This week's five highlights

Oil and Geopolitics Around Venezuela

U.S. Sphere of Influence or More for Greenland

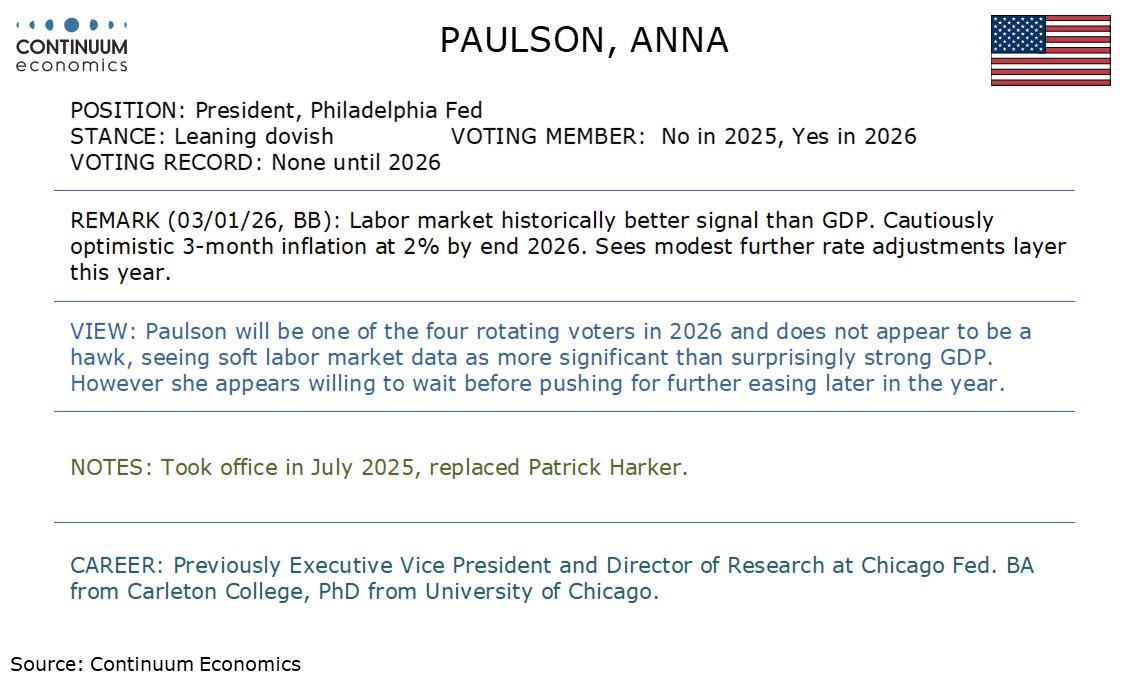

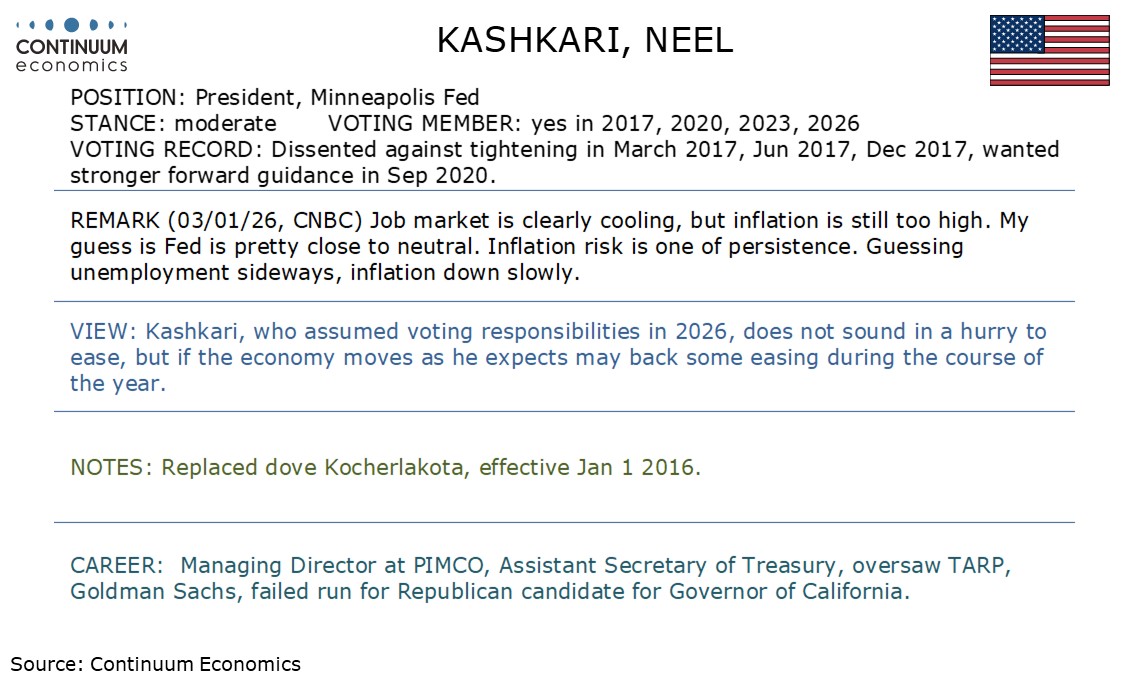

This Week's Fed Speakers

DXY on a Good Start So Far

EZ Services Inflation Still Resilient But Core Goods Soften Further

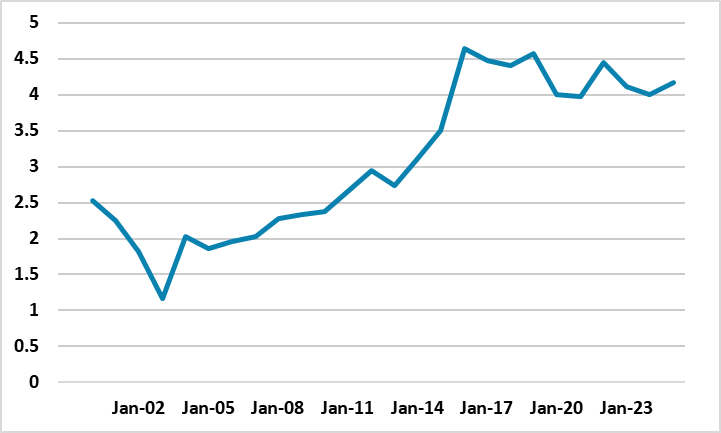

Figure: Iraq Oil Production (Mln B/D)

Venezuela’s oil production will likely take years to increase substantively due to poor infrastructure, the need for substantive investment, and a lack of democratic political stability. In terms of geopolitics, operations in Venezuela reinforce the Trump administration’s pivot in its national security strategy toward the Americas, which could lead to political instability in Cuba.

Moreover, the Russia-Ukraine war can continue with EU funding replacing the U.S. and we see the current peace negotiations failing before a deal eventually occurring in late 2026. President Xi, after Venezuela, could ask Trump to accept eventual Taiwan reunification for a trade deal, but Trump could find this difficult to concede. Our baseline remans against invasion of Taiwan by China in 2026/27.

A lot of uncertainty still exists over how the U.S. will be involved with Venezuela and the spillover globally, but our early thoughts are.

