Published: 2025-11-03T09:16:00.000Z

EUR flows: EUR generally softer as 1.1540 resistance level holds

1

EUR/USD extends modest downtrend

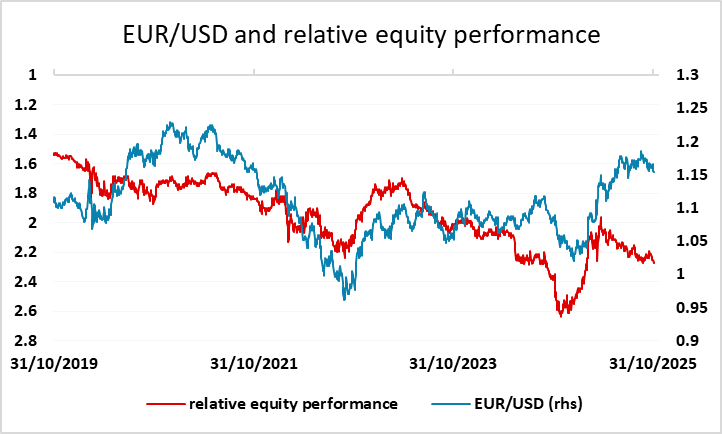

The EUR coming under some general pressure this morning after testing and failing to break back above the 1.1540 level in early trading. There is no obvious trigger for EUR weakness. The Eurozone final manufacturing PMI was the only Eurozone data of note and came in unrevised at 50.0. The strong EUR/USD gains from April which came on the back of the announcement of US residual tariffs were seen as reflecting a decision by international investors to shift away from the US towards the Eurozone, but the resilience of the US economy and equity market may be challenging this view, with US equities outperforming since then. The lack of US data makes any definitive judgement difficult, so downward pressure on EUR/USD seems likely to remain mild, but the tone remains negative, with the 1.14-1.15 area representing support.