U.S. November trade deficit more than fully erases October plunge, Initial Claims still low but revised higher in payroll survey week

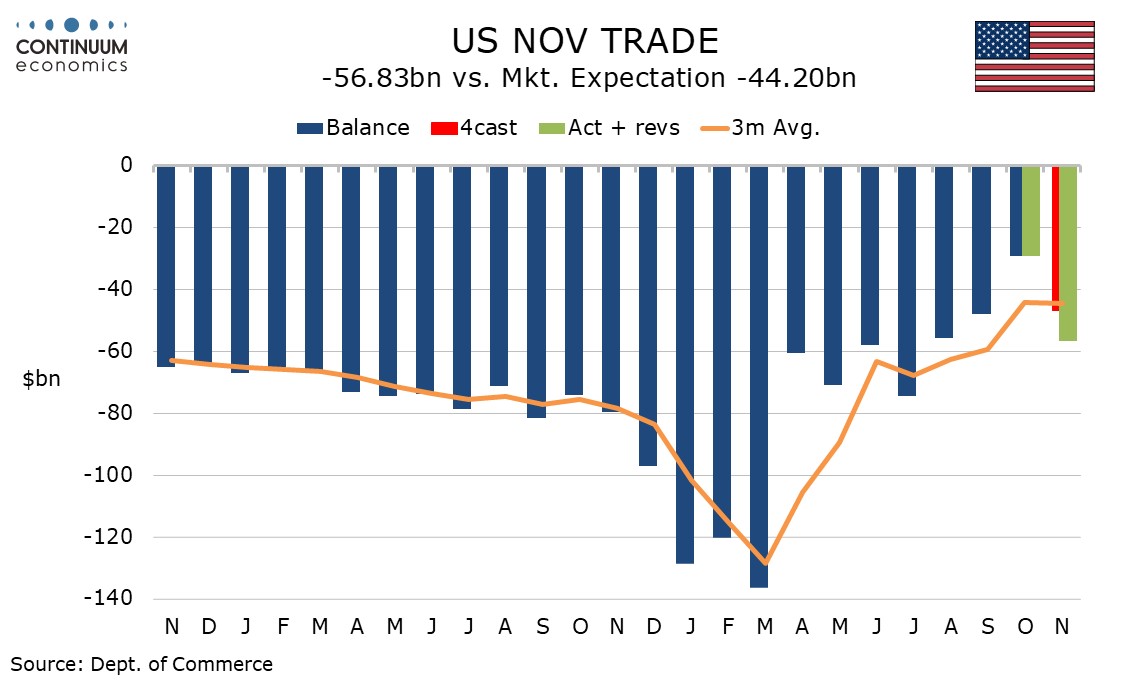

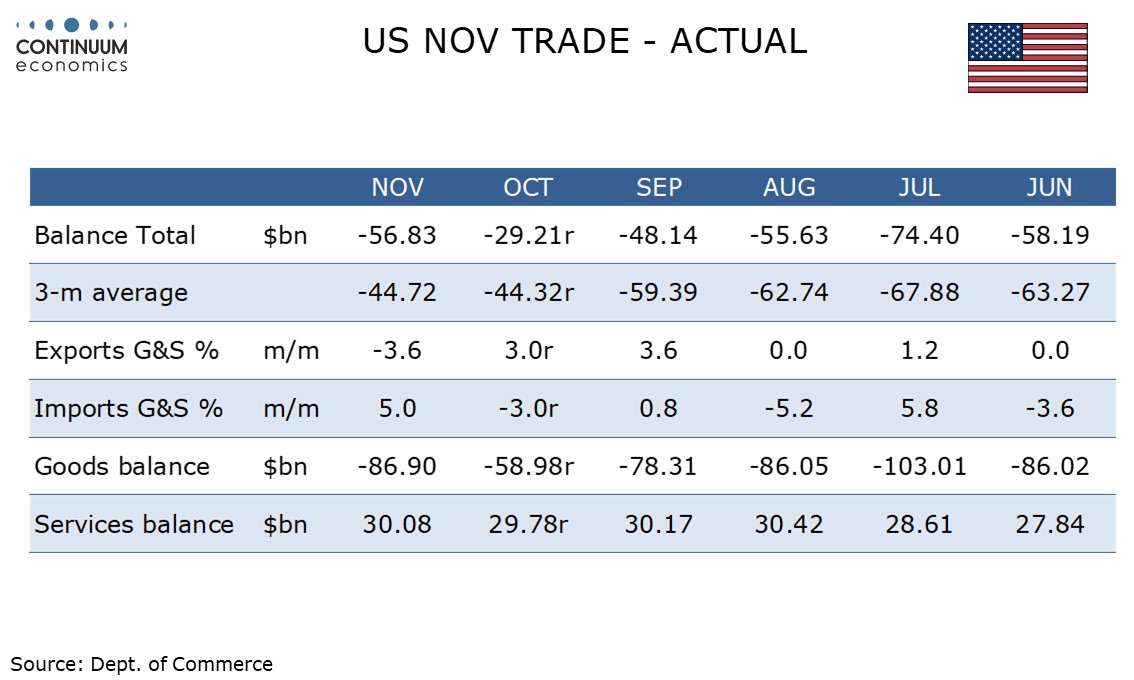

After a startlingly narrow October trade deficit of $29.2bn, the lowest since February 2029, November’s deficit has seen a larger rebound than expected, to $56.8bn, which is the widest since June, though still well below the record pre-tariff deficit of $136.4bn seen in March.

