Published: 2023-12-13T14:15:42.000Z

Preview: Due December 15 - U.S. November Retail Sales - Autos and gasoline to fall, modest gains seen elsewhere

-

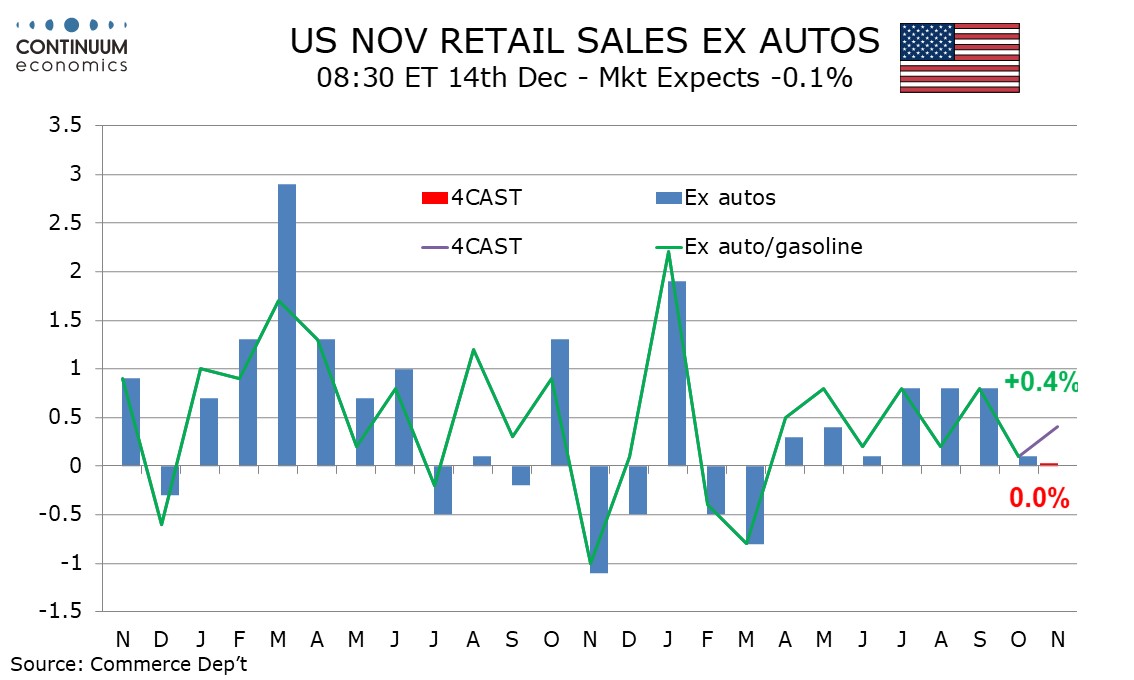

We expect a second straight 0.1% decline from November retail sales, assuming no October revision, with a flat outcome ex autos to follow a 0.1% October increase. However ex autos and gasoline to show a 0.4% increase, stronger than October's rise of 0.1%, suggesting the consumer still has some momentum.

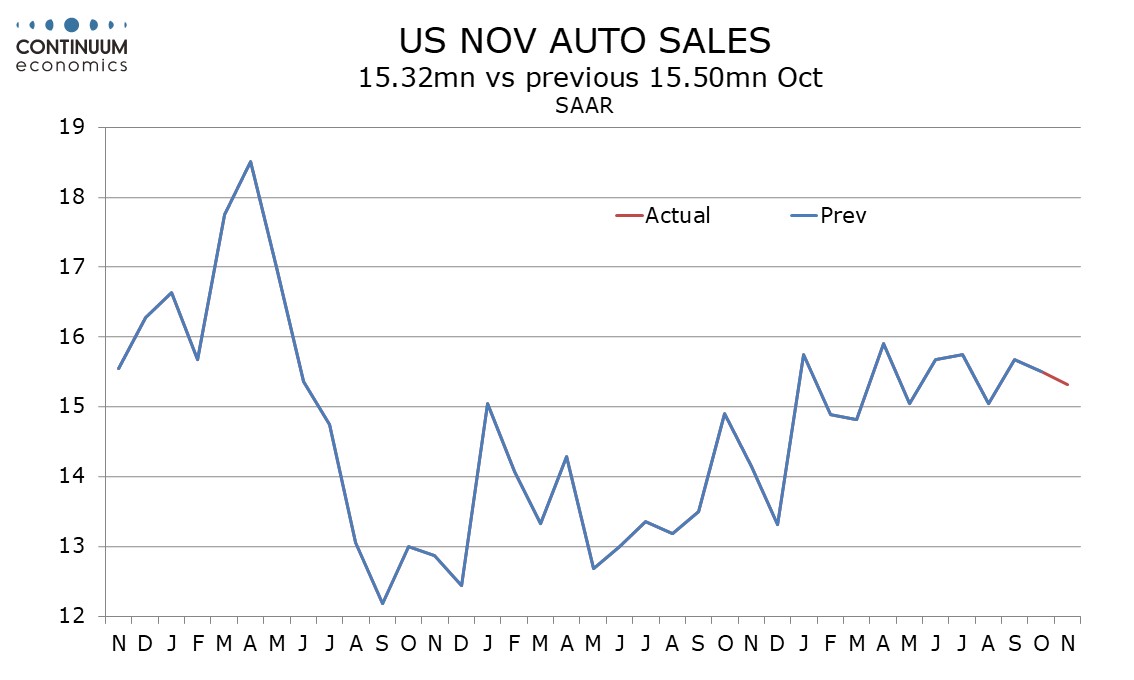

Industry data shows a second straight modest decline in auto sales though trend in auto sales has been fairly flat through 2023 to date.

Gasoline prices are lower for the second straight month and this is likely to bring a decline in gasoline sales that surprisingly was not seen in October, when gasoline sales appear to have risen in volume terms.

October saw a weak 0.1% rise ex auto and gasoline after a strong 0.8% increase in September. The last six months ex auto and gasoline have seen the series alternate between strong gains (each of 0.8%) and weak ones of either 0.2% or 0.1%. A 0.4% rise would be in line with trend and consistent with a view that trend is likely to slow in the coming months.