U.S. October trade deficit plunge not sustainable, Initial Claims still low, Unit Labor Costs fall but Non-Labor Costs surge

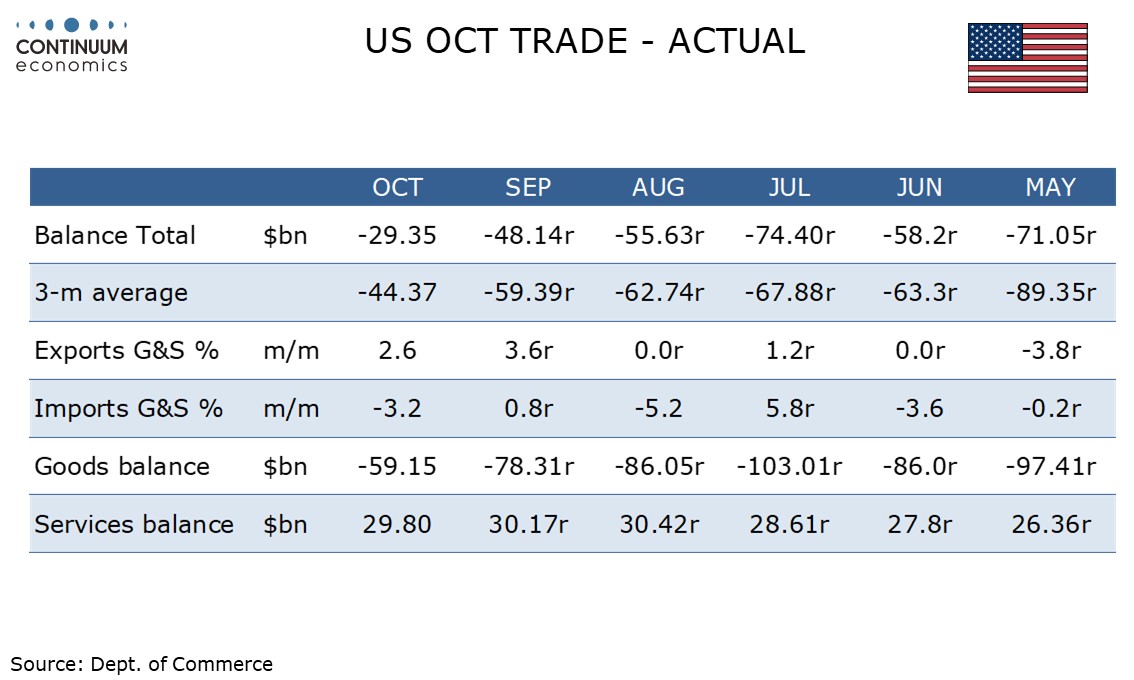

The big shock in the latest data is a dramatic fall in October’s trade deficit to $29.4bn from $48.1bn, to its lowest level since February 2009. This will lift Q4 GDP estimates and give Trump a political boost as the Supreme Court prepares to make a judgement on his tariffs. However the strength, led by surging nonmonetary gold exports and plunging imports of pharmaceutical preparations does not look sustainable.

