U.S. June JOLTS, July Consumer Confidence - Stable headlines, some details a little softer

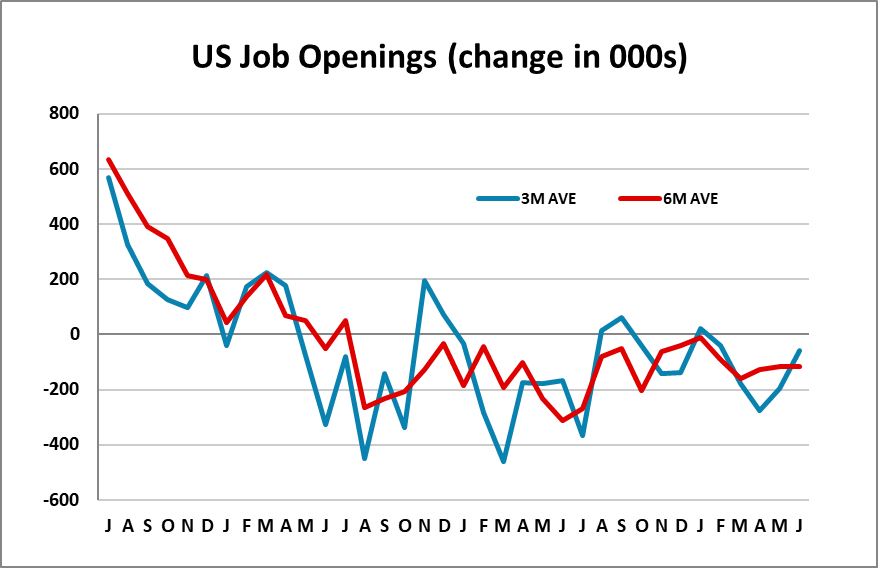

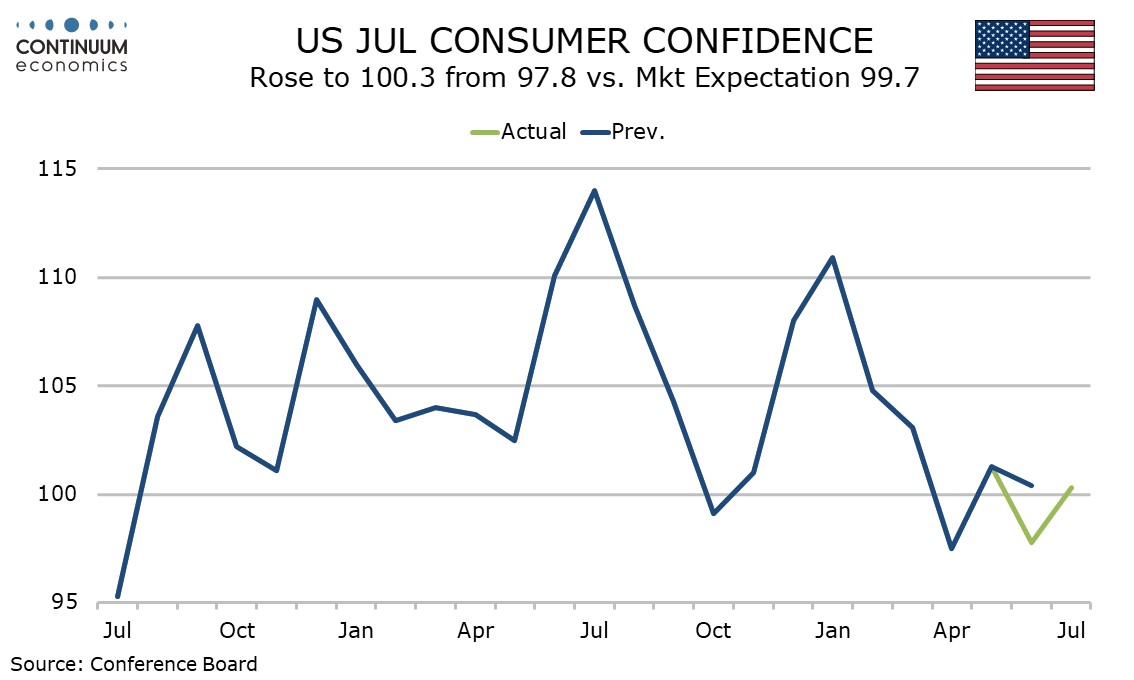

June’s JOLTS report has shown only a marginal 56k decline after a 311k increase in May (revised significantly higher from 221k) failing to restore the downtrend that was seen in two straight losses of over 400k in both March and April. July consumer confidence is also showing resilience, up to 100.3 from 97.8, though up only because June was revised down from 100.4.

