Published: 2024-05-29T12:20:16.000Z

Preview: Due May 30 - U.S. Preliminary (Second) Estimate Q1 GDP - Slower still on retail and inventories

4

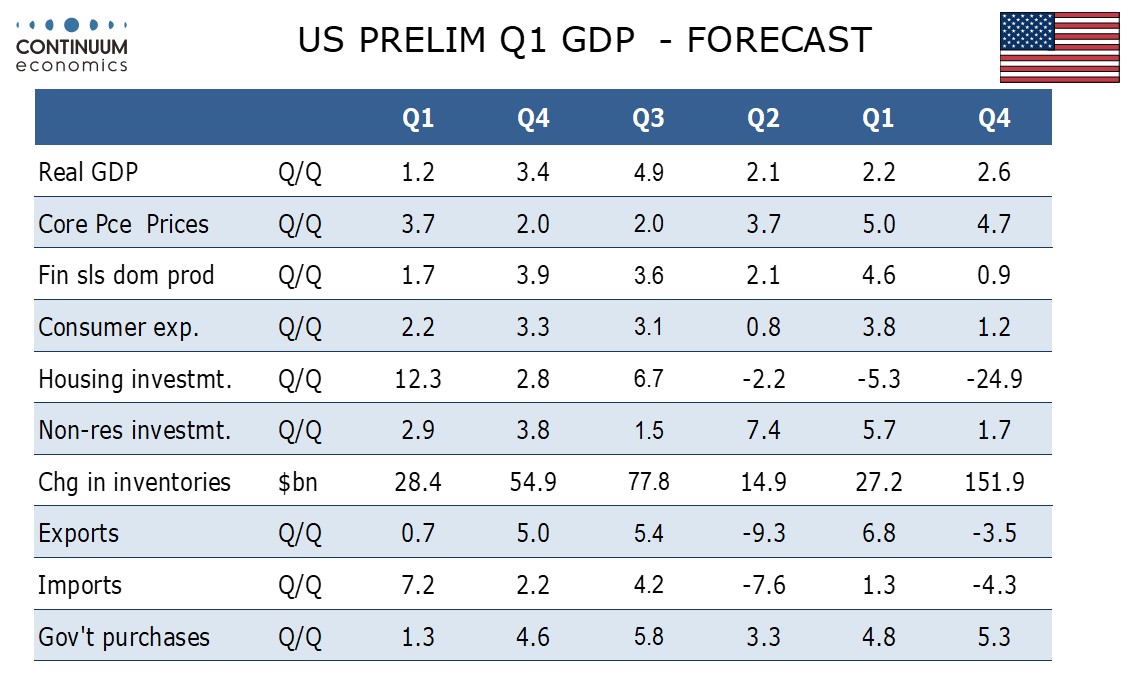

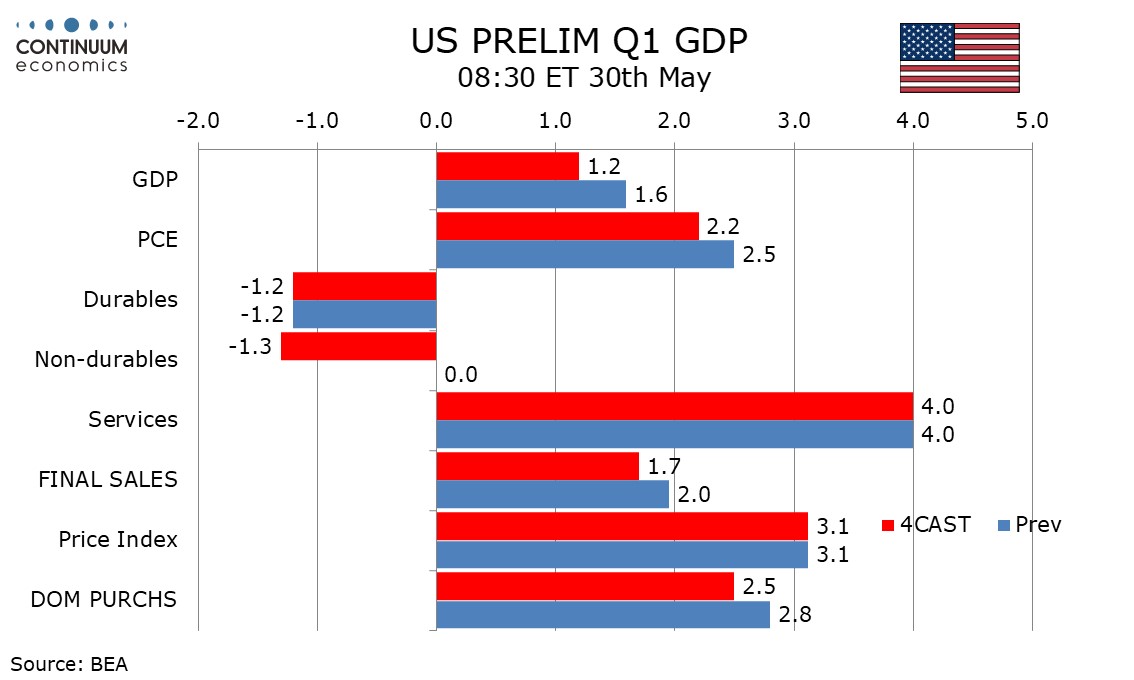

We expect the second (preliminary) estimate for Q1 GDP to be revised lower to 1.2% annualized from the advance estimate of 1.6%. This will remain the slowest quarter since a decline in Q2 2022. Our current estimate for Q2 is for a rise of 2.0%.

The main source of the revision will be retail sales, where February and March data was revised down with April data. We also expect a downward revision to inventories. We expect final sales (GDP less inventories) to be revised down to 1.7% from 2.0%.