· U.S. works with the new President. The U.S. has stopped short of regime change, with the vice president sworn in and having support of the military. President Trump and U.S. Secretary of state Rubio have had differing views on the U.S. relationship with Venezuela, with Trump going for the headline grabbing “we now run Venezuela” to Rubio’s more nuanced “we dictate to Venezuela”. Trump’s loathing for ground wars suggests that Rubio’s guidance is likely and the U.S. wants the Venezuela regime to crack down on drug gangs and open up to U.S. oil investment. Despite volatility in the coming days, this is the most likely scenario that the new President will follow rather than have a war with the U.S.

· Oil. The U.S. is keeping pressure on the Venezuelan oil industry via sanctions and intermittent blockades, which could see the new Venezuelan president conceding ground. However, Iraq experience after 2003 is illustrative of the challenges that Venezuela faces with decaying infrastructure that needs large scale investment to boost oil output back to the 3-4mln barrels per day of Venezuela glory days. Additionally, sources close to U.S. oil companies have already expressed a precondition of stable politics including new parliamentary elections. Iraq took until 2010 for production to really take off (Figure 1), which suggests that Venezuela oil really ramp up could be beyond the 2026-27 period – though some rebound is feasible from current depressed levels and would be another worry for oil prices (our Commodity Outlook is here).

