USD, JPY flows: USD/JPY edges lower after claims data

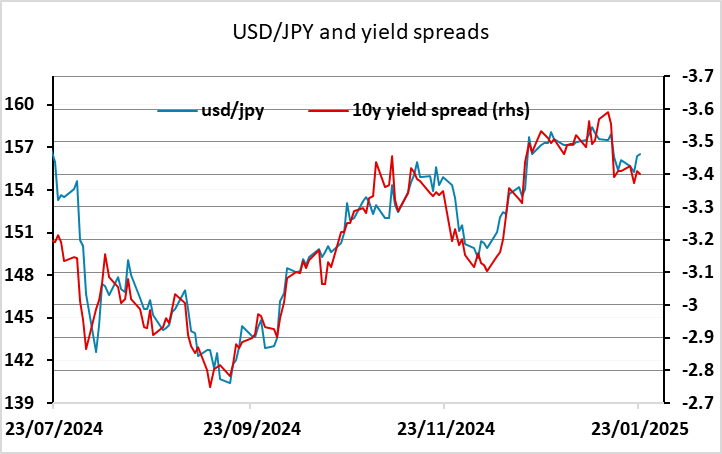

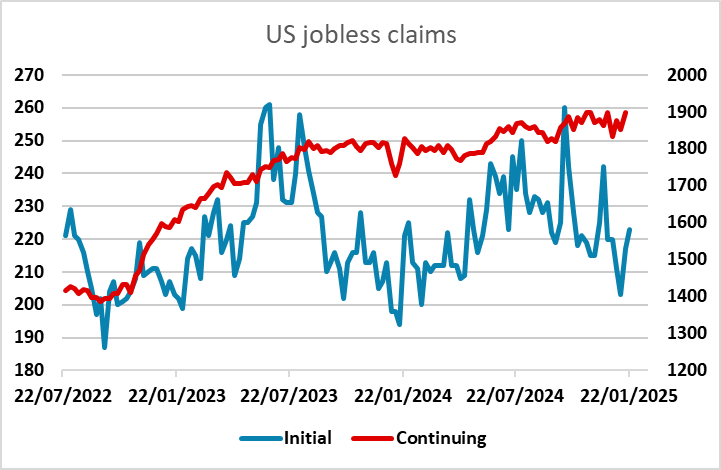

Higher continuing claims provide some evidence of US labour market softening. USD/JPY edging lower helped also by expectation of BoJ rate hike tomorrow.

US jobless claims came in slightly above consensus, particularly continuing claims, which at 1899k were the highest since the pandemic affected 2021. But there’s still no sign of a significant pick up in initial claims. This suggests that there is less hiring going on but not more firing. Either way, continuing claims ought to correlate with unemployment, so provides some suggestion of a weakening in the labour market. However, US yields are not much changed, and US equity markets are on the edge of another all time high. We are getting increasingly wary of current valuations, and if we are seeing some signs of softening on the labour market, there could be a significant correction coming. The JPY would likely be the main beneficiary in those circumstances, and USD/JPY is a touch softer since the data. A 25bp BoJ rate hike tomorrow should be enough to trigger a move down to 155.