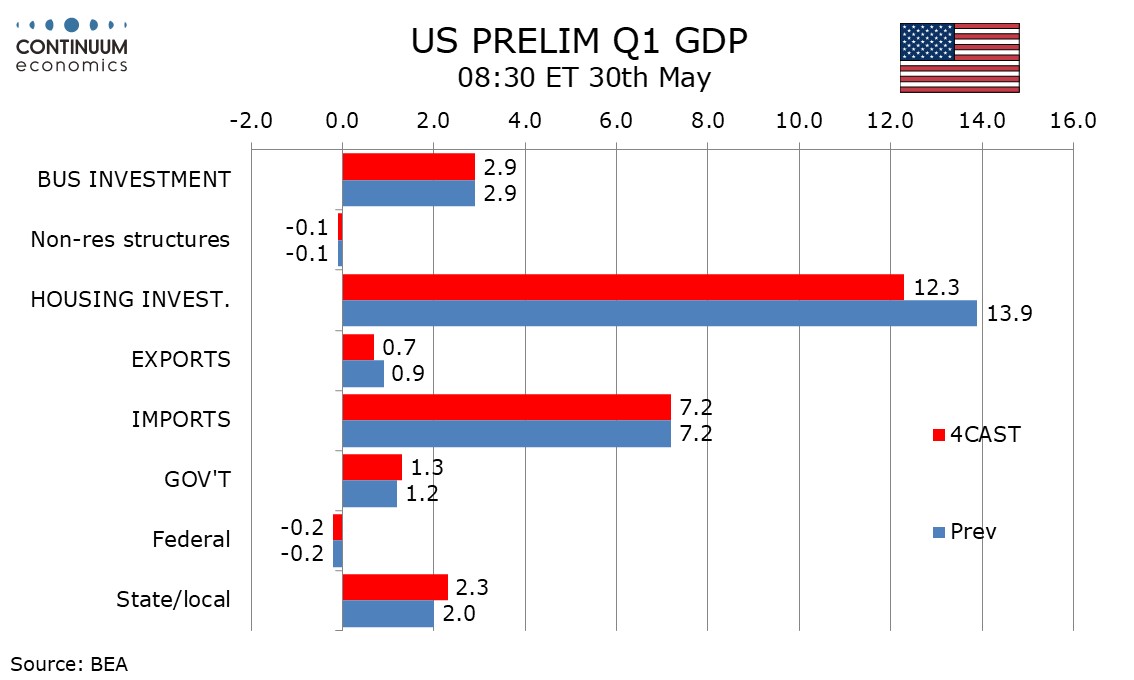

Other revisions are likely to be minor, slightly downwards for housing and net exports but slightly positive for government. Final sales to domestic buyers (GDP less inventories and net exports) will remain stronger than GDP, buy we expect a downward revision to 2.5% from 2.8%.

We do not expect any revisions to the price indices, from 3.1% for GDP, 3.4% for overall PCE and 3.7% for core PCE, the latter an unwelcome acceleration from two straight quarters that at 2.0% annualized were consistent with target.