U.S. June ADP Employment slightly slower, Initial Claims trending higher

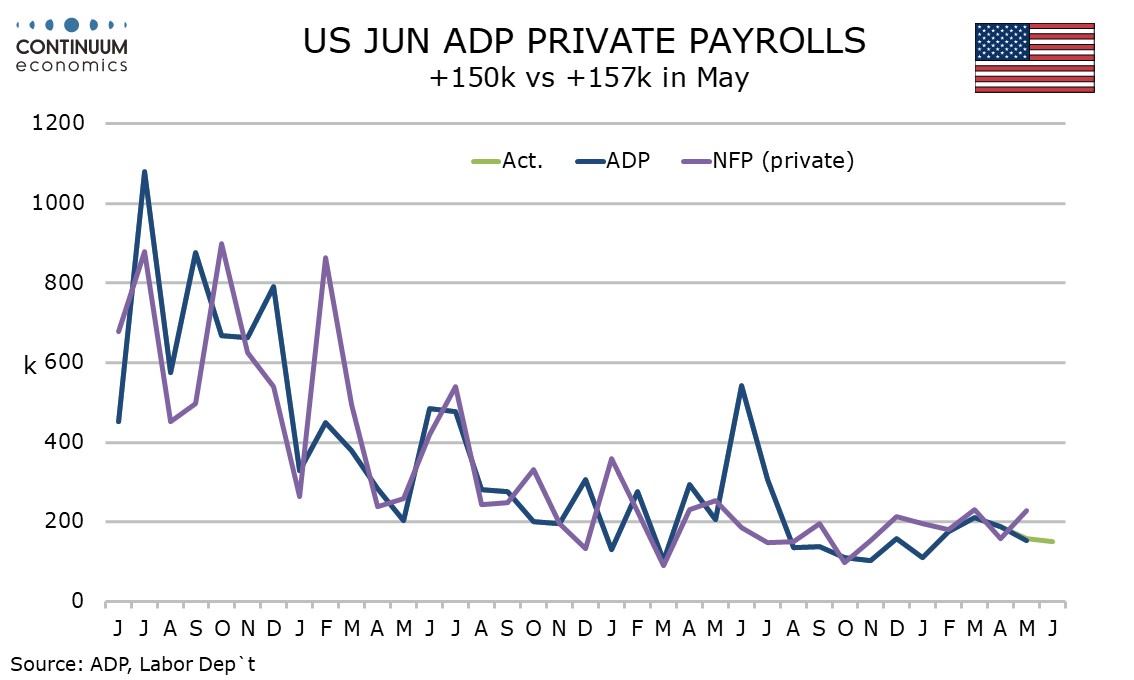

ADP’s June estimate for private sector employment growth of 150k is marginally below expectations though little changed from May’s 157k (revised from 152k). Initial claims continue to trend higher, suggesting some loss of labor market momentum.