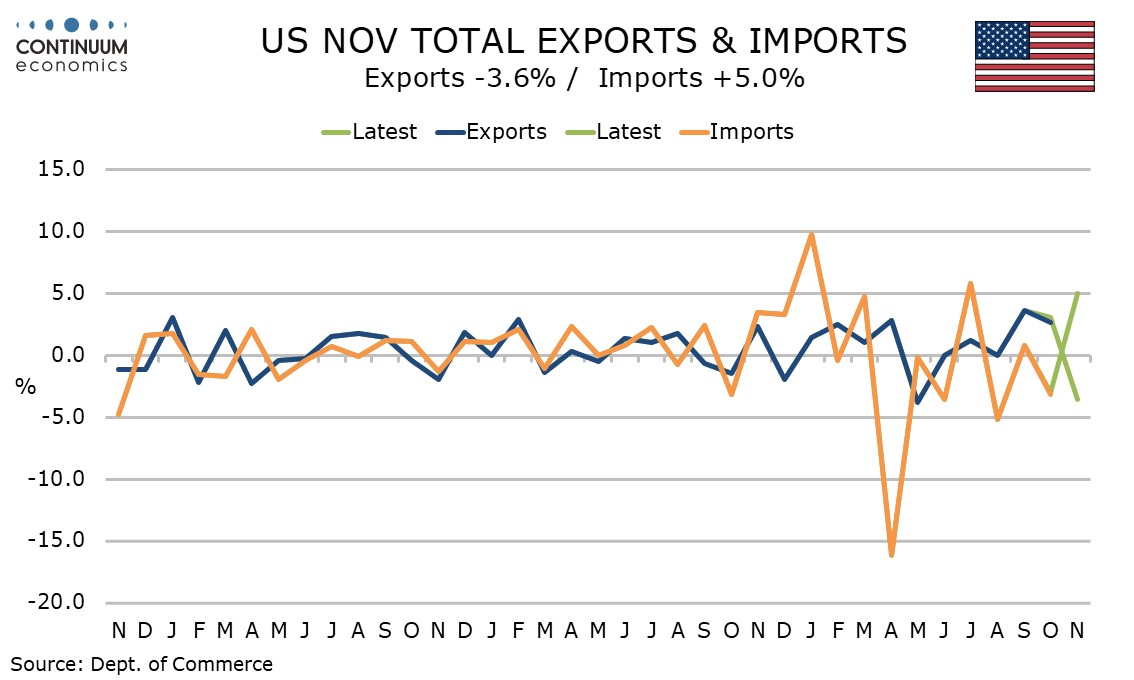

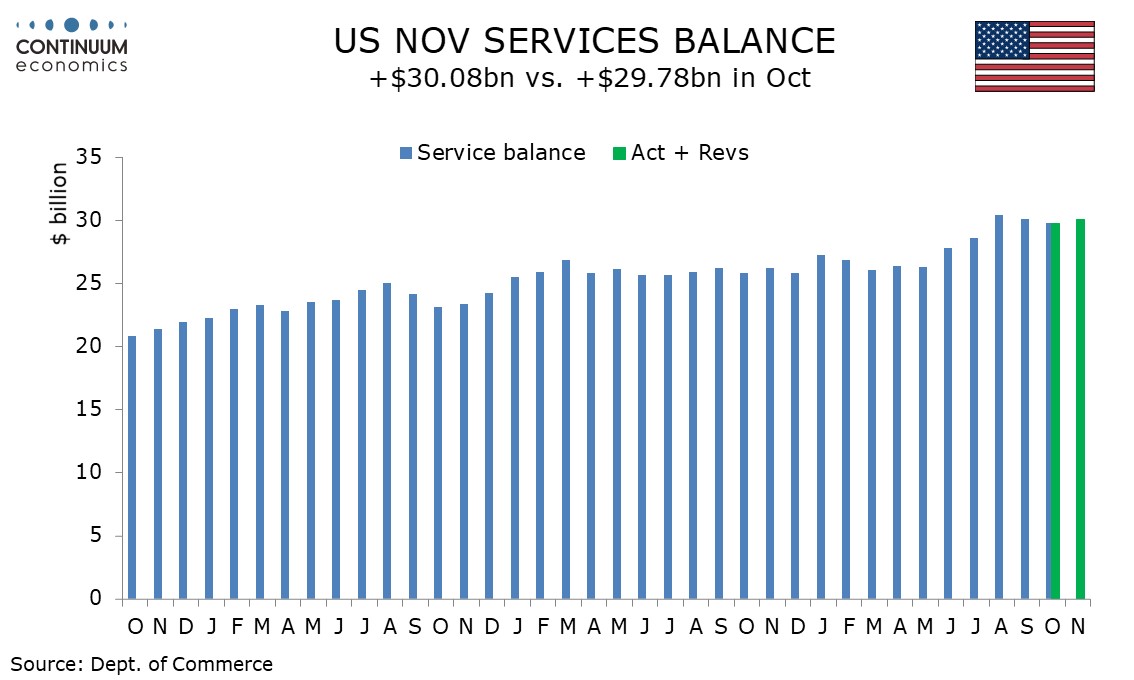

Exports fell by 3.6%% after a 3.0% increase in October, while imports increased by 5.0% after a 3.0% decline in October. Goods exports fell by 5.6% and goods imports rose by 6.6%. Services saw a 0.2% increase in exports and a 0.1% increase in imports.

October’s increase in exports (as was September’s) was largely explained by non-monetary gold. Non-monetary gold exports did fall in November, by $4.2bn, but this explains only 38% of the exports decline. Another big fall of $2.9bn came from pharmaceutical preparations, while precious metals fell by $2.6bn. These three components explain 87% of the goods exports decline.

October’s imports decline was more than fully explained by pharmaceutical preparations. This sector saw imports rise by $6.7bn in November, though computers with a $6.6bn increase were not far behind. These two components explained 80% of the increase in goods imports.

The real goods balance in Q4 to date averages $75.2bn, compared to $87.3bn in Q3, so net exports look likely to be a positive in Q4 GDP if not as sharply as thought after the October data. November’s real balance of $87.1bn is very close to the Q3 average however, and is probably closer to the underlying picture than October’s. The deficit is still slightly below the pre-tariff trend, though the correction from highly inflated pre-tariff deficits in Q1 may not be done yet.

