EUR, SEK, NOK flows: SEK softer after CPI, EUR unchnaged despite strong German orders

Weak Swedish CPI barely makes a dent in recent SEK strength, but NOK/SEK looks cheap. German orders very strong in November but volatile

Swedish CPI

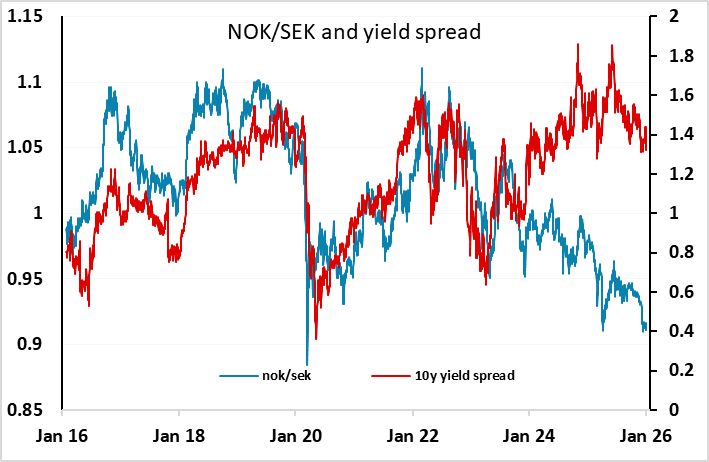

Preliminary Swedish CPI has come in well below consensus for December triggering a modest rise in EUR/SEK, but the gain is only around a figure and with EUR/SEK having been soft so far this week it barely makes a dent in the decline we have seen. While the trend in CPI does appear to be softening, the Riksbank is likely to require a lot more evidence to consider easing policy, especially since the preliminary CPI data has been revised in the past. For those looking for a weaker SEK, we see NOK/SEK as much the best trade, with attractive yield spreads and the drop to 0.91 seen yesterday representing excellent long term value.

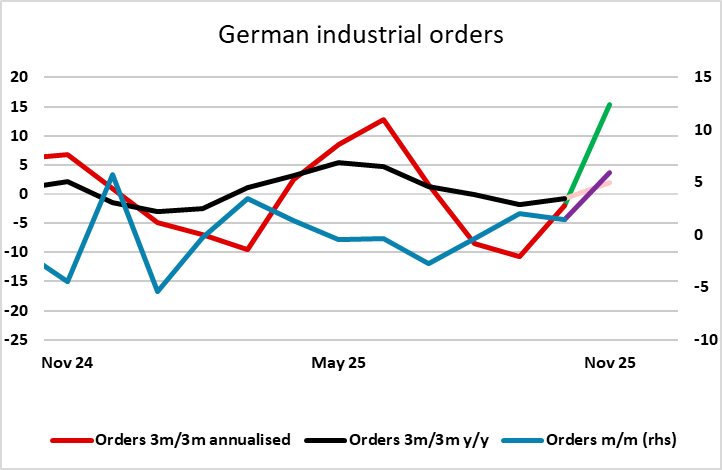

German factory orders have also been released this morning, and have shown a huge 5.6% gain on the month. The data can be very erratic from month to month, so we would be wary of drawing conclusions at this stage. There has been no noticeable impact on the EUR, but given the softer tone to the European data of late, and the softer EUR tone the numbers may help to stabilise EUR/USD above support at 1.1650.