Preview: Due July 1 - U.S. June ISM Manufacturing - A little firmer, not quite at neutral

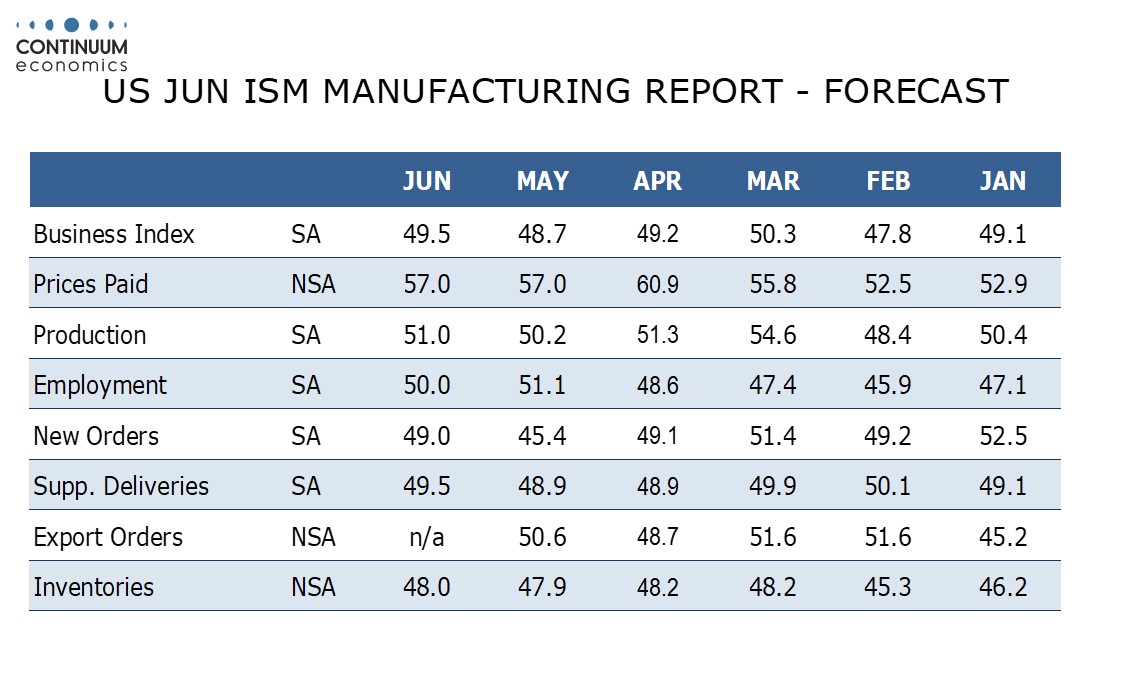

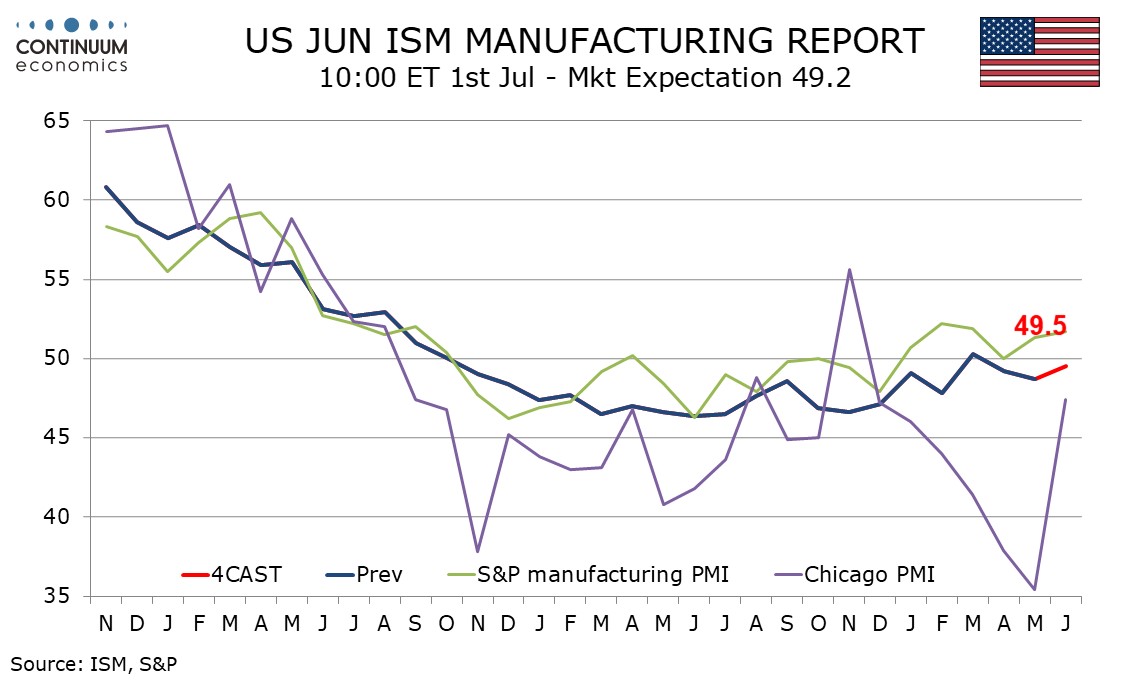

We expect three month high ISM manufacturing index of 49.5 in June, up from 48.7 in May though not matching March’s 50.3 which was the first reading to each neutral since October 2022.

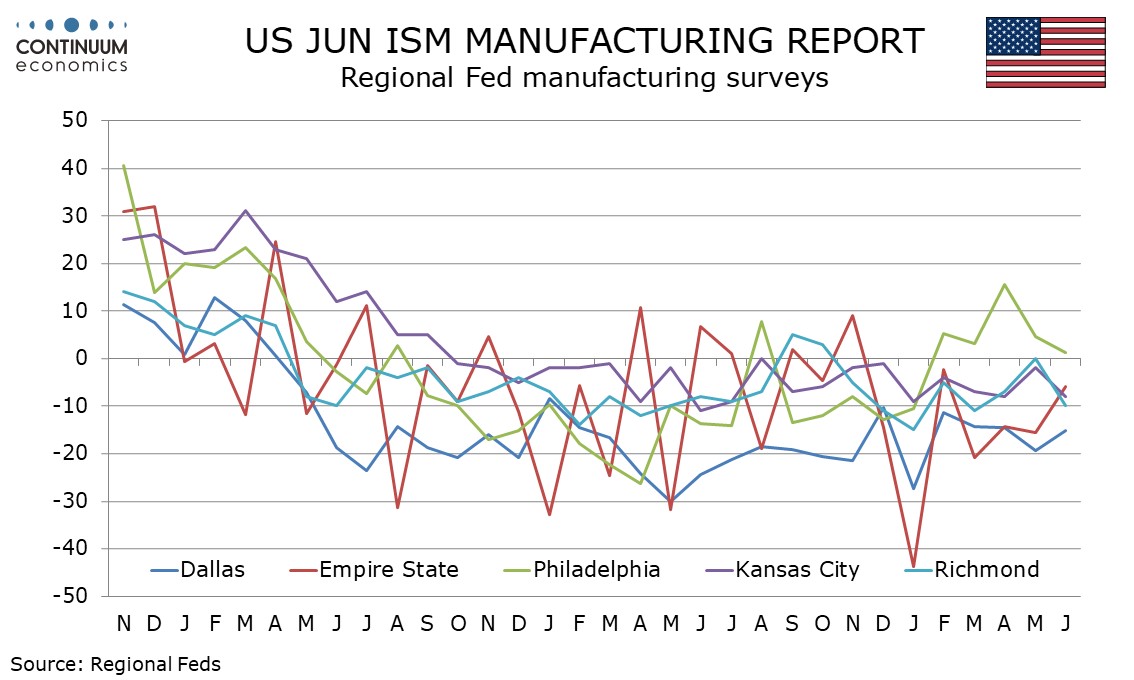

A stronger Markit manufacturing PMI in June is the main justification for a stronger ISM index. Regional Fed manufacturing surveys have been mixed, with the Philly Fed’s less positive, the Empire State and Dallas Fed data less negative, but slippage seen from the Richmond and Kansas City Feds. The Chicago PMI was significantly less negative, but still weak.

Improvement in the ISM index is likely to be led by new orders which slipped sharply in May to a 12-month low of 45.4. We expect marginal gains in production, deliveries and inventories, but a correction lower in employment, after a May bounce above neutral for the first time since September 2023.

Prices paid do not contribute to the composite. Here we expect the index to remain at May’s level of 57.0 after a correction lower from April’s 60.9 which was the highest reading since June 2022.