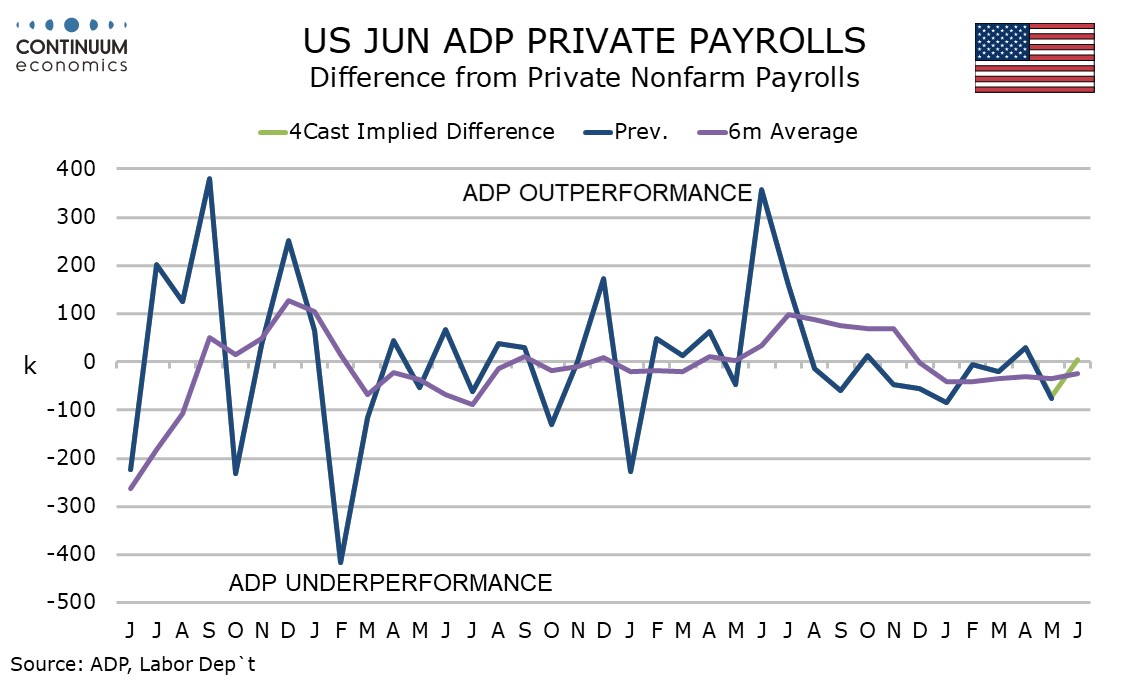

ADP has tended to underperform payrolls in recent months though our 145k forecast for June’s private sector payroll is slightly below ADP’s estimate. We see overall payrolls up by 185k.

The ADP detail shows strength in leisure and hospitality with a rise of 63k and construction at 27k is quite firm. Elsewhere data is subdued, though business and professional rose by 25k. Manufacturing fell by 5k while education and health, which has led recent non-farm payroll growth, rose by only 9k.

Wage data showed a 4.9% rise in growth for job starters, down from 5.0% in May, and a 7.9% rise for job changers, down from 8.0% in May. The gain for job stayers is the slowest since August 2021. The ADP data is consistent with a labor market moving back inti balance, even if in line with recent trend in job gains.

