CAD flows: CAD falls on weaker CPI

BoC core CPI measures weaken incrasing the chance of a June 5 rate cut

Canadian CPI comes in on the weak side of expectations. While the headline y/y rate was as expected at 2.7%, the m/m was 0.5% against the market consensus of 0.6%, and the median and common CPI measures, which the BoC look at as two of their core measures, were both below expectations at 2.6%. The trimmed mean, which is the other core measure used by the BoC, was as expected at 2.9%.

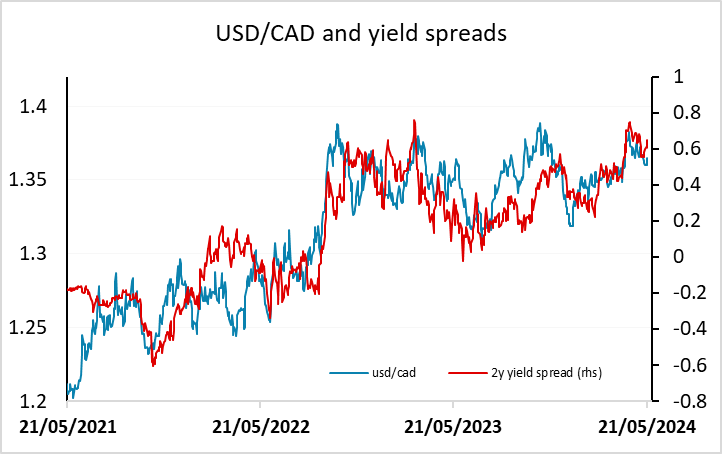

The data looks to us to be just soft enough to tip the BoC over the edge into cutting rates in June. Ahead of the data this was priced as around a 37% chance, but the market has now moved it up to a 49% chance. USD/CAD has initially risen around 30 pips to 1.3650, but there is still potential upside as the market can yet price in a June 5 cut more aggressively, and USD/CAD was already starting from a point that looked a little low relative to the yield spread correlation. 1.37 looks possible.