GBP flows: EUR/GBP edging lower but UK labour market data neutral

EUR/GBP decline likely to stall near 0.84.

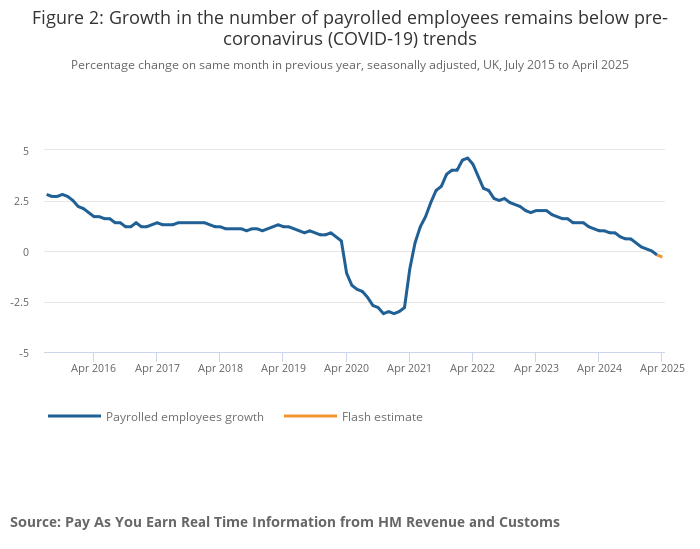

EUR/GBP is not much changed in response to mixed UK labour market data this morning. The employment data was on the weak side of consensus, both in the ONS and HMRC measures, but the earnings data was slightly on the strong side in both measures, although excluding bonuses, earnings on the ONS measure were slightly below expectations at 5.6% in March, down from 5.9% in February. The HMRC measure showed earnings growth rise to 6.4% in April from 5.9% in March, but payrolled employment continues to fall on the HMRC measure, down 33k in April after a 47k fall in March and a 27k fall in February. The ONS measure still shows employment rising 112k in the 3 months to March (this includes self-employment).

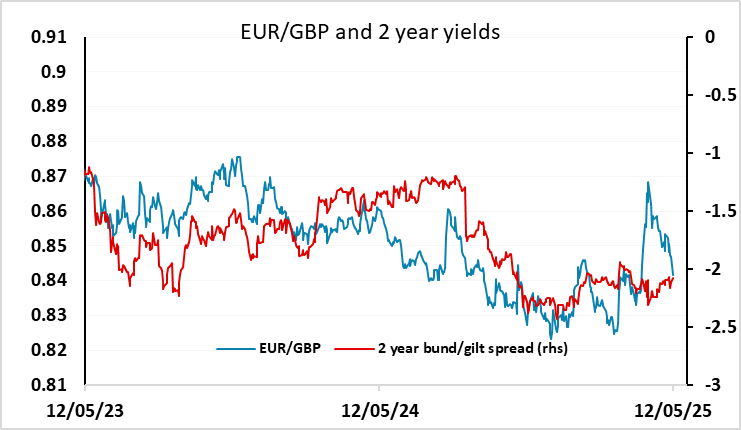

The data will probably not significantly change the stance of most UK MPC members. The strength of earnings growth despite relatively weak employment growth will maintain the concern that the hawks have about persistent inflationary pressures, while the weakening employment picture and slow decline in earnings growth will support the dovish case. As it stands the market is priced for two more cuts this year, with the next likely to be in August, and while we see some scope for a larger move, today’s data is unlikely to change that picture. While EUR/GBP is still showing some downward momentum, it has now fallen back to levels seen pre-tariff announcement and is broadly in line with the historic yield spread correlation, so the short term picture should now be quite neutral with 0.84 likely to be difficult to break below.