NOK flows: NOK little changed after Norges Bank

NOK steady as Norges Bank leaves rates unchanged but still has potential for recovery

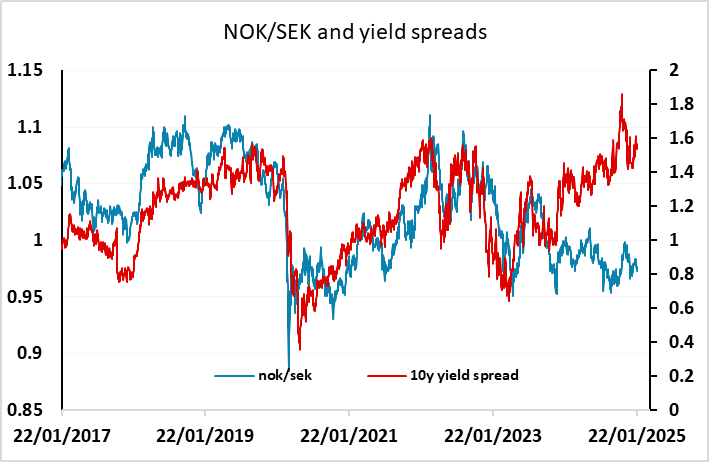

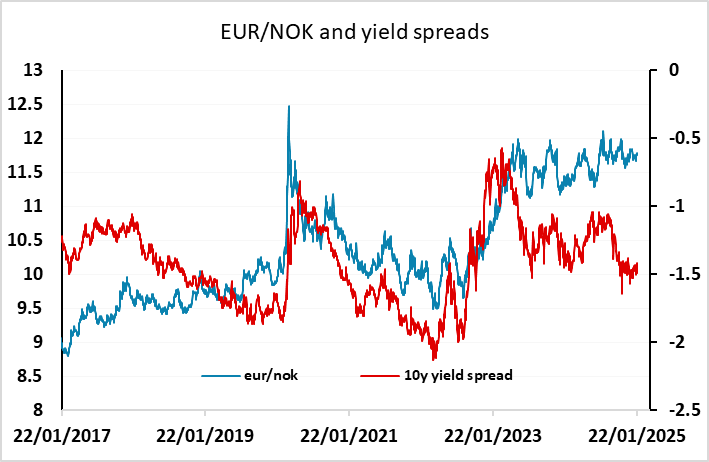

There’s nothing particularly surprising in the Norges Bank statement. EUR/NOK is little changed on the announcement, and we continue to see potential for a NOKrecovery given its major underperformance over the last year. Norges Bank continue to indicate that they are likely to cut rates in March, encouraged by lower than expected CPI inflation, even though fewer rate cuts abroad are now expected than before. This might normally mean that Norwegian rate cuts would lead to a weaker NOK, but in the current circumstances, the NOK hasn’t shown much inclination to follow moves in yield spreads. A modest decline in yield spreads would still leave the NOK looking very cheap relative to the normal relationships which held in previous years. The statement also highlights the potential for a rise in tariffs to dampen global growth – an aspect of Trump’s policies that isn’t currently bothering the equity markets, but could do so in the future if tariffs are implemented rather than being used as a negotiating tool.