EUR flows: Focus on PMIs but limited scope for impact

EUR/USD likely to hold close to 1.05 unless PMIs show surprising move

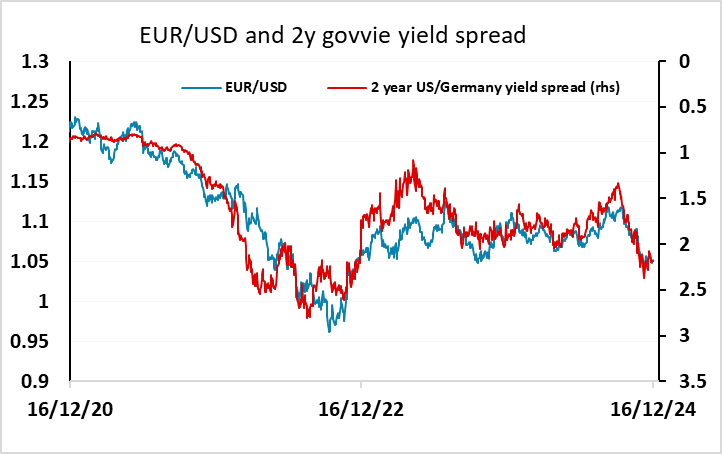

Eurozone December PMIs should set the tone for the EUR this morning. The November Composite PMI dropped to a 10-mth low and we see no further change this time around, which is broadly in line with consensus (which sees a marginal drop of 0.1 to 48.2). The Japanese PMIs overnight showed a modest rise, and these have mild correlation with European PMIs, so suggests we could see a small improvement in Europe after last month’s exceptionally weak numbers. But the data probably won’t have a significant impact on market expectations for the ECB. Front end Eurozone yields have already risen since the ECB meeting last week, and even a small rise in the PMIs would still indicate significant economic weakness, so there doesn’t look to be a lot of upside for Eurozone short term yields from here. EUR/USD continues to move closely with short term yield spreads, so should continue to hold close to 1.05.