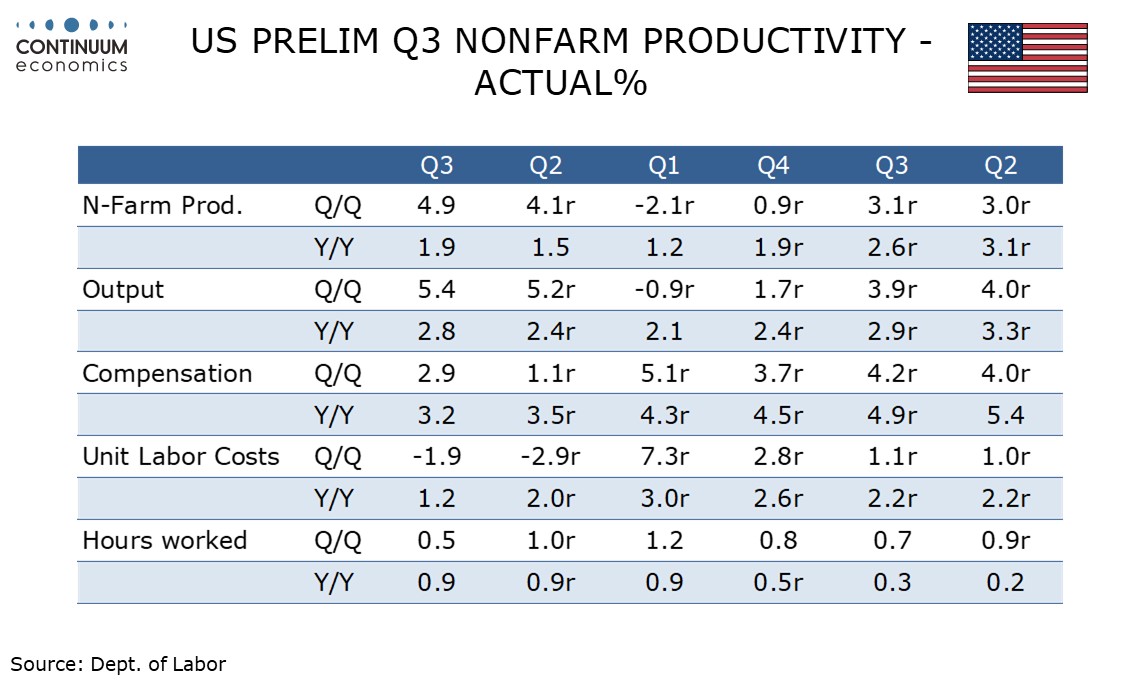

Strong Q3 GDP combined with subdued aggregate hours worked as payroll data had already implied is behind a strong 4.9% rise in Q3 non-farm productivity, which is in line with expectations, and with moderate wage growth has seen unit labor costs fall by 1.9%, softer than expected, though non-labor costs at the same time are surging, presumably lifted by tariffs.