The openings data suggest that while the labor market has lost some momentum, it is now in a reasonable balance after having been very tight for some time. Turnover is however down, with hiring down by 314k and separations down by 302k, while quits fell by 121k, hinting at reduced job opportunities.

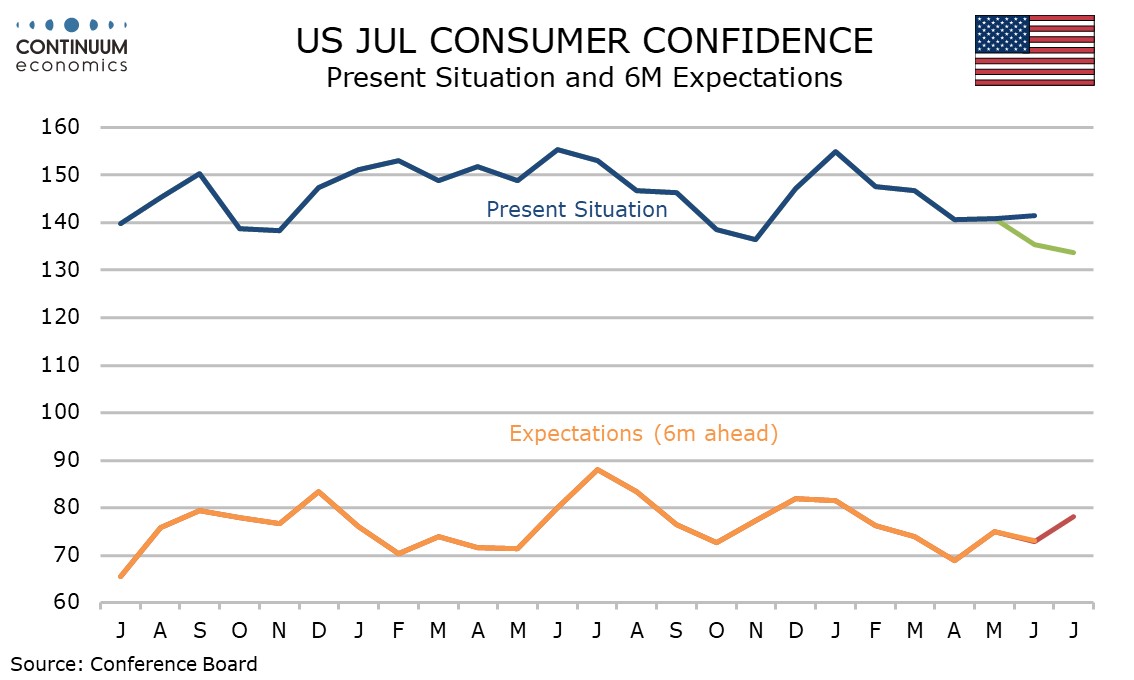

The consumer confidence detail shows expectations softer at 133.6 from 135.3, with June revised significantly lower from 141.5. However expectations picked up to 78.2 from 72.8, the latter revised only marginally from 73.0.

A weaker present situation but rising expectations is consistent with the Michigan CSI, and suggests some loss of economic momentum but rising hopes for Fed easing.

