EUR, SEK flows: SEK firm after higher CPI, German production disappoints

EUR/SEK dips after higher than expected Swedish CPI and weak German production data

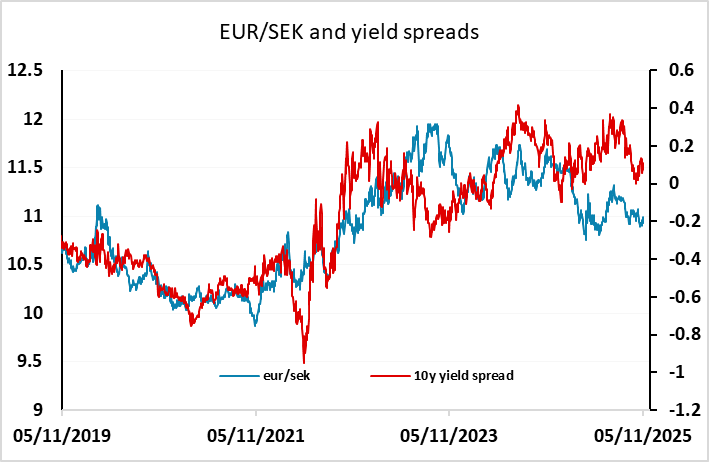

Stronger than expected preliminary Swedish CPI data for October have pushed EUR/SEK around 3 figures lower in early trade, trading to 10.97. The targeted CPIF measure was unchanged from September at 3.1% y/y, against a consensus expectation of a drop to 2.9%. In practice, this is still very unlikely to impact Riksbank thinking in the enar term, with little prospects of any change in the policy rate in the near future, so the EUR/SEK drop we have seen should extend much further. The SEK has in any case outperformed yield spreads this year, so further gains should be more of a struggle.

German industrial production data was weaker than expected in September, rising only 1.3% after a 3.7% drop in August, which was mostly due to seasonal maintenance and holiday shutdowns. While the 3m/3m trend remans reasonably solid, the numbers do create some concern about potential slowdown in manufacturing, although the auto sector did recover most of the sharp August decline. Nevertheless, for now we would see the data as choppy rather than clearly weak, and there is unlikely to be any significant FX impact.