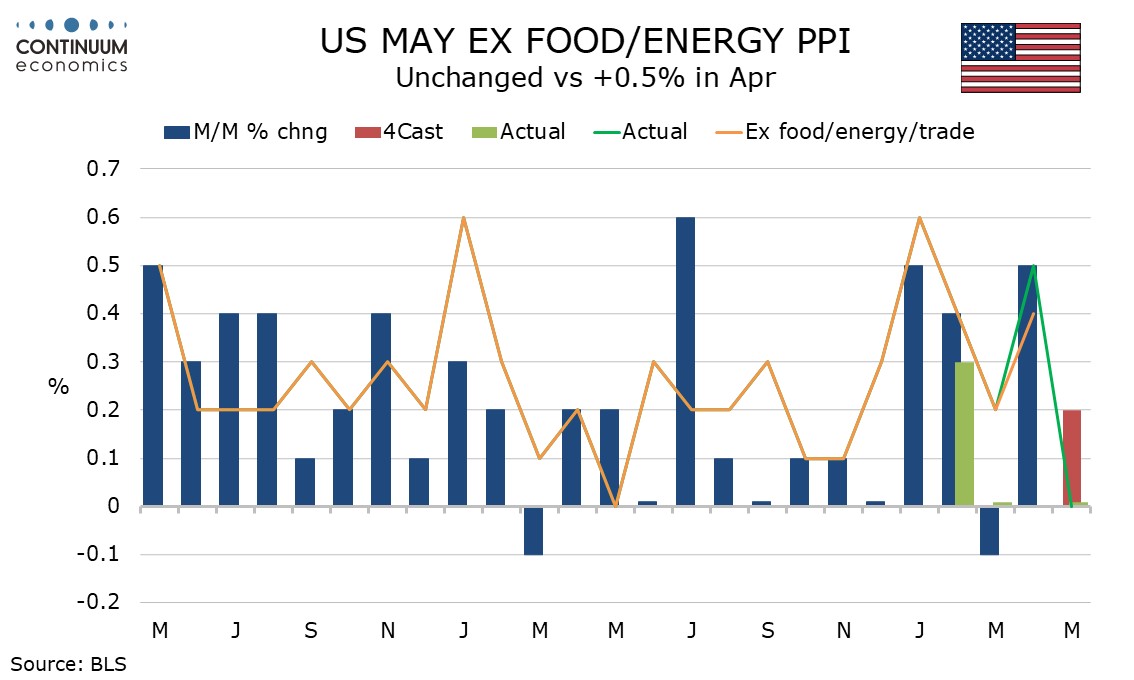

May’s flat core PPI rates follow gains of 0.5% in April both ex food and energy and ex food, energy and trade, so the two months taken together look acceptably subdued but not strikingly so. January and February saw strong data but March was more subdued. The picture, like the CPI, is of a strong start to the year which is now fading.

Overall PPI was restrained by a 4.8% decline in energy that more than fully reversed an April increase while food fell by a marginal 0.1%. Goods PPI ex food and energy was actually on the firm side of trend with a 0.3% increase but services were flat, restrained by a sharp 1.4% fall in transportation and warehousing.

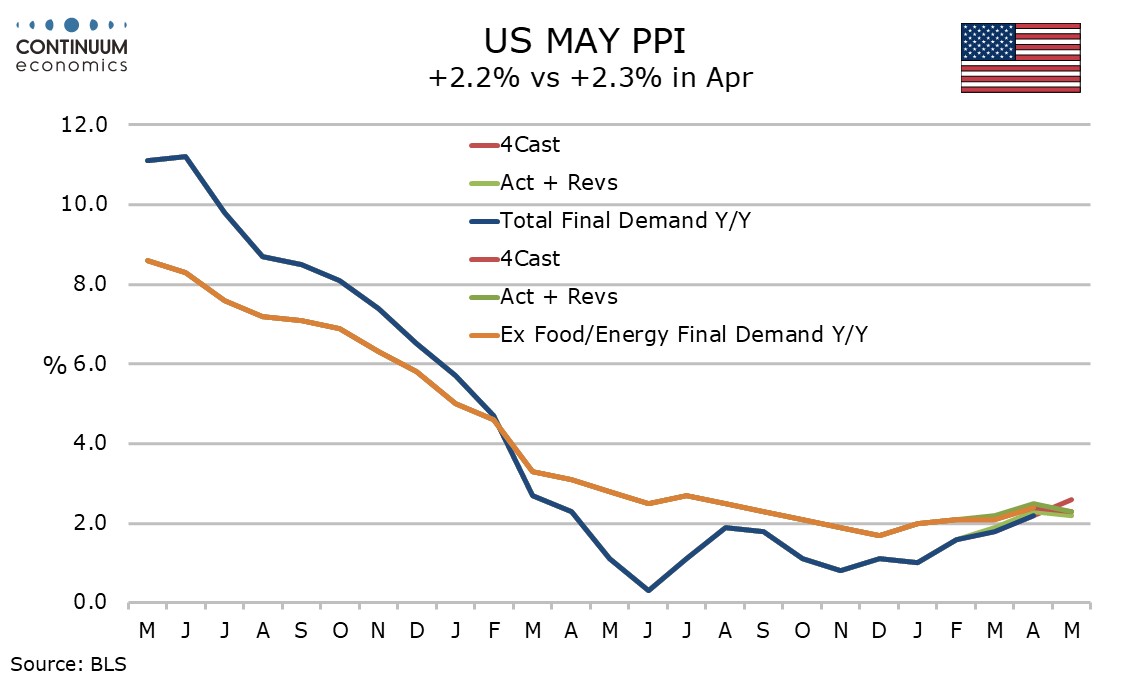

Yr/yr PPI slipped to 2.2% from 2.3% and ex food and energy fell to 2.3% from 2.5%, but ex food, energy and trade still looks quite firm, unchanged at 3.2% and the highest since April 2023.

Intermediate PPI was mixed on the goods side, processed goods falling by 1.5% with a 0.1% increase ex food and energy, and unprocessed goods falling by 1.8% with a 1.8% increase ex food and energy. Intermediate services were soft with a rise of only 0.1%.