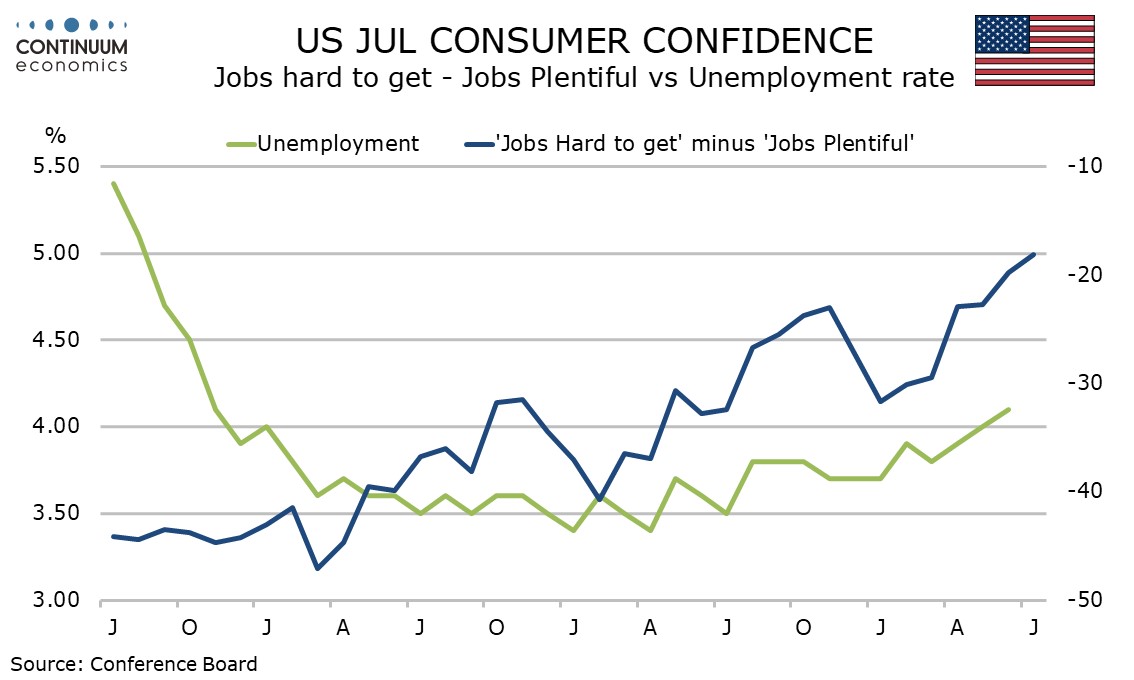

The labor differential shows the gap between those seeing jobs as plentiful and those seeing them as hard to get narrowing to 18.1% from 19.8%, and is the lowest since March 2021, and therefore this series suggests some loss of labor market momentum.

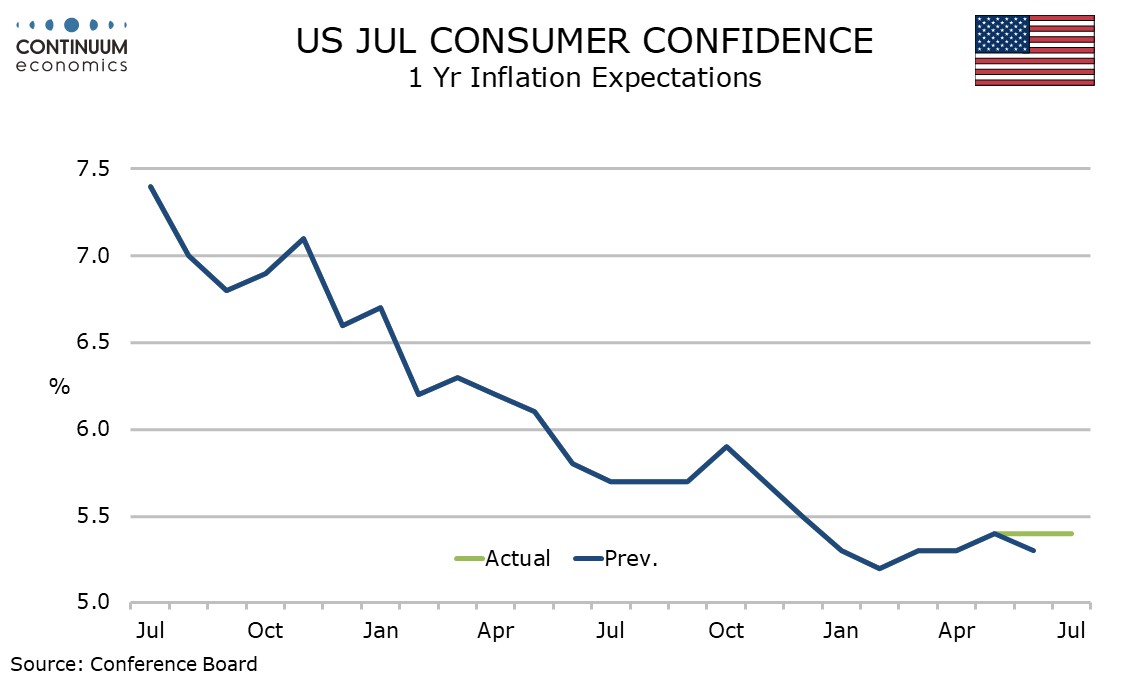

The one year inflation expectation is stable at 5.4% for a third straight month. This series consistently overestimates inflation.