Published: 2024-07-24T13:55:56.000Z

U.S. July S&P PMIs - Mixed data may tell us little about ISM indices

3

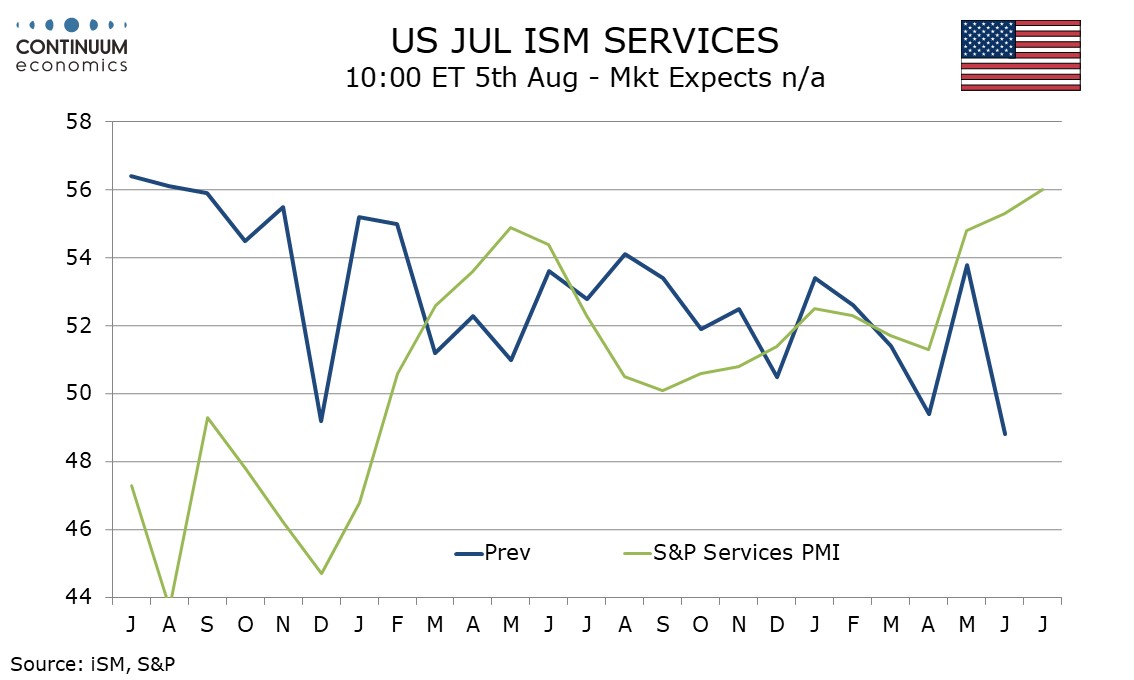

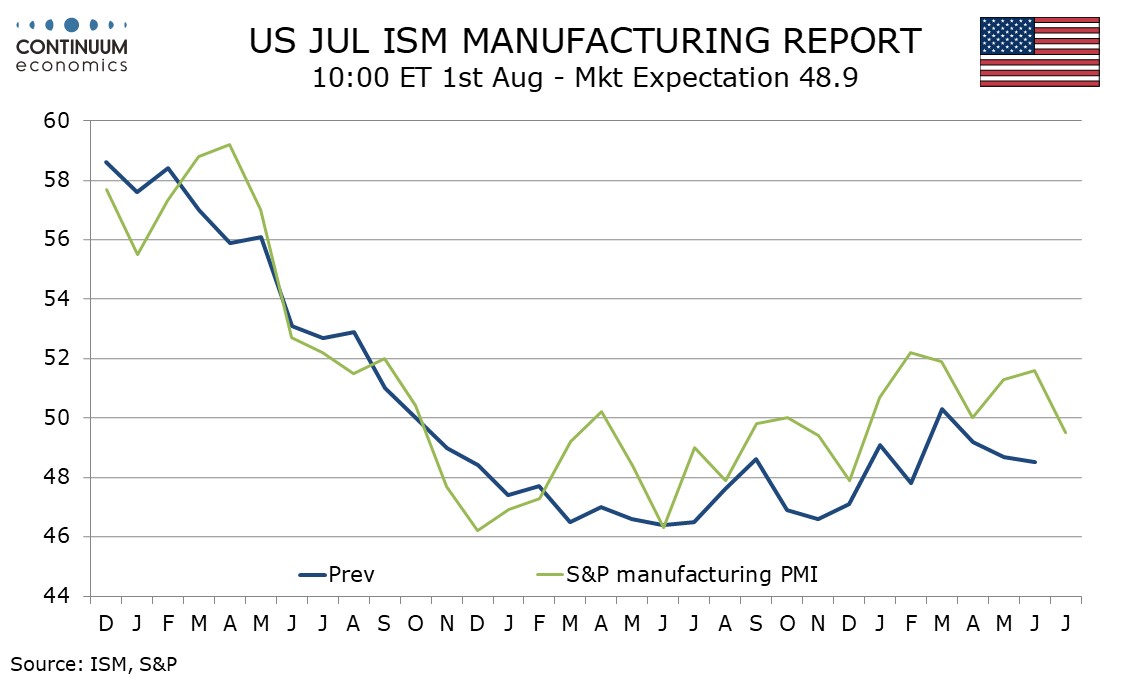

July preliminary S and P PMIs have seen manufacturing slipping back below neutral to 49.5 from June’s stronger 51.6 but services extending recent strength with a rise to 56.0 from 55.3.

The manufacturing index is the weakest since December but follows recent data that has been outperforming other manufacturing surveys, particularly the ISM’s. The dip probably does not tell us much about how July’s ISM manufacturing index will perform.

The S and P services index is the highest since March 2022 but not well correlated with its ISM counterpart with June having shown a particularly sharp contrast with a weak ISM services index. The S and P services index appears more sensitive to interest rate expectations than the ISM and may be responding to rising hopes for Fed easing. However, the ISM services index looks unlikely to remain below the neutral 50 in July.