EUR flows: EUR little changed after ECB cuts 25bps as expected

ECB cuts 25bps. Limited scope for ECB to impact EUR/USD near term. Press conference will be watched but Fed and Trump look more likely to trigger moves

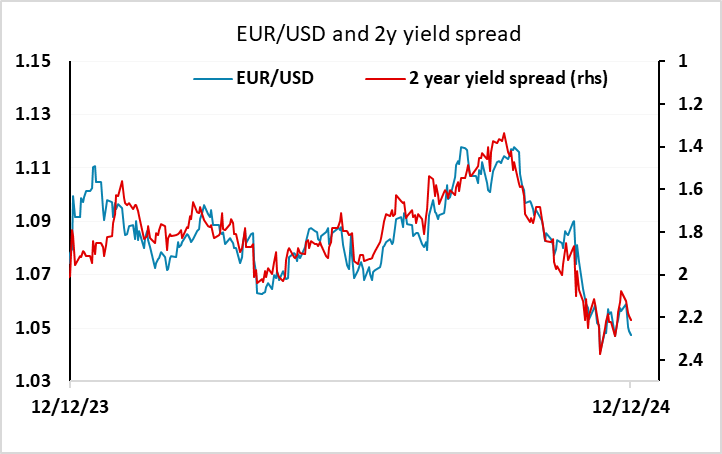

As expected, the ECB cut the deposit rate by 25bps. There was a small risk of a 50bp cut priced in, but the EUR has nevertheless fallen slightly on the news, hlped by downwrad revisiosn in growth and inflation forecasts. But there is limited scope for volatility from here. The focus now will be on the press conference, and whether it provides any indication of future policy. As it stands, there is a further 125bps of easing priced in for the next year, with rates expected to stabilise at 1.5-1.75% by H2 2025. It looks hard for the ECB to say much to challenge that view. Eurozone growth isn’t strong enough for them to indicate a more hawkish stance, but after a 25bp cut, it is also hard for them to suggest more rapid easing, with 25bp cuts broadly priced in for the next 5 meetings. The outlook for EUR/USD will likely depend more on the Fed next week, as there is greater scope for volatility in US rate expectations. and on Trump’s policies when he comes in in January. As it stands, EUR/USD continues to stick close to moves in 2 year yield spreads.