· Cuba/Colombia/Ukraine. Trump’s Venezuela campaign shows that he believes in the Monroe Doctrine of a pivot in U.S. policy toward the Americas. This was clearly highlighted in the November National Security Strategy (here). Though Trump, on Sunday, lashed out at Colombia and Greenland, Cuba is the real prize for Trump and Rubio and a vote winner among Latino voters. U.S. action will likely be to squeeze Cuba regime rather than direct military action at this stage, as Cuba is heavily dependent on discounted Venezuelan oil. Outside the Americas, actions on Venezuela will increase nerves about a Trump administration focused on the Americas. Trump could lose patience with the Russian/Ukraine peace discussions that appear deadlocked and we see failing before an eventual peace deal in late 2026 (here). However, European leaders know they cannot depend on Trump, which is leading to a surge in military spending in some European countries.

· Asia and Taiwan. Asia is different, as dependency on the U.S. is great, with Japan and S Korea military spending less than European countries. The biggest focus is on Taiwan. President Xi could ask Trump not to intervene in any future reunification of Taiwan in exchange for a trade deal. This raises the stakes around Trump’s proposed visit to China in April. However, Xi is cautious, and the Trump administration has rejected ideas to shift from the Taiwan strategic ambiguity policy. Thus, our baseline remains for ongoing grey warfare around Taiwan, with a 10% probability of invasion or blockade (here) and a 20% risk of a temporary and partial quarantine.