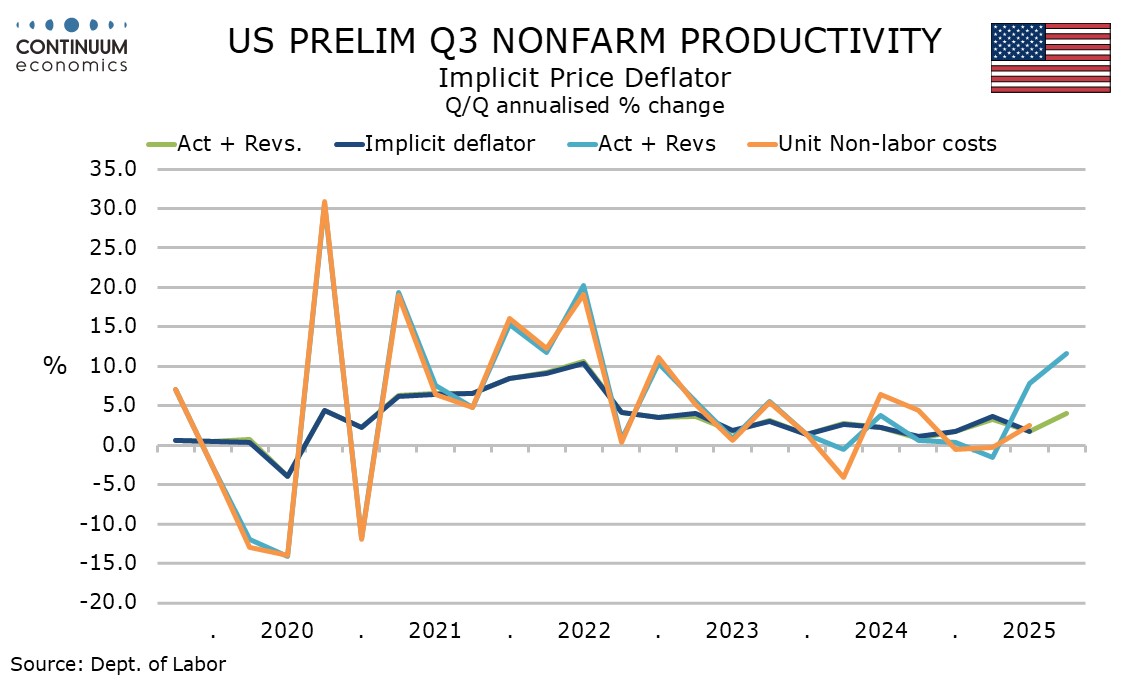

Non-farm business output rose by 5.4% as seen in GDP data and aggregate hours worked rise by 0.5% (compared with unchanged in the payroll detail) while hourly compensation rose by a moderate 2.9%. While all this delivered a fall in unit labor costs, non-labor costs surged by 11.6% after a 7.8% rise in Q2, meaning that the implicit deflator rose by 4.0% annualized in Q3 and 2.7% yr/yr. The latter is the highest since Q3 2023, even with Q3 unit labor costs up by only 1.2% yr/yr.

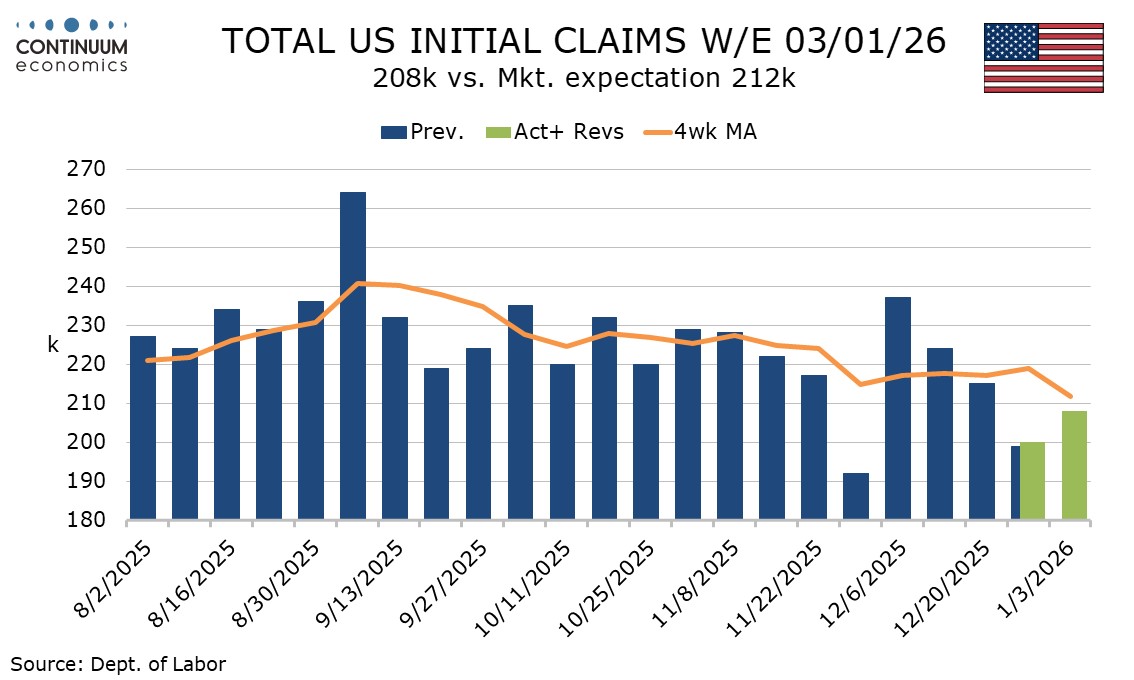

Initial claims at 208k have returned to a more normal, though still lower than expected, level from last week’s 200k, though both weeks included holidays, this week New Year and last week Christmas, making seasonal adjustments difficult.

