Preview: Due January 17 - U.S. December Industrial Production - Bounce in aircraft to lead rise

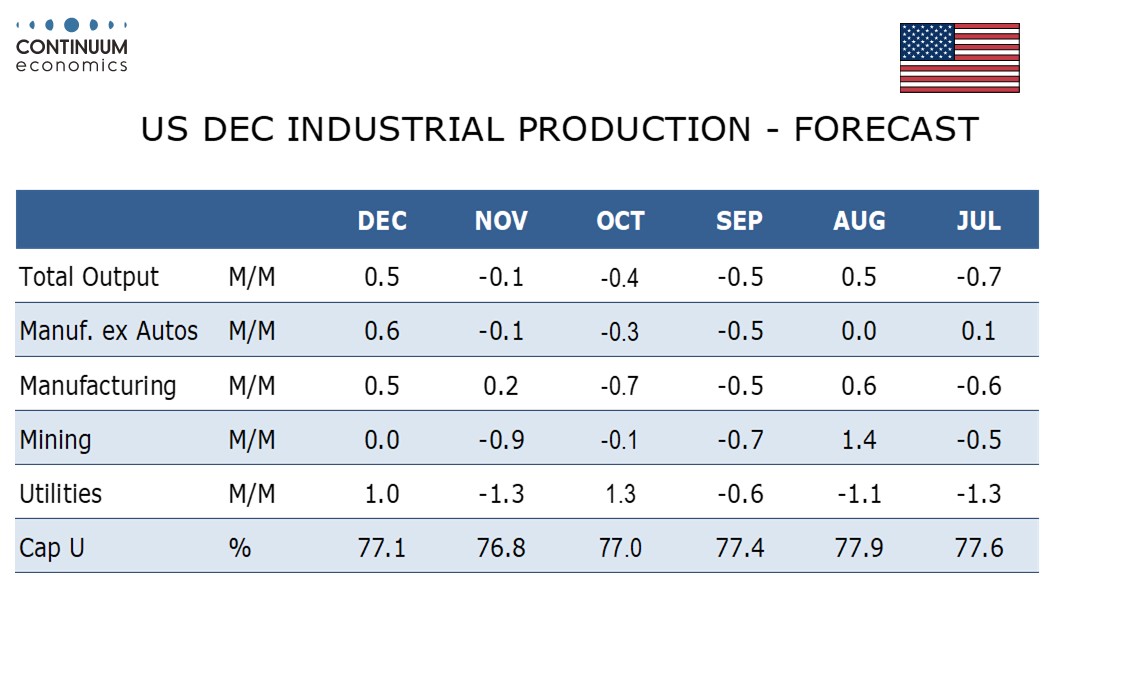

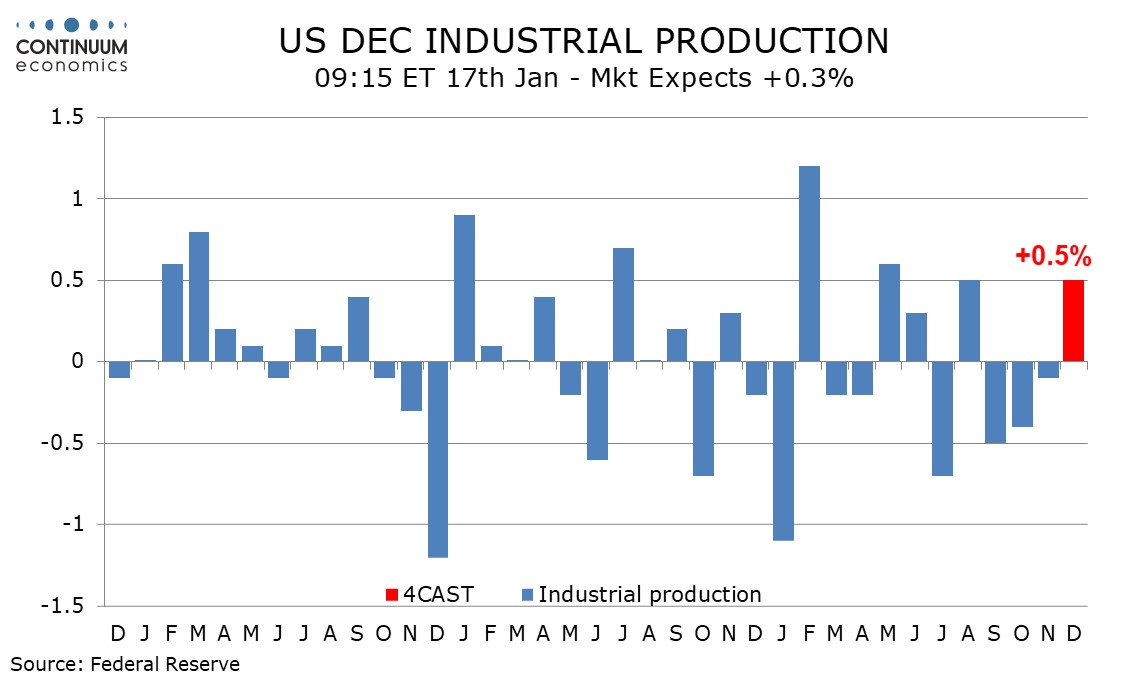

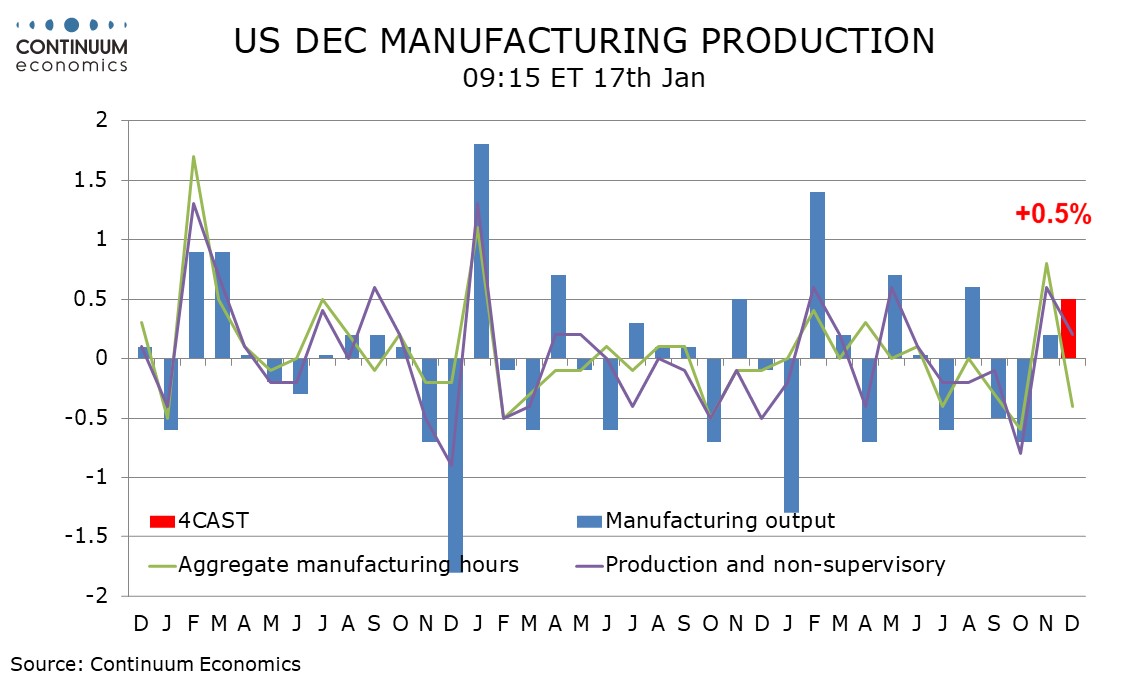

We expect gains of 0.5% in both industrial production and manufacturing output in December, likely to be led by a rebound in aircraft after three straight declines caused by a strike at Boeing. The strike as resolved in early November but output failed to recover in that month, making a bounce due.

Outside a rebound in aircraft the data is likely to look quite subdued. Non-farm payroll data showed a decline in manufacturing employment with aggerate hours worked also down, though aggregate hours did edge up for production and non-supervisory workers. ISM manufacturing data was also slightly improved in December.

Payroll data suggests a slip in auto output. We expect manufacturing output ex autos to rise by 0.6%. Weekly electrical output implies a modest rise in utilities output and we expect a pause in mining after three straight declines. However, the impact of this on overall production will be modest.

We expect capacity utilization to rise to 77.1% overall from 76.8%, and to 76.3% from 76.0% in manufacturing. Both will be at their highest levels since September.