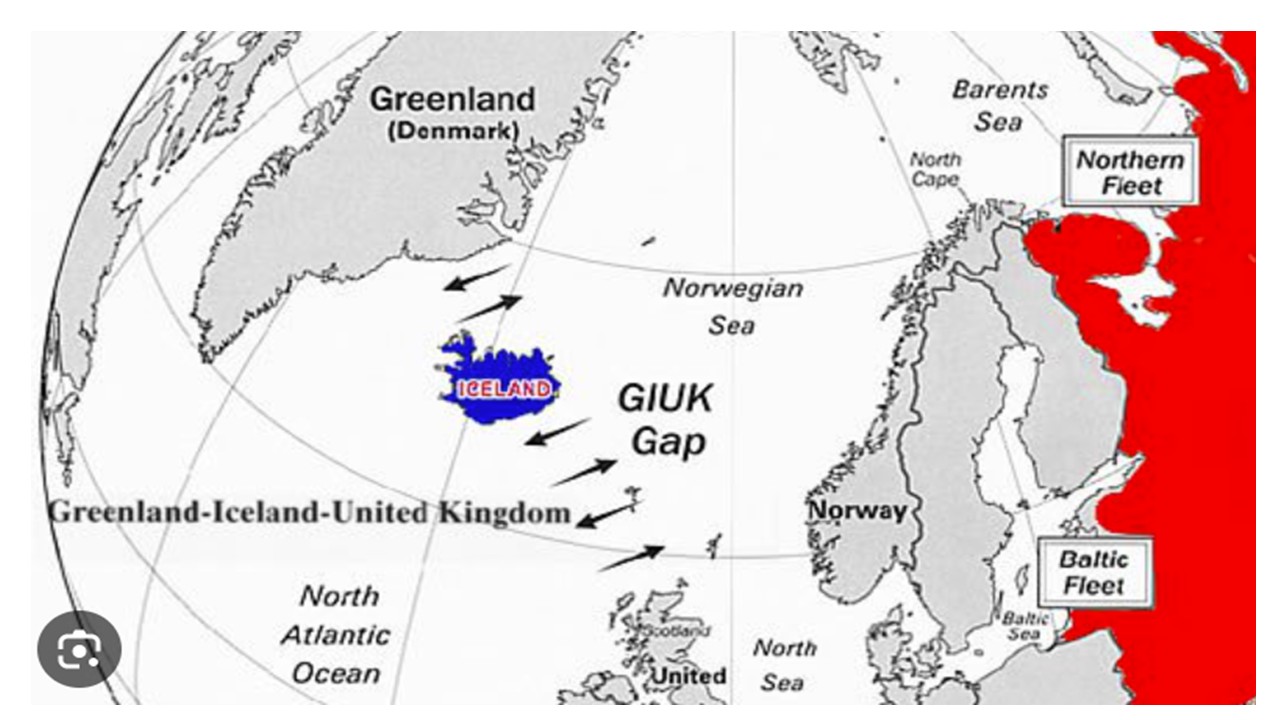

Figure: Greenland/Iceland/UK Gap

Trump will likely go for more pressure and then seek to negotiate with Denmark and Greenland. Denmark and Greenland already have mutual interests with the U.S. on security; minerals and Russia/China that are already covered by previous agreements and understandings. Trump would like to see an independent Greenland, that could then directly negotiate with the U.S. A new three-part agreement could be the final solution. We would only attach a 10-30% probability of a large U.S. navel show of strength. A 2nd option is cohesion via a naval blockade or quarantine (like with Venezuela in Q4 2025), but this is low probability. An invasion is low probability, as Trump hates the risk of U.S. military casualties. Trump appears to want to takeover Greenland, which means that probabilities are fluid and could rise. However, Trump still need to deal with the aftermath in Venezuela; risk of a regime change/collapse of government in Cuba; the forthcoming Supreme court ruling on tariffs and MAGA concerns about overseas military campaigns.

The 1823 Monroe doctrine is being rebooted with the 2025 U.S. national security strategy (here), which put the Americas first above Europe and Asia. This could involve the U.S. having a greater sphere of influence in the Americas by diplomatic means and negotiations, but the military intervention in Venezuela has raised questions of whether this could see military aggression elsewhere. Could this lead to a military conflict over Greenland? Trump could possibly shift U.S. navy assets towards Greenland once the Venezuela situation is under control, as a show of strength and to bully Denmark/Greenland. The North Atlantic also seen posturing in the past between NATO countries e.g. UK/Iceland Cod clashes 1972-3, 1975-6 (here). Trump’s Greenland ambitions could be more important to him, than NATO cohesiveness. The Trump administration also knows that Europe ex France/UK is critically dependent on the U.S. nuclear deterrent and in a crisis Europe’s support for Denmark would likely fracture. This would however cause a crisis of confidence between Denmark/Europe and the U.S. and within NATO, which would be too high a cost for even the Trump administration. We would thus only attach a 10-30% probability of a large navel show of strength. A 2nd option is cohesion via a naval blockade or quarantine (like with Venezuela in Q4 2025), but this is low to modest risk probability. An invasion is low probability. Trump hates having U.S. troops on foreign soil for any length of time and the odds of a ground invasion are low. Trump’s foreign escapades are restrained by the November mid-term election, as too much foreign military intervention could put MAGA off turning up to vote and hand the House of Representatives to the Democrats. Trump will likely go for more pressure and then seek to negotiate with Denmark and Greenland. Denmark and Greenland already have mutual interests with the U.S. on security; minerals and Russia/China that are already covered by previous agreements and understandings. A new three part agreement could be the final solution. Trump would also like to see an independent Greenland, that could then directly negoicate with the U.S., which would require a referendum.

The greenback is off to a good start in 2026. Even with Trump doing his rounds from economy and military, the USD remain well supported. Partially attributed to haven flows, the run higher in USD has not been accompanied by rising Treasury yields, which meant the rally could be short-lived.

On the chart, there is no change to the modestly positive tone, as intraday studies continue to rise, with prices extending gains to currently trade around 98.80. Positive daily readings highlight room for a break above here towards the 99.31 weekly high of 9 December. But already overbought daily stochastics and bearish weekly charts are expected to limit any tests of this 99.00/31 range in renewed selling interest. Meanwhile, support remains at congestion around 98.50 and should underpin any immediate setbacks.