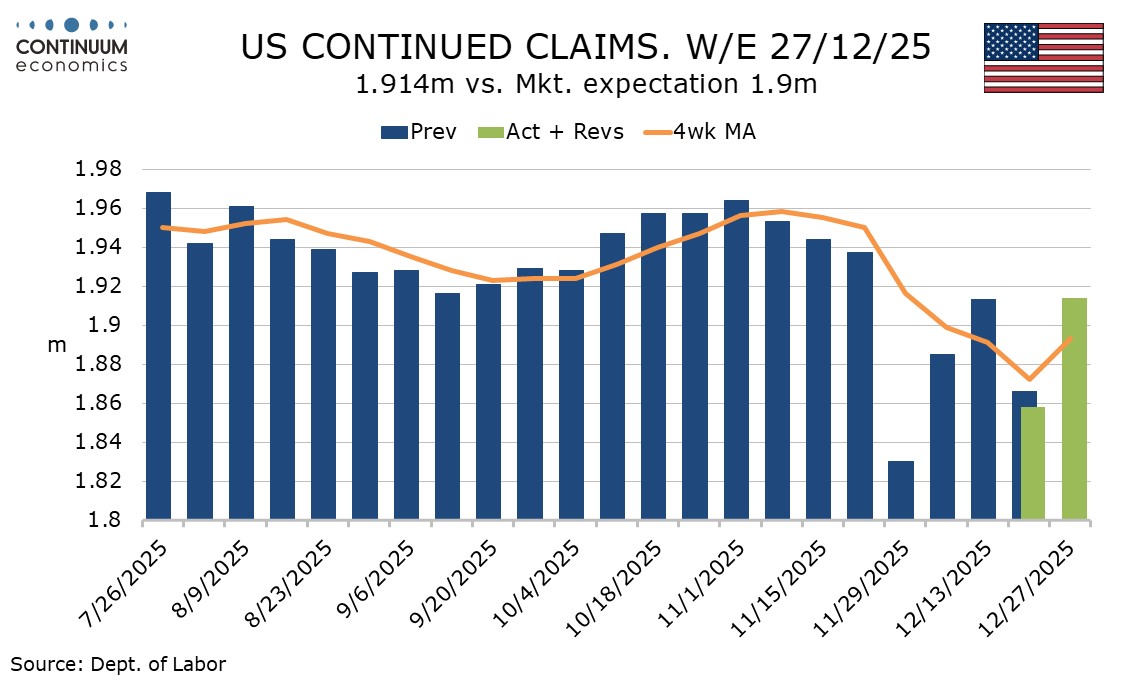

Continued claims at 1.914m are higher than expected, exactly reversing a dip to 1.858m in the preceding week. Continued claims cover the week before initial claims, so the latest continued claims data is for Christmas week.

December’s non-farm payroll was surveyed three weeks before this week’s initial claims data and two weeks before the continued claims, but trend in both series has improved from November implying some improvement in payrolls. A yr/yr decline in December’s payroll announcement from Challenger, Gray and Christmas gives a similar message, the worrying October layoffs data now looking erratic.

