CHF flows: CHF weakens as inflation drops

CHF sharply lower as Swwiss inflation drops and market expectations of SNB cuts increase. CHF/JPY looks most vulnerable

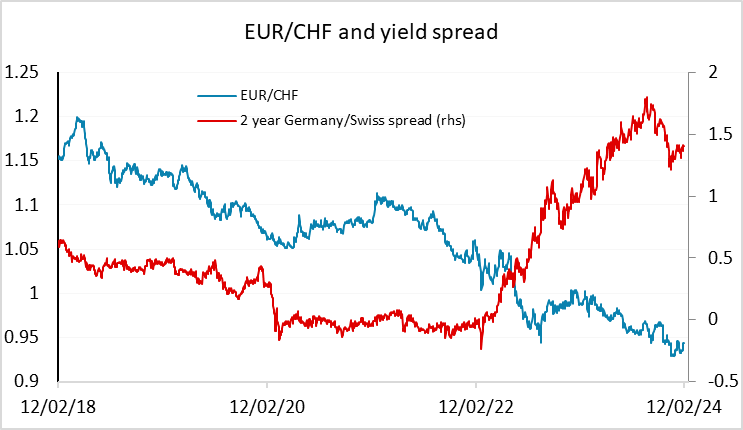

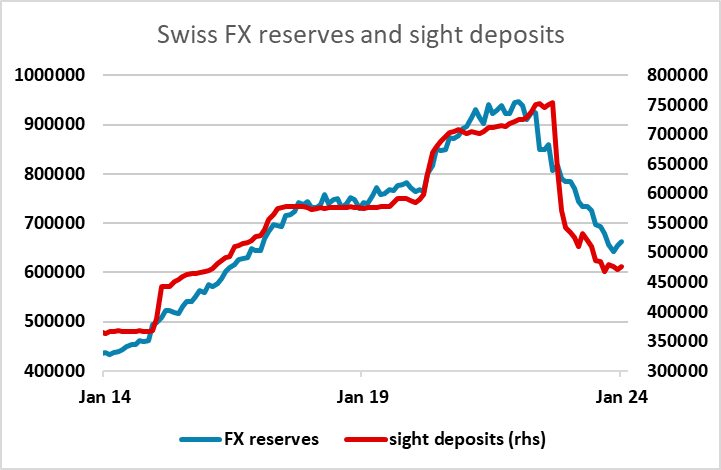

EUR/CHF is sharply higher after Swiss CPI came in substantially below expectations in January at 1.3% y/y against the 1.7% expected. Front end yields are lower with 2 year yields down 5bps and a March rate cut now priced as a better than 50% chance. Of course, there hasn’t been much correlation between EUR/CHF and yield spread moves, in part because of relatively low Swiss inflation, in part because the SNB’s unwinding of its balance sheet has involved a lot of selling of FX reserves and buying of CHF. However, with this now over, and Eurozone inflation back to levels much closer to Swiss levels, there may be some greater impact of policy on EUR/CHF.

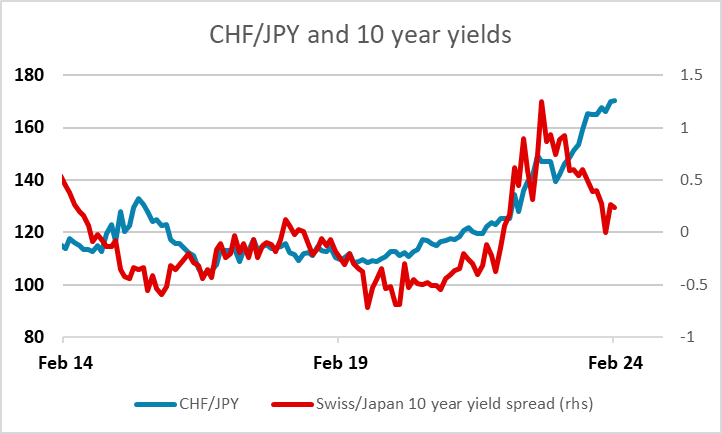

However, we continue to see CHF/JPY as a better trade to reflect the downside risks of the CHF, as the weakness of the JPY has been the most pronounced against the CHF, despite similar risk characteristics. The CHF gains on the back of rising yields in recent years ought to be reversed now that the yield spread move has itself been almost fully reversed.