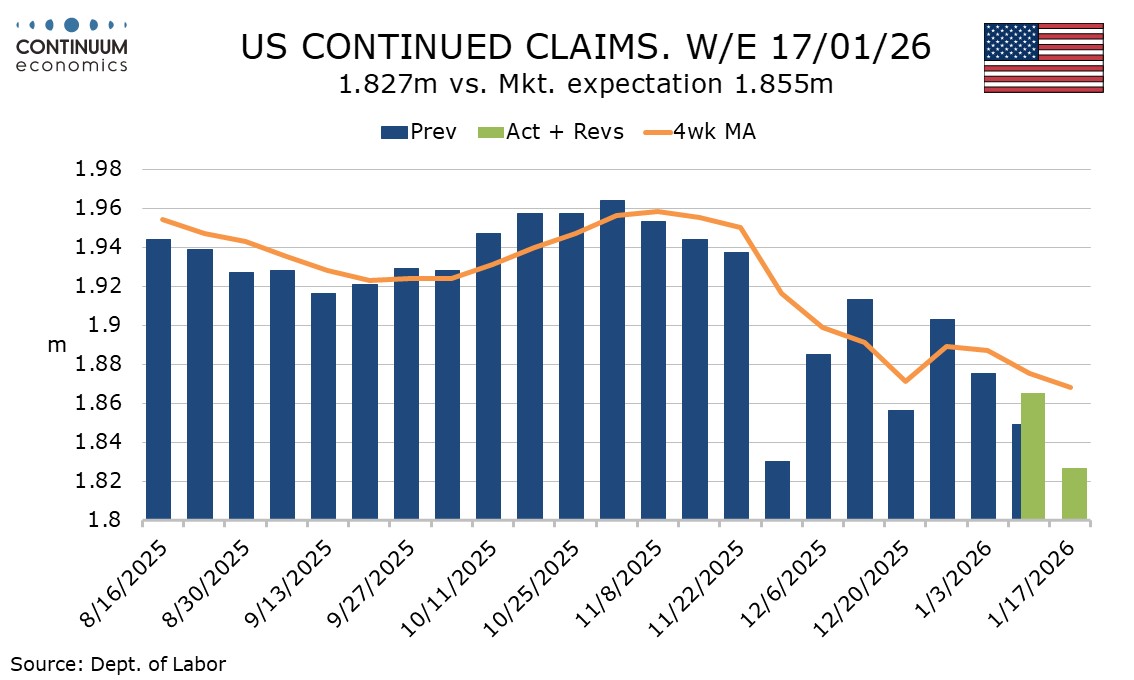

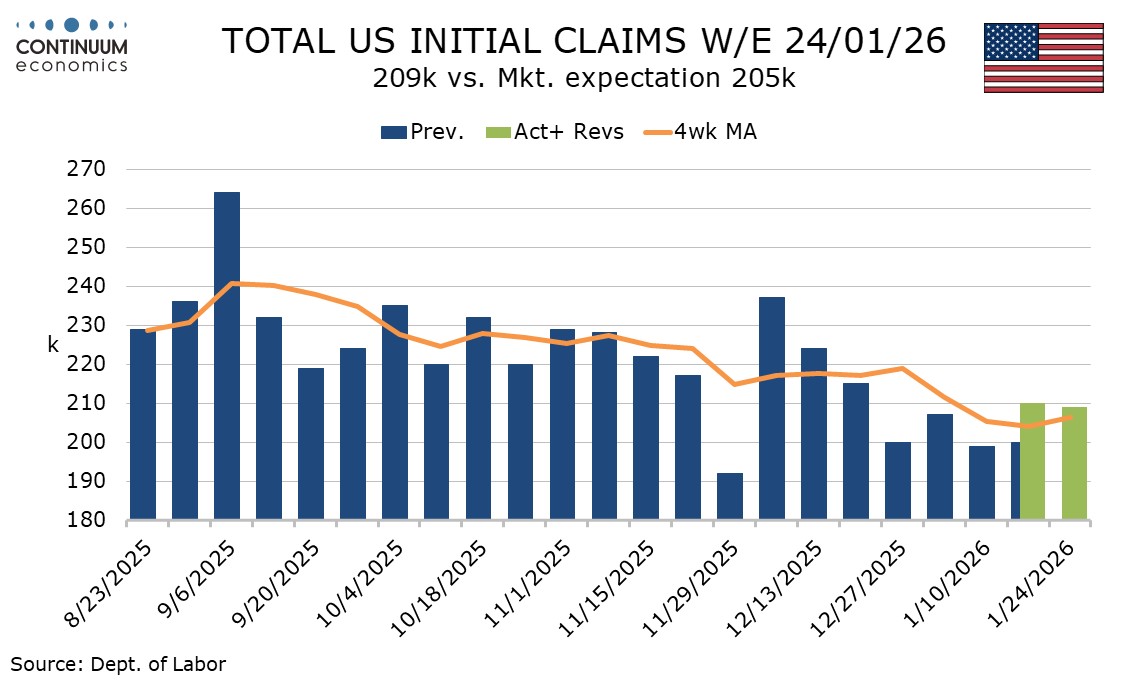

Initial claims were higher than expected at 209k though more significant was an upward revision to the preceding week, to 210k from 200k. The preceding week covers the survey week for the non-farm payroll. Still, the 4-week average in the survey week of 204k is well below the 217.5k seen in December’s payroll survey week, if possibly distorted lower by holiday seasonal adjustments. The latest week includes the Martin Luther King Day holiday, but there was no holiday in the previous week when the payroll was surveyed.

Continued claims cover the week before initial claims and thus the fall to 1.827m from 1.865m, taking the series to its lowest level since September 2024. This is a positive signal for the payroll, offsetting the less positive picture coming from the initial claims revision.