Preview: Due April 1 - U.S. March ISM Manufacturing - Seasonal adjustments more suportive

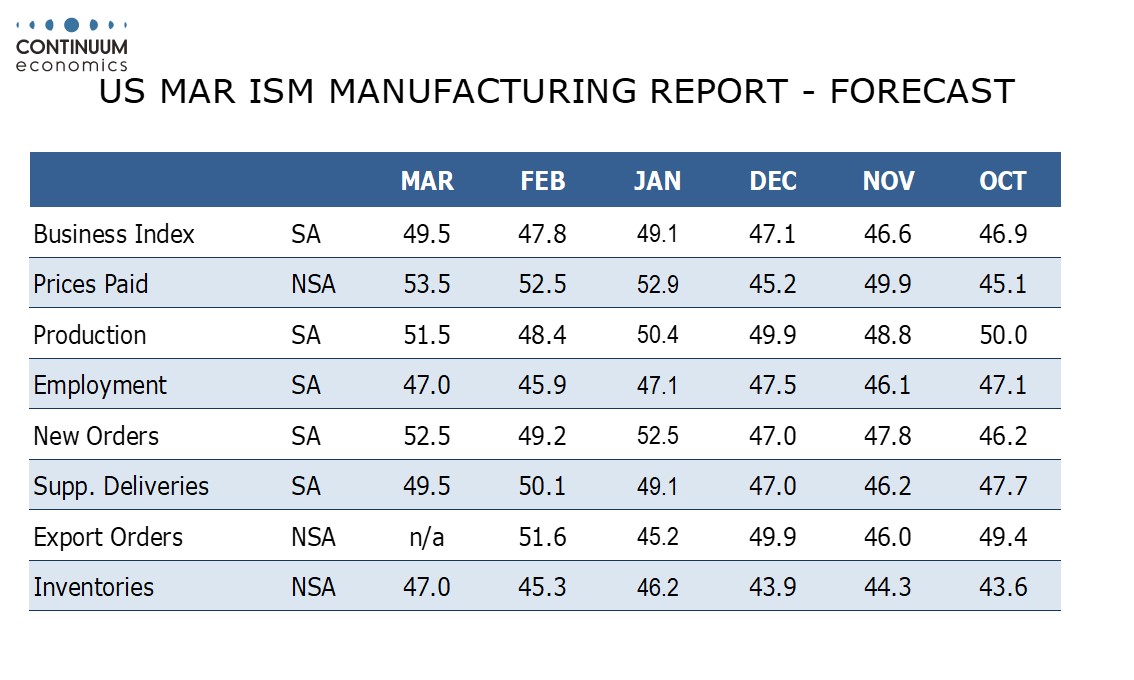

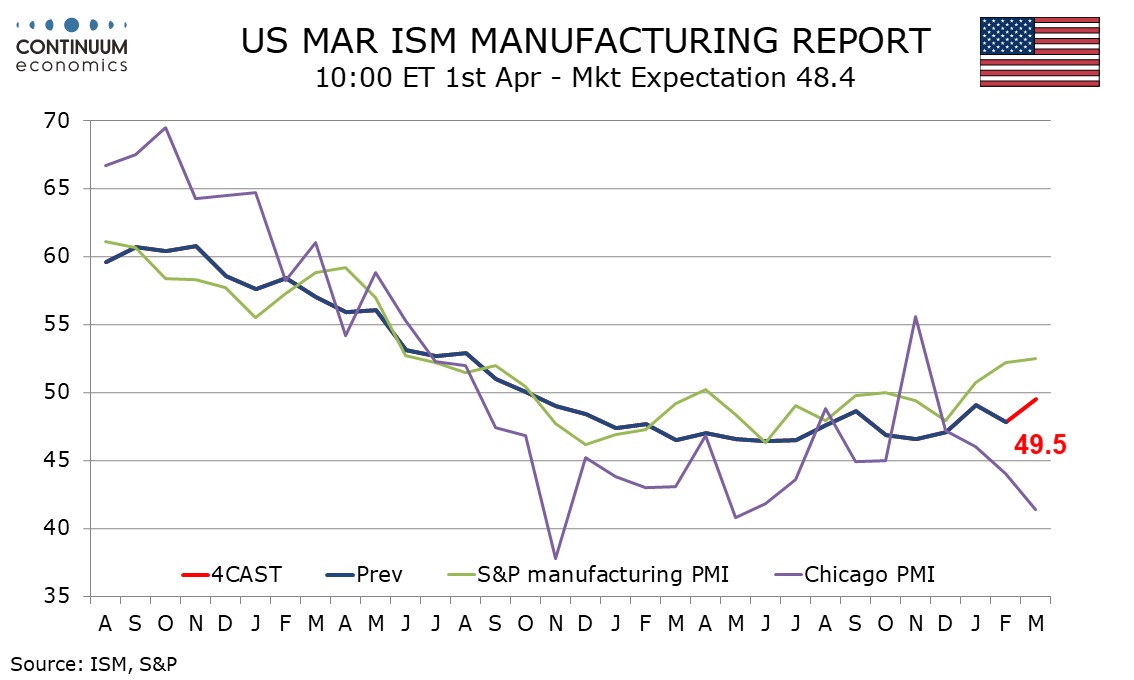

We expect a March ISM manufacturing index of 49.5, which would be the strongest since October 2022, and up from 47.8 in February though only marginally above January’s 49.1.

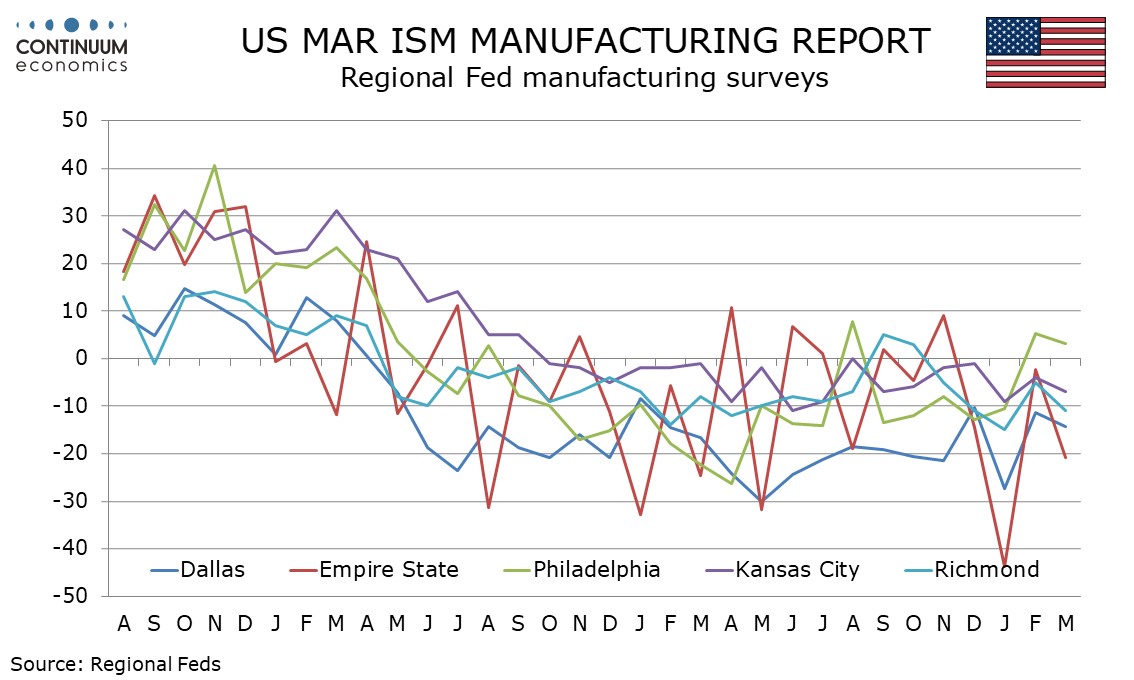

Slippage in the ISM manufacturing index is February contrasted generally stronger data from the S and P manufacturing PMI and the regional Fed surveys, and was probably due in part to tougher seasonal adjustments. Seasonal adjustments are more supportive in March. The S and P manufacturing PMI has continued to improve though the regional Fed surveys have corrected from improved February data, and the Chicago PMI was very weak.

We expect four of the five components that make up the ISM’s composite to show improvement, the exception being delivery times which was the one component to improve in February. March seasonal adjustments should provide support to new orders, production and inventories. Employment has less supportive seasonals but a correction from a very weak February is likely.

Prices paid do not contribute to the composite and are not seasonally adjusted. Here we expect a increase to 53.5 from 52.5, which would be a third straight positive and the highest reading since July 2022.