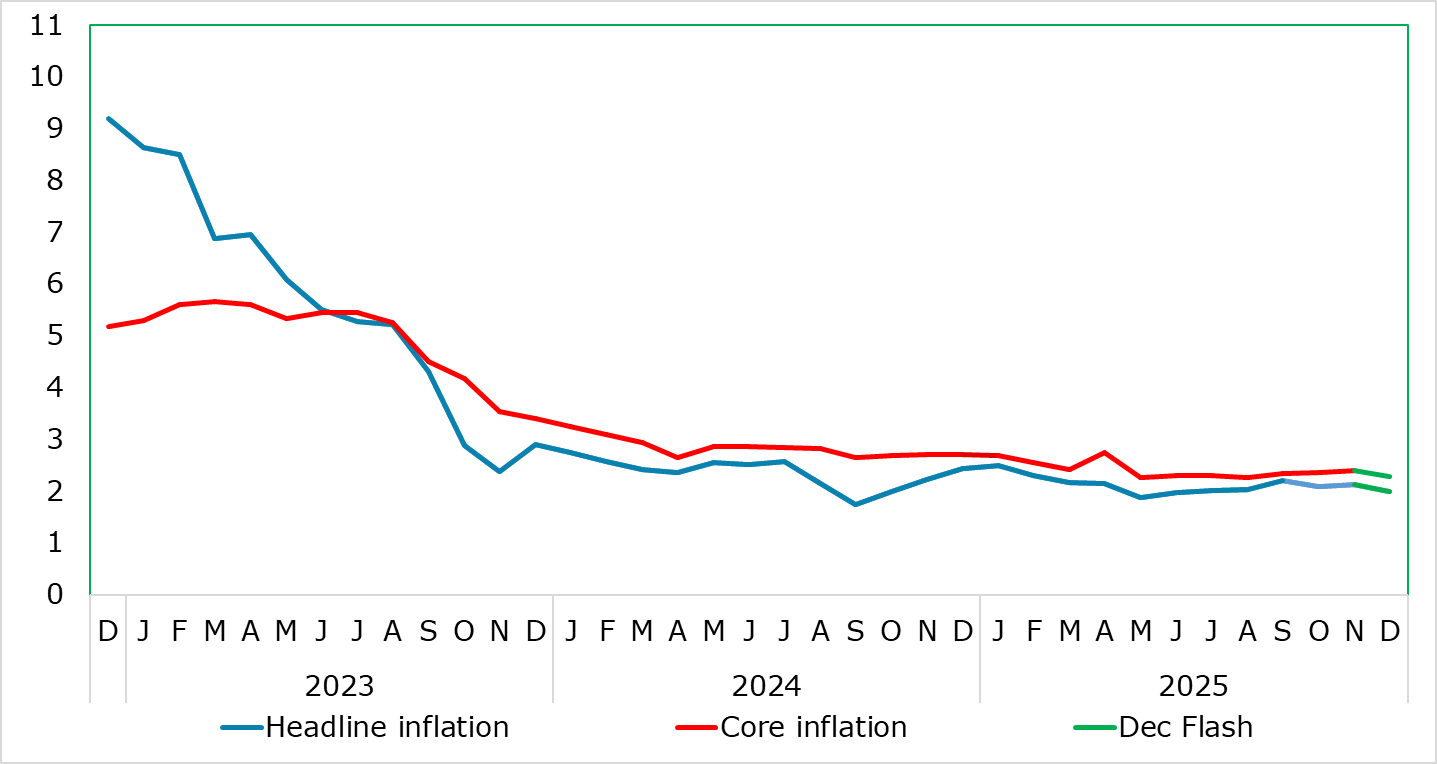

Figure: Headline and Services Edge Lower

HICP inflation has been range bound for the last 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. And it stayed in that range falling to 2.0% in the December flash numbers, albeit where adverse rounding pre vented a fall to 1.9%. We see this as the start of a fresh but what may be a short-lived fall toward 1.5% in H1 2026. Some of this may be energy related but a 0.1 ppt correction back in services last month did the core down a notch to a new cycle low of 2.3%. However, this also reflected a further fall in non-energy industrial goods (NEIG) inflation, this possibly an increasing sign of softer import prices possibly related to Chinese export dumping. While this may temper hawkish thinking, the December data very much chime with the ECB’s latest projection.

With what were previously unfavourable energy-related base effects reversing, EZ inflation edged down 0.1 ppt to 2.1% in October, largely in line with consensus thinking, but with the main core rate stable at 2.4%. This reversed in the flash November numbers but which were later revised down to match the October outcome. But the diehard hawks at the ECB will have focused on the small further rise in services inflation to a seven month high of 3.5%, a shift higher echoed by less favourable, but still target-consistent, adjusted m/m data. Even so, this seems to have reverberated within the ECB and seemingly has prompted the upward revisions to the 2026 HICP outlook.

Even so, the fresh fall back to 3.4% (seemingly very much transport price driven) will not placate the hawks. What may do so is the other component of core inflation. Indeed, a fall in non-energy industrial goods inflation to a 15-mth low of 0.4% is possibly an increasing sign of softer import prices possibly related to Chinese export dumping – ie such evidence is echoed by the clear fall in overall import price numbers of late. The question is whether what may be more than a cyclical fall in core goods inflation will offset any further resilience in services (Figure 2), should the latter not succumb to lower wage pressures as we think will be the case. If so, then core inflation may see a two-pronged downward push in the coming year. This may be a major issue for the ECB, even if it goes against the worries and thinking of the hawks.