Preview: Due December 15 - U.S. November Industrial Production - Rebounding from auto strikes

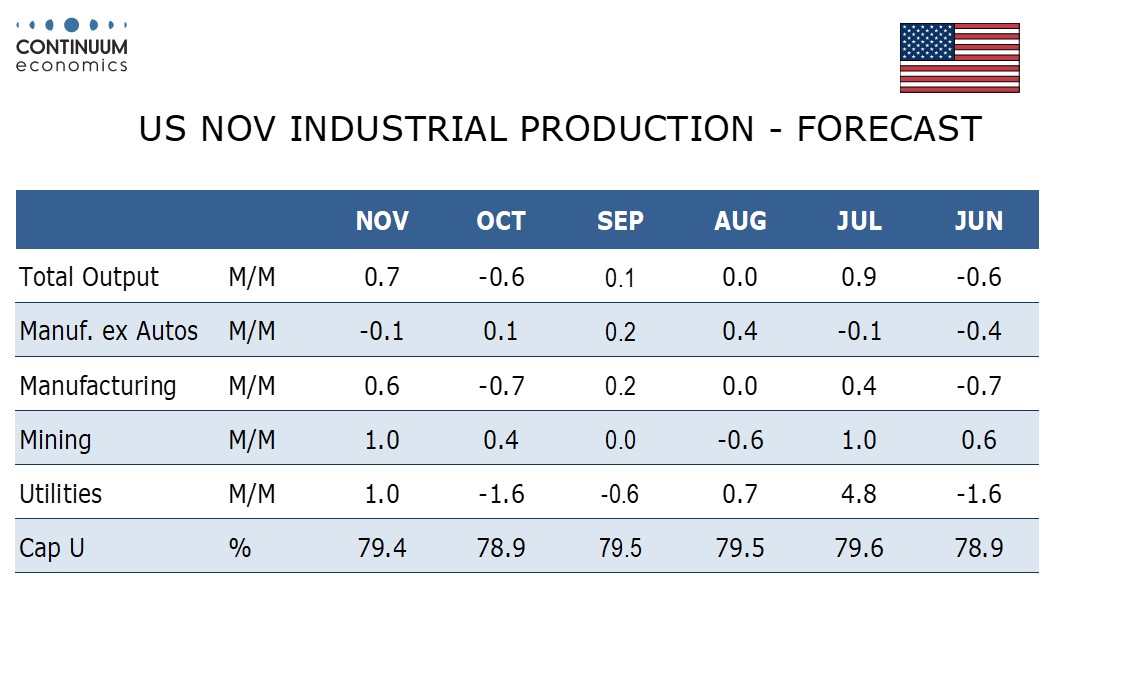

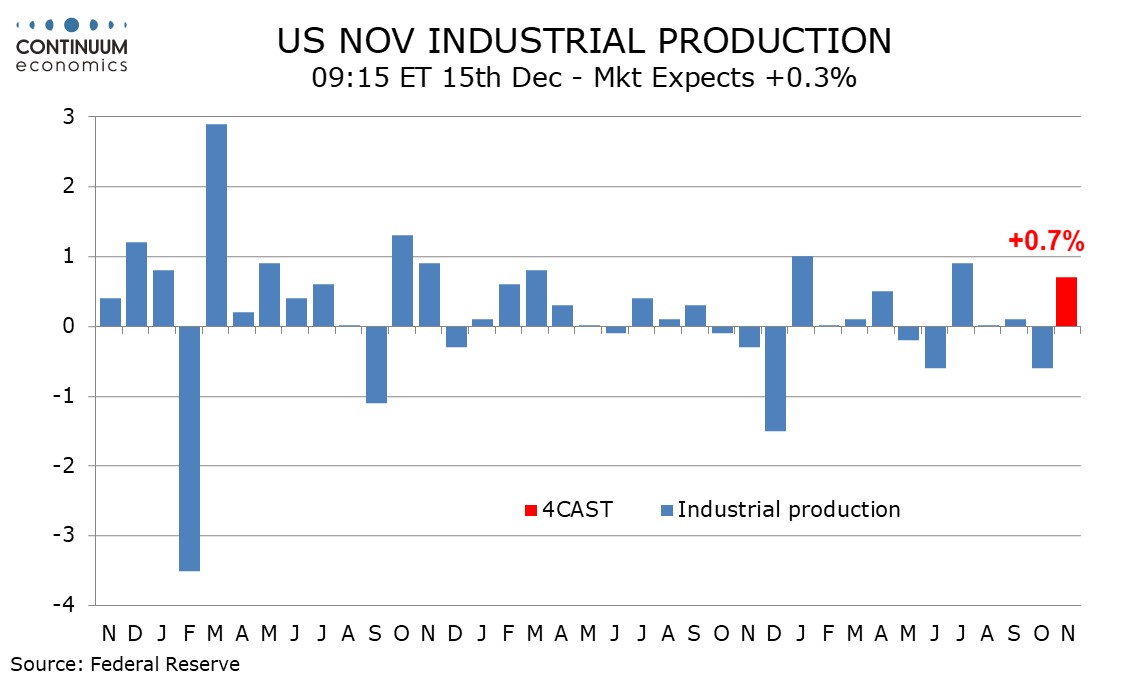

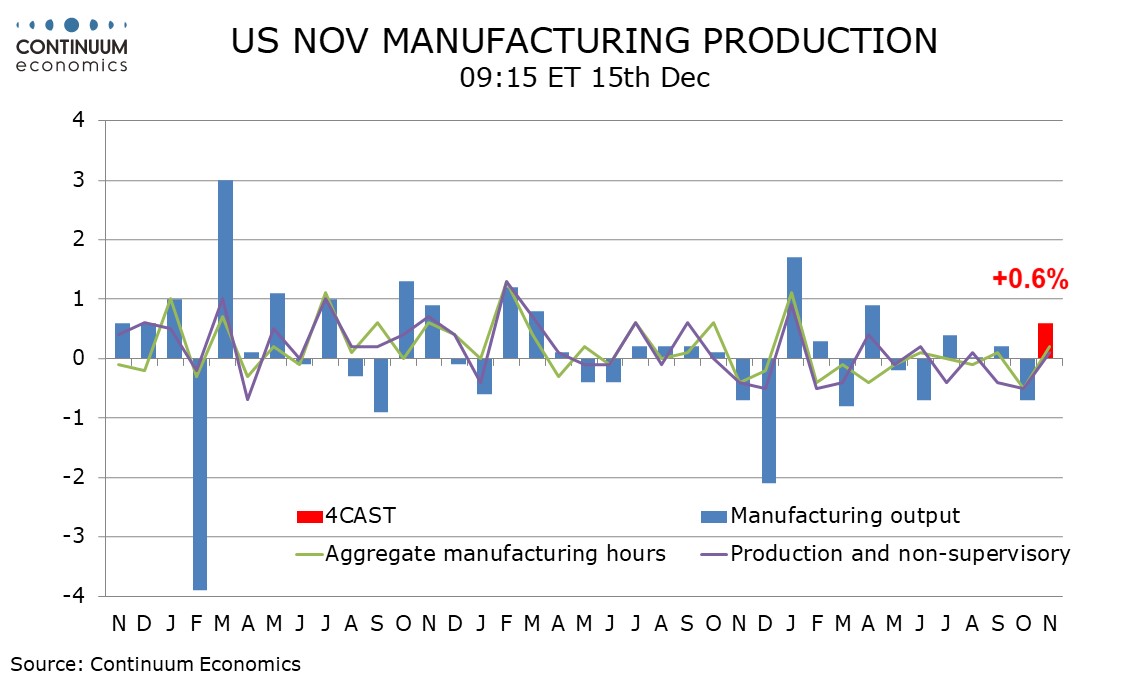

We expect November industrial production to rise by 0.7% after a 0.6% October decline with manufacturing rising by 0.6% after falling by 0.7% in October. The rise will be led by the end of auto strikes. We expect manufacturing ex autos to fall by 0.1% after a 0.1% increase in October.

While payrolls showed manufacturing employment reversing most of an October decline as auto strikers returned to work, aggregate manufacturing hours rose by only 0.2% after a 0.5% October decline. That the ISM manufacturing production index fell below the neutral 50 in November suggests some underlying weakness despite the end of the auto strikes.

We expect overall industrial production to get a lift from gains of 1.0% in both mining and utilities, the former a second straight gain as implied by payroll details for the sector, and the latter a rebound from two straight declines in this weather-sensitive sector. We expect capacity utilization to rise to 79.4% from 78.9% with manufacturing at 77.5% from 77.2%. However both would remain below their respective September levels of 79.5% and 77.8%.