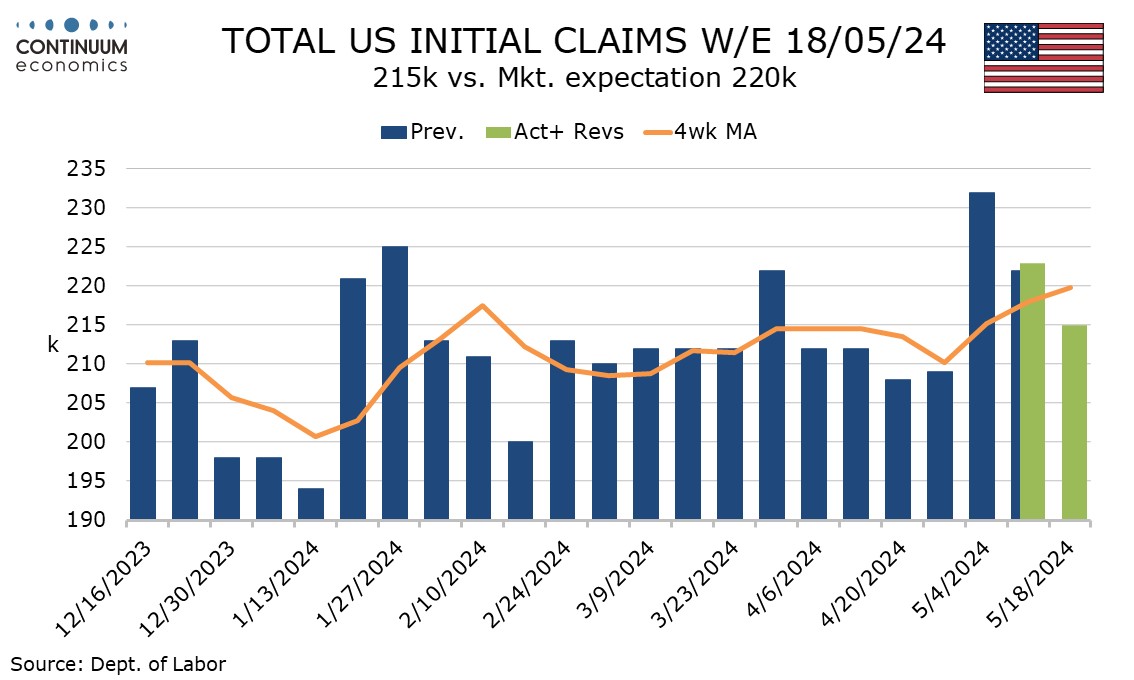

U.S. Initial Claims suggest any labor market slowing is marginal

Initial claims at 215k have fallen from 223k, a second straight fall from the 232k outcome two weeks ago that was the highest since August 25 2023. The latest data is not much above the trend seen before the spike of two weeks ago, suggesting that while the labor market may be easing slightly, it is still strong.

This week’s initial claims data covers the survey week for May’s non-farm payroll. The 4-week average hints at a slight slowing but the high number of two weeks ago looks erratic, with around half of the rise coming in New York. A lack of seasonally improved weather may be a factor behind a slight uptick in the claims trend.

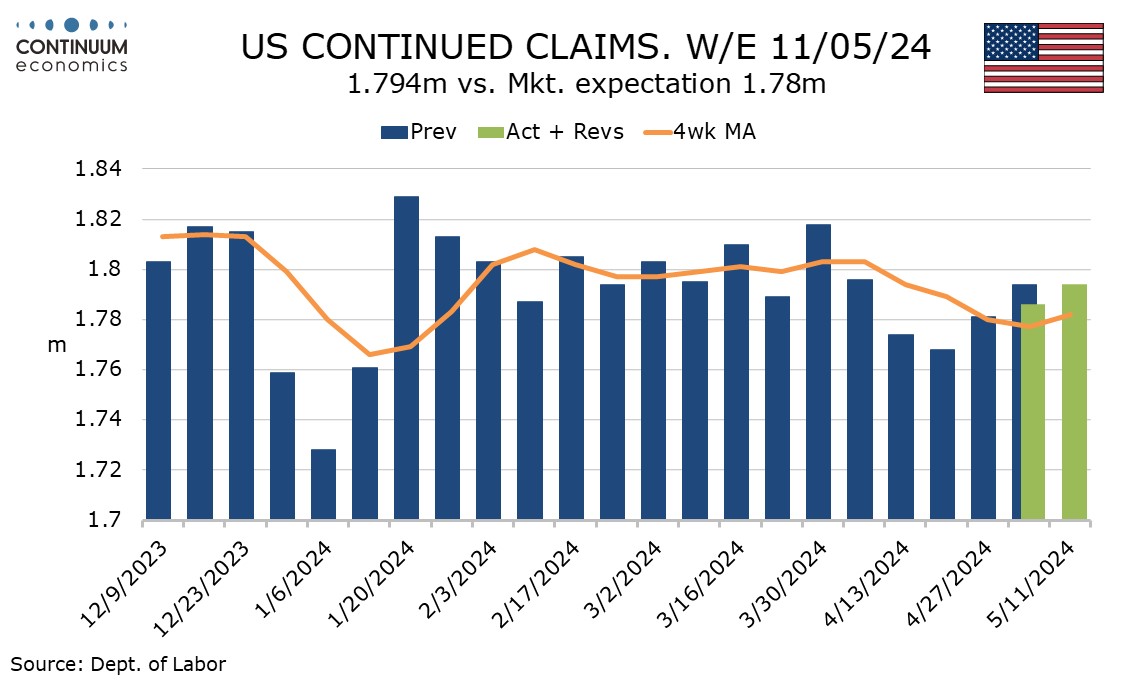

Continued claims cover the week before initial claims and saw a modest rise to 1.794m inly because last week was revised to 1.786m from 1.794m. This series saw a dip in April but seems to be edging higher in May, though with no sign of any labor market weakness.