JPY flows: USD/JPY spikes on suggestion BoJ won't hike in December, but...

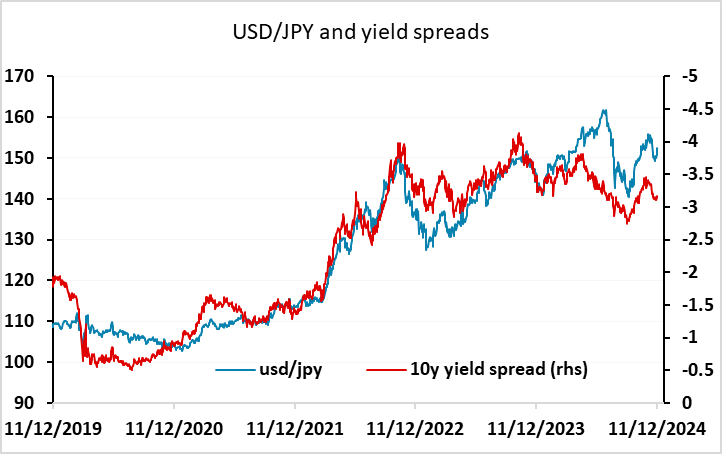

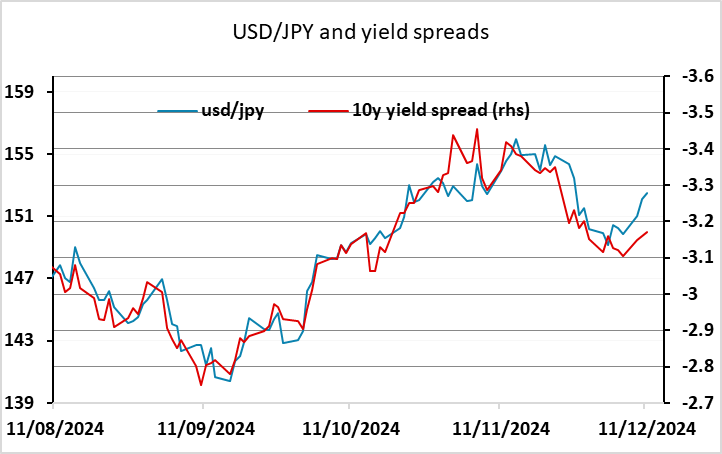

USD/JPY spikes a big figure after a Bloomberg story indicating BoJ official see little risk in waiting to hike rates, b ut yield spreads still suggest USD/JPY too high

USD/JPY has spiked higher on a Bloomberg report saying the BoJ see little cost in waiting for the next rate hike, and see less risk of a weak JPY pushing up inflation. While the report also says that some are not against a December rate hike, the JPY has fallen sharply, with USD/JPY up a big figure. The market is now only pricing 6bps of tightening for the December meeting, down from 10bps yesterday. However, there hasn’t been much impact on yields down the curve, and these are generally more correlated with the JPY in everything but the very short term. The short term correlation with 10 year yield spreads is still consistent with USD/JPY near 150, so we would be wary of the JPY move lower at this stage. Even if the BoJ don’t hike in December, spreads are likely to move in the JPY’s favour in the coming months, and already suggest scope for USD/JPY declines, with longer term spread correlations even more JPY positive.