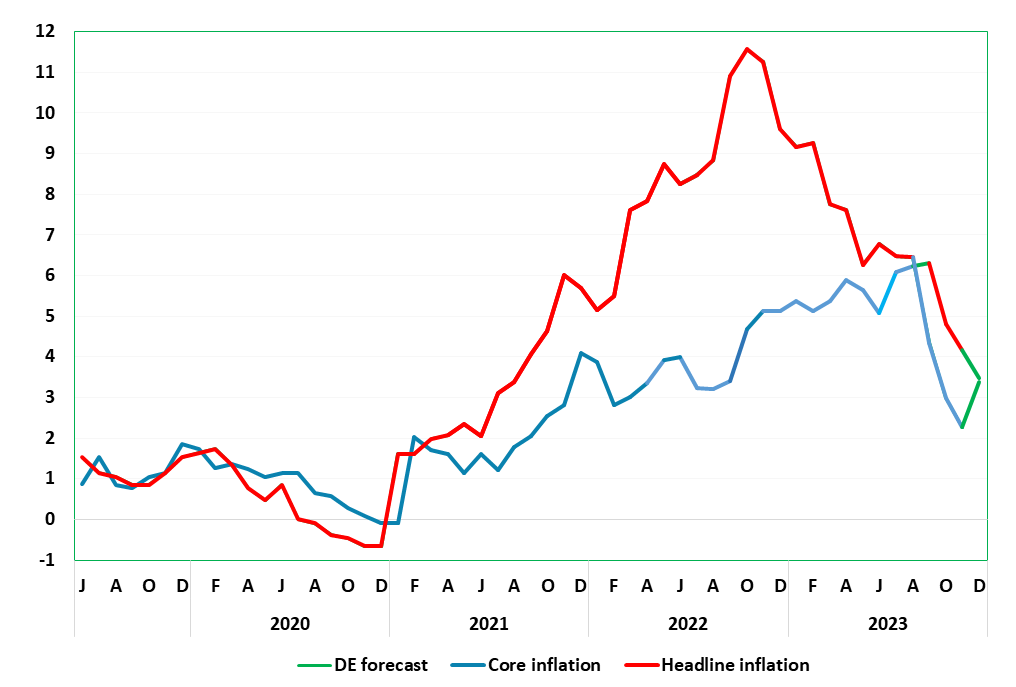

German Data Preview (Jan 4): Headline CPI Inflation to Jump on Energy Base Effects?

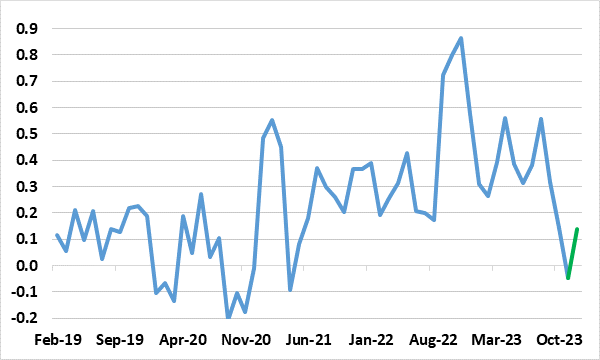

We have been highlighting repeatedly a clear and continued fall in overall German and EZ inflation pressures, initially evident in survey data but spreading to official numbers. This downtrend was much more evident in the softer-than-expected October and also the November HICP numbers. Indeed, helped by a small and further fall in fuel prices, weaker food inflation, all alongside favourable recreational sector base effects, the headline and core rate came down further, the former easing 0.7 ppt to 2.3%, a 29-month low, with the core dropping by 0.7 ppt to 3.5%. Despite by a further fall in fuel prices, recreation-sourced and particularly energy-related base effects, are likely to push up the headline rate back to 3.3% in December but with the core stable (Figure 1). Regardless, the disinflation backdrop underlined by an ever softer core seasonally adjusted data (Figure 2). Indeed, the headline y/y rate may resume a downtrend in the new year.

Figure 1: HICP Inflation to Jump?

Source: German Federal Stats Office, CE

Disinflation Continues Meanwhile

German HICP inflation continues to be volatile but with a downtrend more discernible and ever broader after the downside surprises of recent months. But that headline rate may rise afresh in December, albeit where energy inflation will jump due to bse effects and despite a m/m fall in fuel costs.

Figure 2: Adjusted Core Rate Falling Clearly

Source: German Federal Stats Office, CE, % chg m/m, smoothed