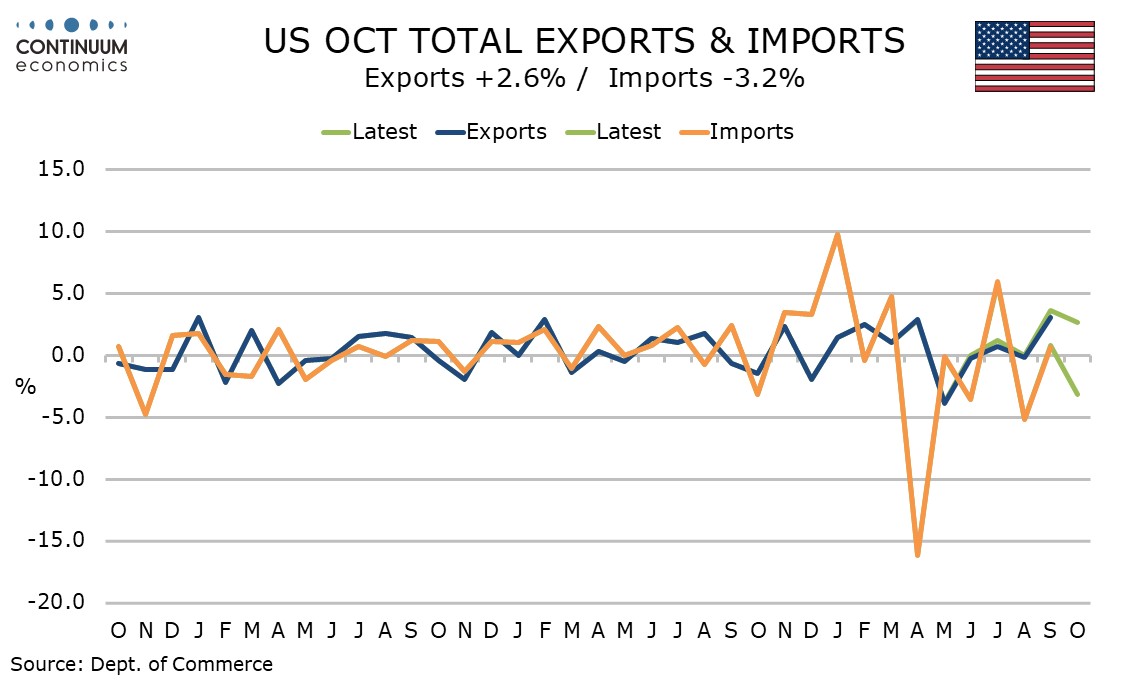

The trade details show exports up by 2.6% for a yr/yr gain of 12.1% while imports fell by 3.2% for a yr/yr decline of 3.6%. The exports strength is the more surprising, with imports restrained by tariffs.

Goods exports rose by 3.8% after a 5.6% September increase, with the bulk of both gains coming in nonmonetary gold. October saw non-monetary gold exports up by $6.8bn, while exports rose by $7.8bn.

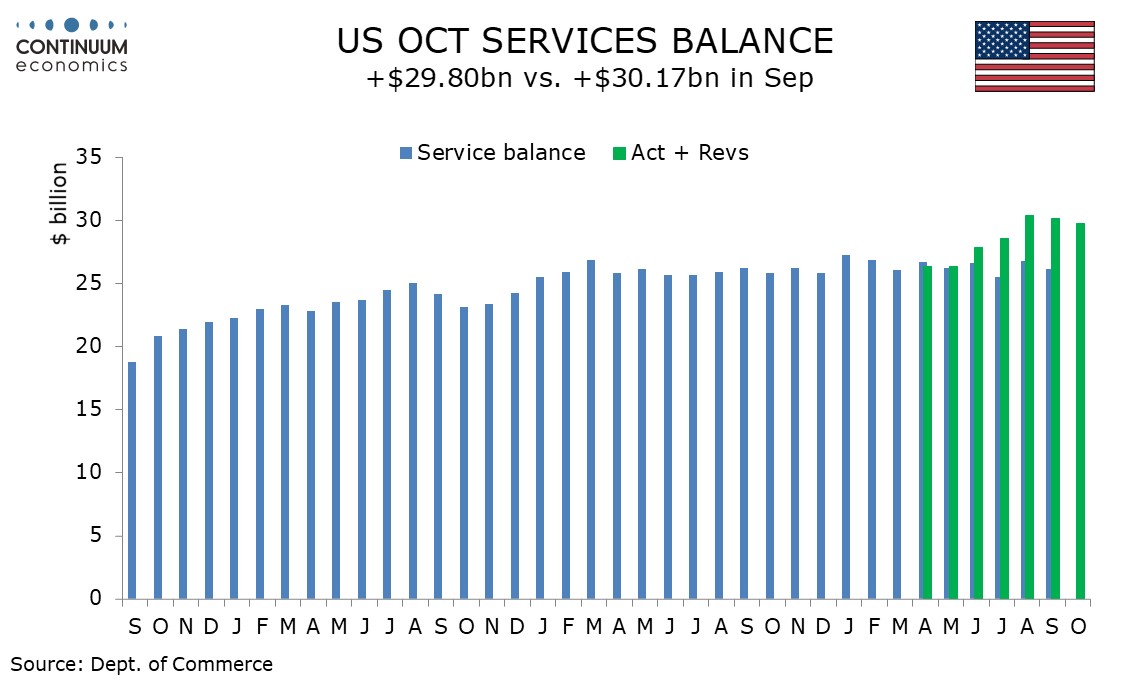

Service exports rose by 0.7%. Service imports rose by 1.4% bringing a dip in the services surplus but recent revisions to surplus trade assisted the positive surprise in the data.

Goods imports fell by 4.5%. The main source of weakness was a $14.3 bn plunge in imports pf pharmaceutical preparations, more than fully explaining a fall of $11.0bn in overall imports. Neither surging exports of nonmonetary gold of plunging imports of pharmaceutical preparations look sustainable.