EUR flows: EUR slips on weak CPIs

French and German Janaury CPI both coming in below consensus

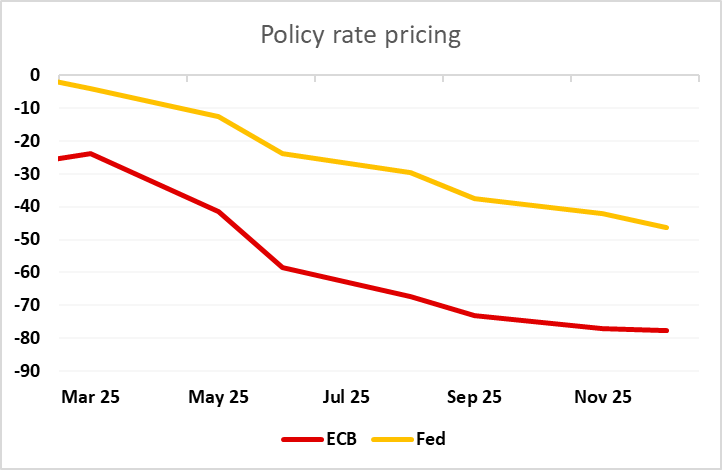

French CPI came in weaker than expected at -0.2% m/m on a HICP basis, and German state CPIs are coming in much weaker than expected as well. The consensus for German national CPI is for the y/y rate to be unchanged at 2.8% (HICP basis) or 2.6% (national basis). But the state CPIs are generally coming in weaker than expected, with the largest state NRW seeing a big decline in the y/y rate to 2.0% from 2.5%, while Bavaria and Baden-Wuerttemberg are also showing large declines in the y/y rates to 2.5% and 2.3% respectively, from 3.0% and 2.6%. While other (smaller) states are more mixed, this data suggests the national CPI will dip to 2.6% or below on an HICP basis. Along with the French data, this maintains the downward pressure on front end EUR yields, with EUR 2 year yields down 8bps on the day. The market is now pricing in 3 more 25bp rate cuts by year end.

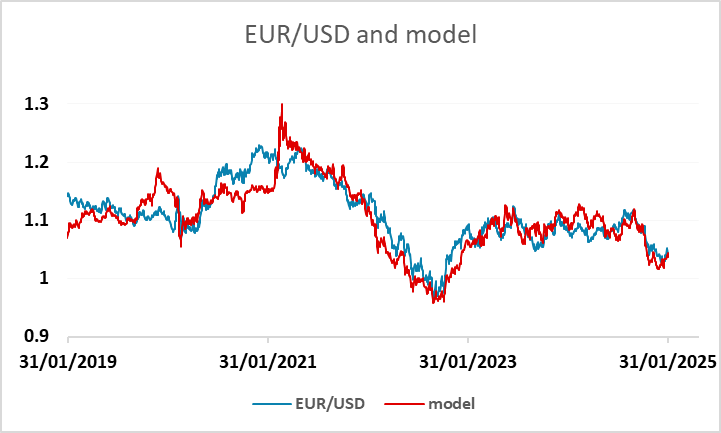

EUR/USD has lost ground as a result, with the 2 year spread with the US widening. But we still wouldn’t expect a further significant decline, as the lower yield structure will support European equities, which tends to be supportive for the EUR. Our model still suggests we will hold near 1.04.