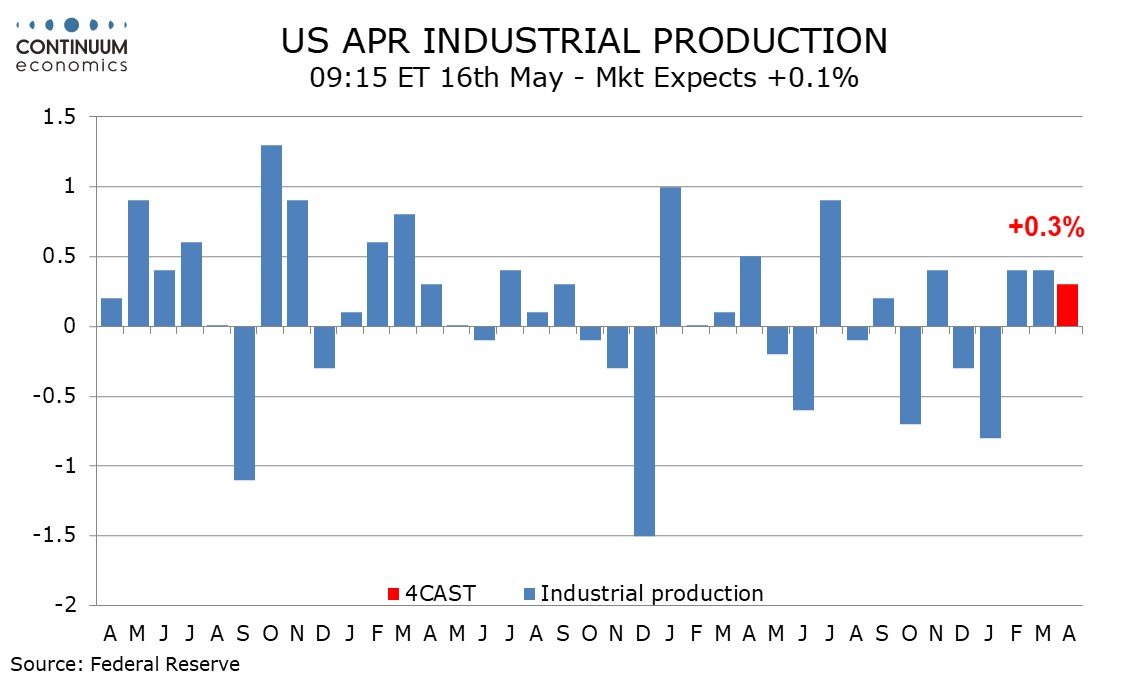

Preview: Due May16 - U.S. April Industrial Production - A modest rise

We expect April industrial production to rise by 0.3% overall with a 0.2% increase in manufacturing. We expect utilities output to provide a lift but negatives from mining and autos.

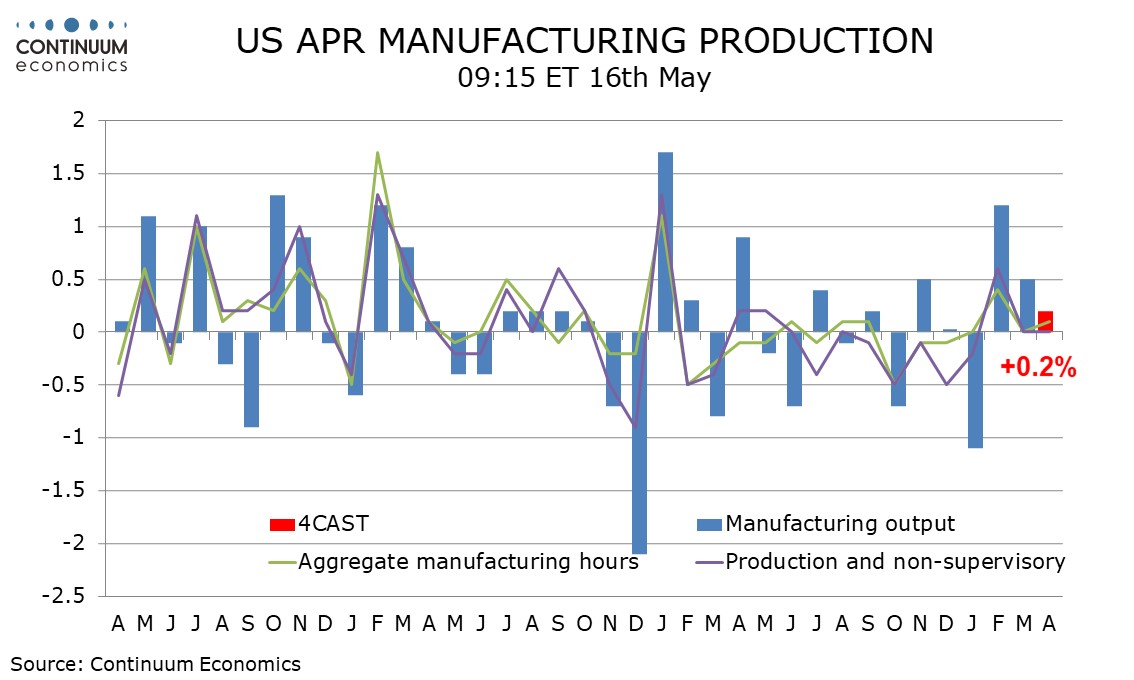

April’s non-farm payroll shows manufacturing employment up marginally but with a dip in autos and aggregate hours worked also up marginally, but unchanged for production and non-supervisory workers. The ISM manufacturing index corrected lower after moving above neutral in March.

We expect manufacturing output to increase by 0.2% after a 0.5% rise in March though ex autos we expect the gain to match March’s increase of 0.3%. Non-farm payroll aggregate hours worked data suggests a modest decline in mining but this should be outweighed by a rise in weather-sensitive utilities output, as implied by weekly data.

We expect capacity utilization to rise to 78.6% overall from 78.4% but with manufacturing unchanged at 77.4%. We are back near late 2023 levels after a significant dip in January but still well below levels seen in early 2023.