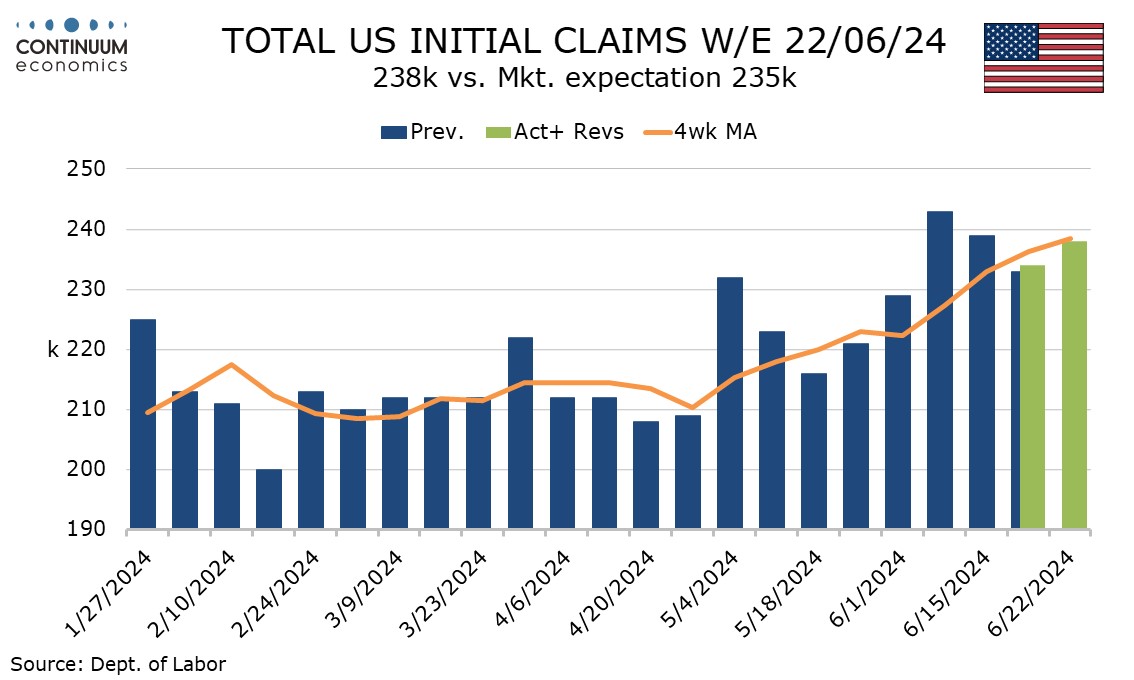

Initial claims at 238k have reversed most of last week’s decline to 234k (from 239k) which could have seen some influence from the Juneteenth holiday. The level is close to the 4-week average of 238.5k which is the highest since August 2023.

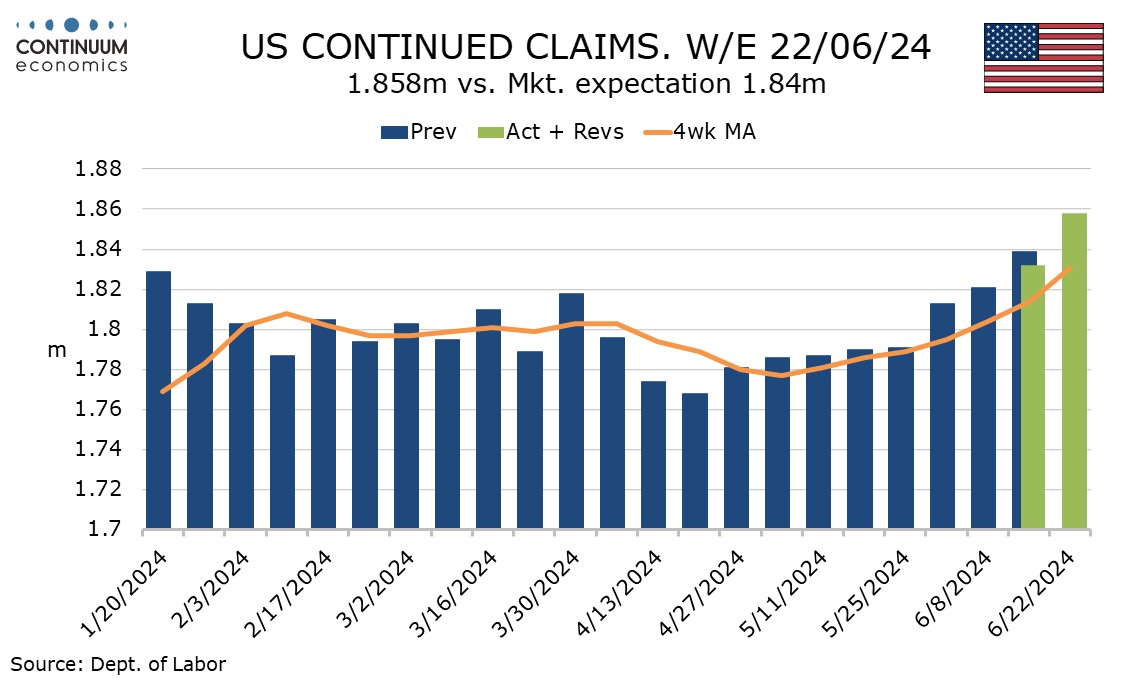

A 26k increase in continued claims to 1.858m is the largest of nine straight gains and the level is the highest since November 2021. The labor market seems to be cooling though June’s non-farm payroll was surveyed two weeks before the latest initial claims data and one week before continued claims.