Published: 2024-02-06T14:21:30.000Z

Due February 15 - U.S. January Industrial Production - Rise seen solely on utilities

-

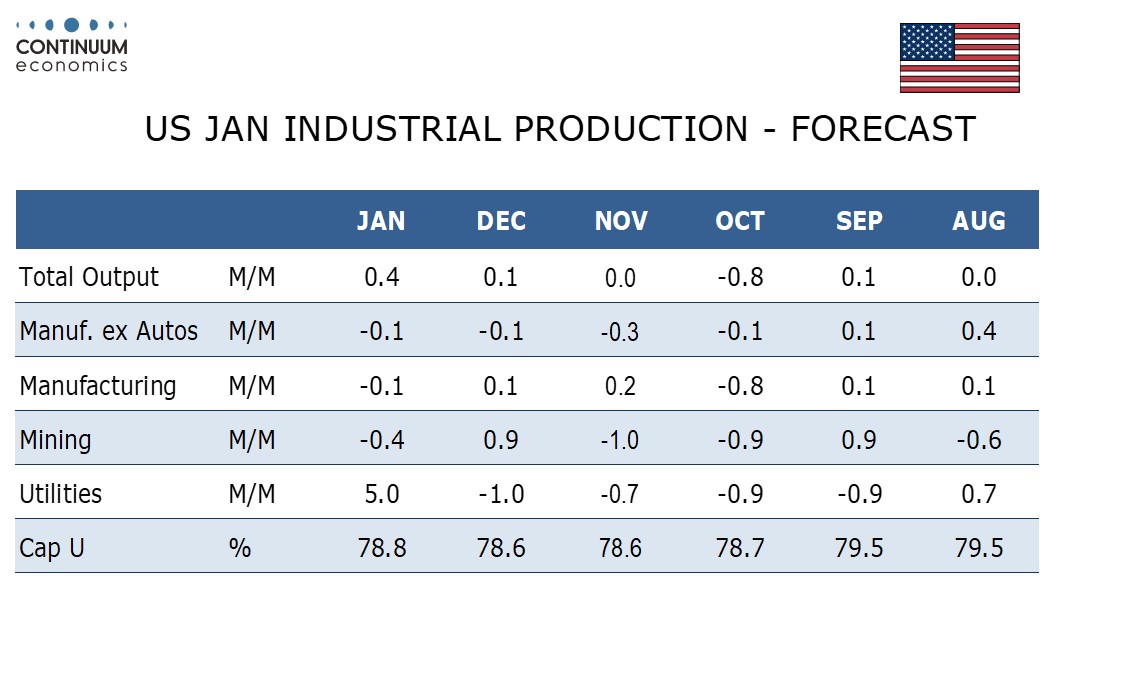

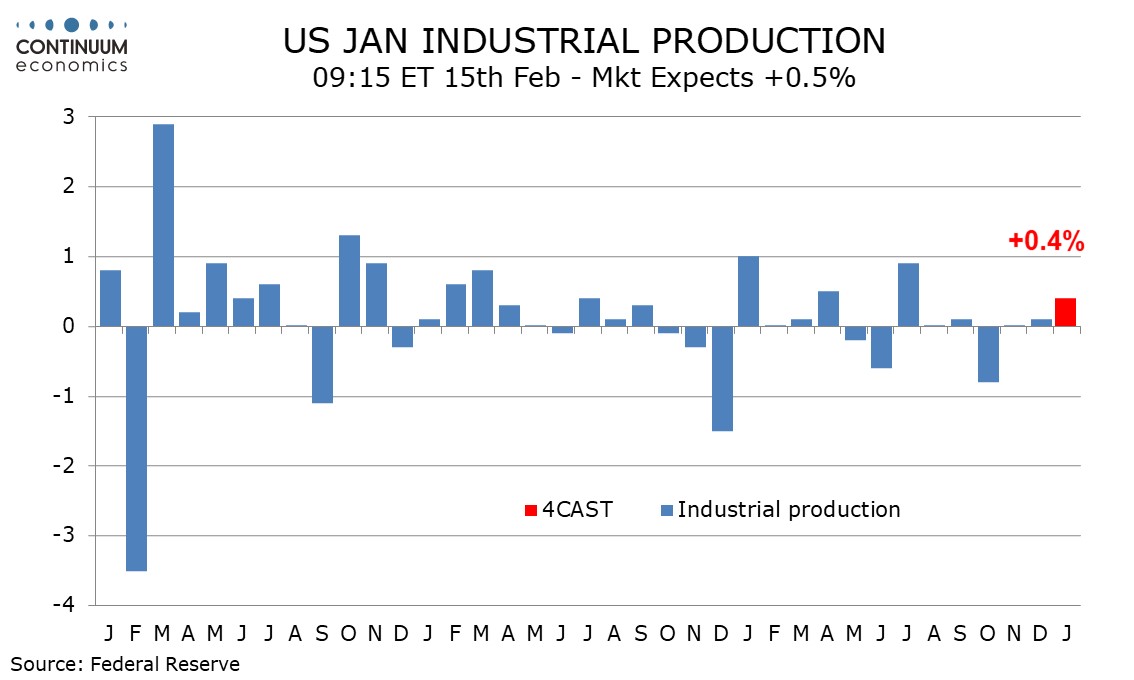

We expect January industrial production to rise by 0.4% but the increase will be fully due to a strong 5.0% rise in utilities due to cold weather.

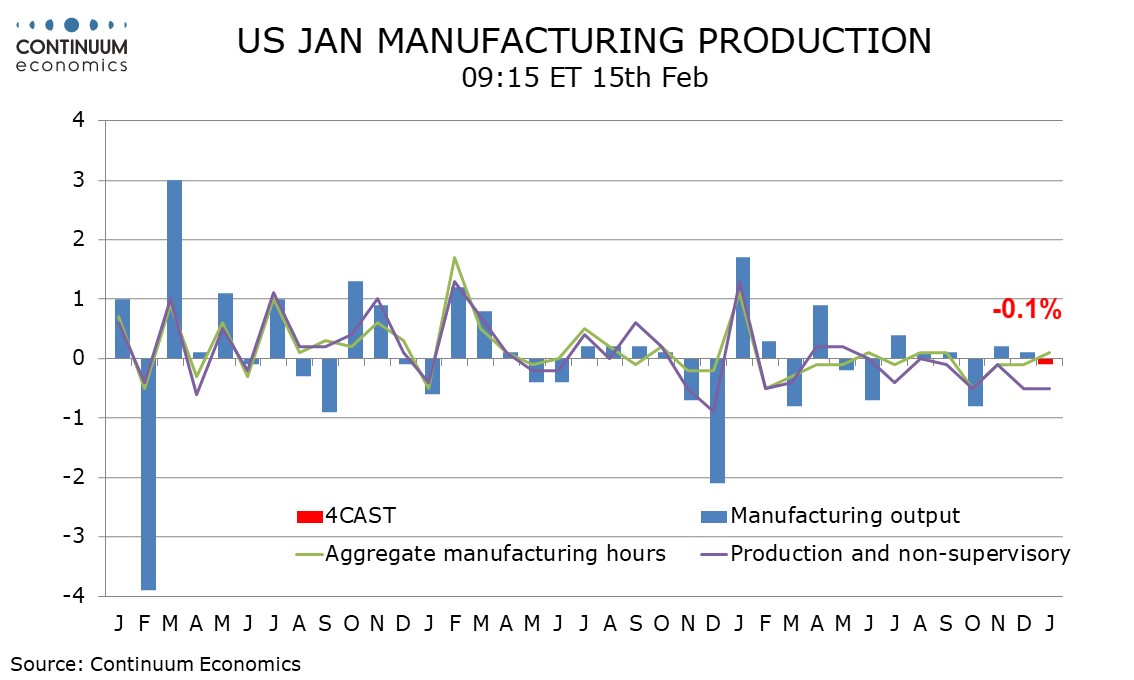

We expect manufacturing output to decline by 0.1%. This would follow two straight gains but those gains were fully due to autos which was recovering from strikes in October. We expect autos to be neutral in January, with manufacturing ex autos matching its 0.1% December decline.

Non-farm payrolls showed aggregate hours worked in manufacturing up by 0.1%, but for production and nonsupervisory workers a second straight 0.5% decline was seen, suggesting continued underlying weakness. ISM manufacturing data did however improve in January, contrasting most regional surveys.

Payroll aggregate hours data suggests weakness in mining, which we expect to decline by 0.4%. We expect capacity utilization to rise to 78.8% from 78.6% overall but to fall to 77.0% from 77.1% for manufacturing. Trend in capacity utilization is moving lower.