Preview: Due May 31 - Canada Q1/March GDP - A stronger quarter assisted by the end of strikes

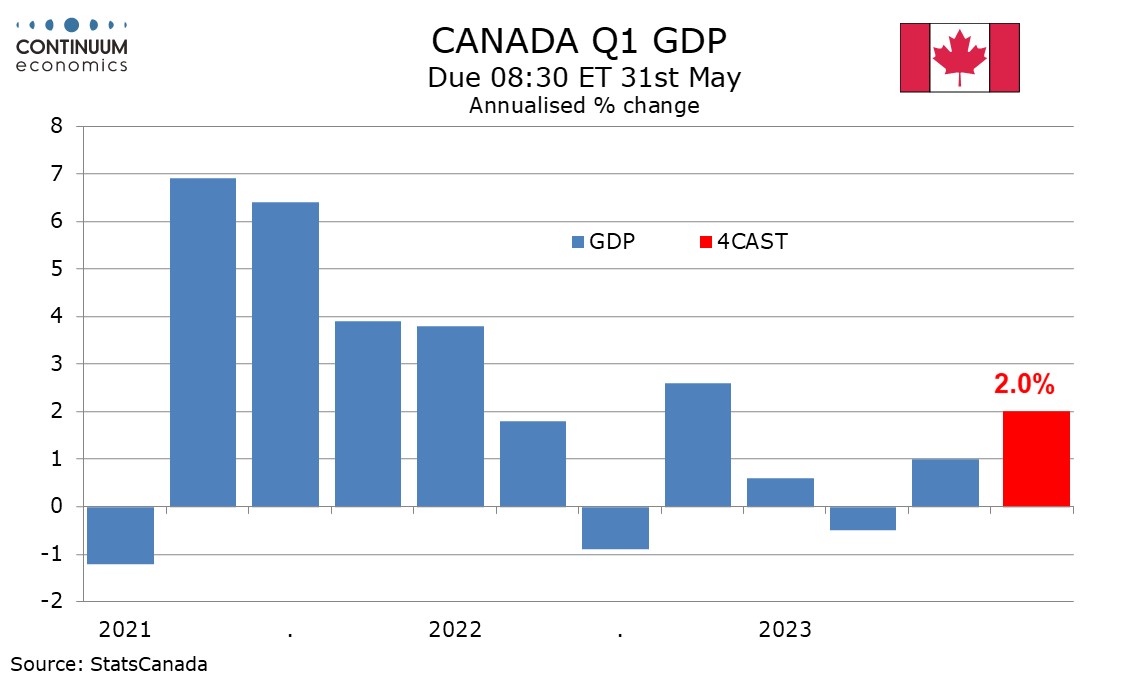

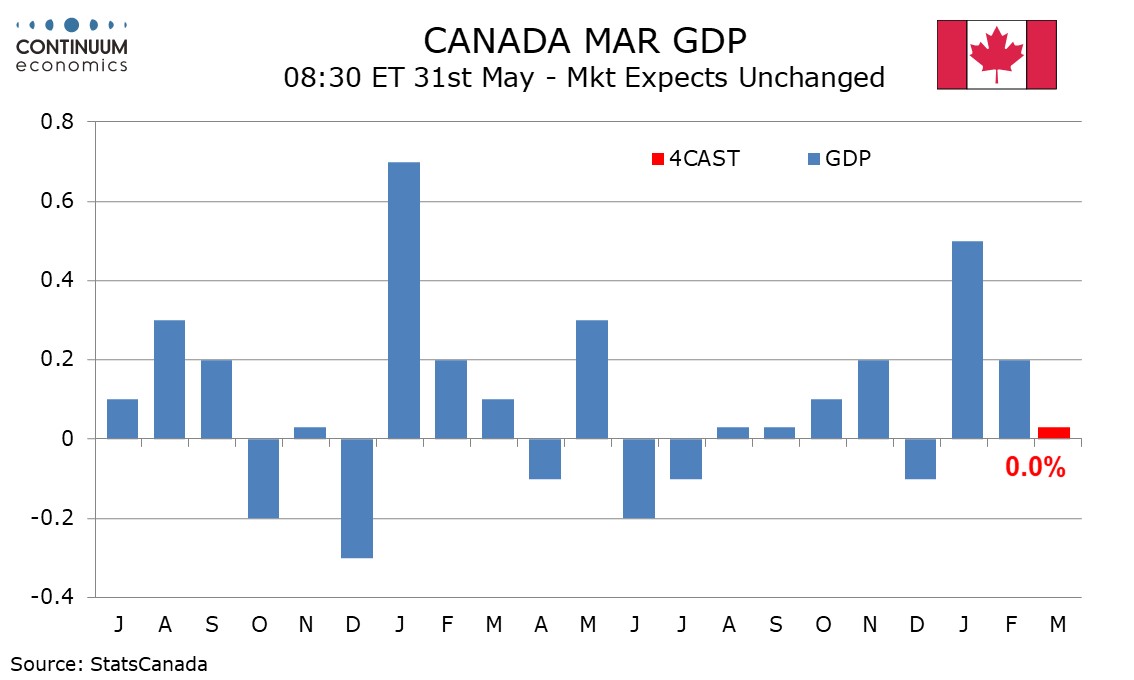

We expect Q1 Canadian GDP to rise by 2.0% annualized, a little above a 1.5% estimate made with the Bank of Canada’s April Monetary Policy Report. We expect an unchanged monthly total for March, with Q1’s growth inflated by a January rebound from a strike-depressed Q4.

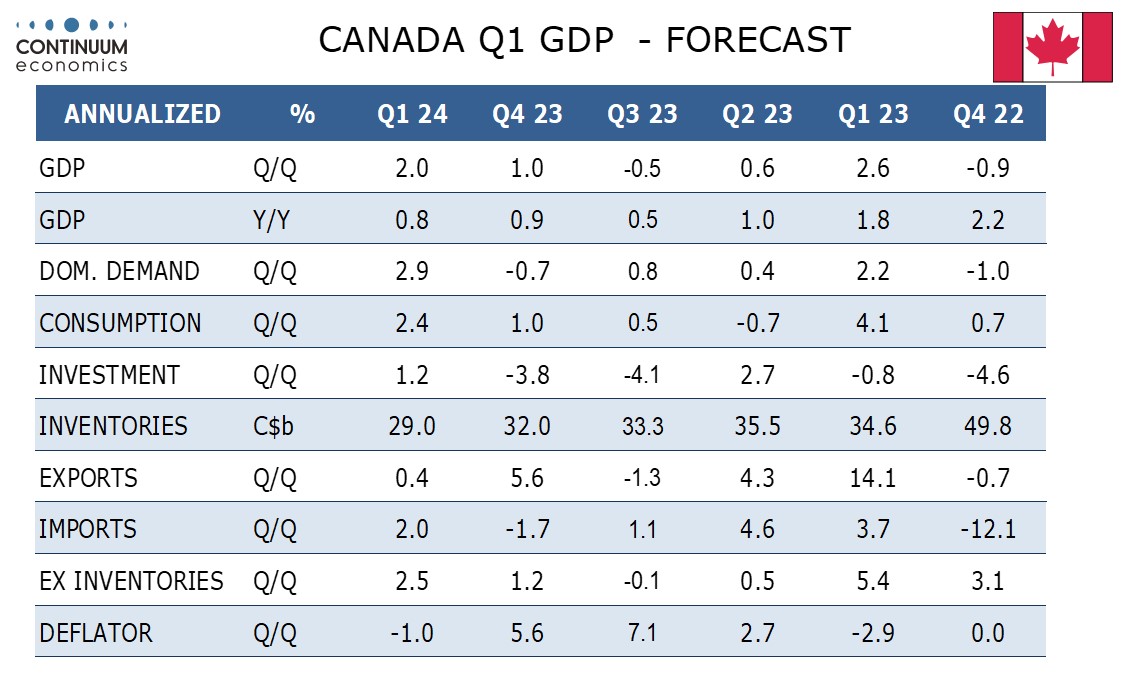

We expect modest negatives from inventories and net exports, and a 2.9% increase in domestic demand, though we expect that to be led by a strong rise in government due to the end of public sector strikes seen in Quebec in November and December. We expect a four quarter high of 2.4% from consumer spending ad a modest 1.2% rise in business investment after two straight declines.

We expect a decline of 0.2% (1.0% annualized) in the GDP deflator to follow two straight strong quarters on slowing CPI growth and a decline in export prices.

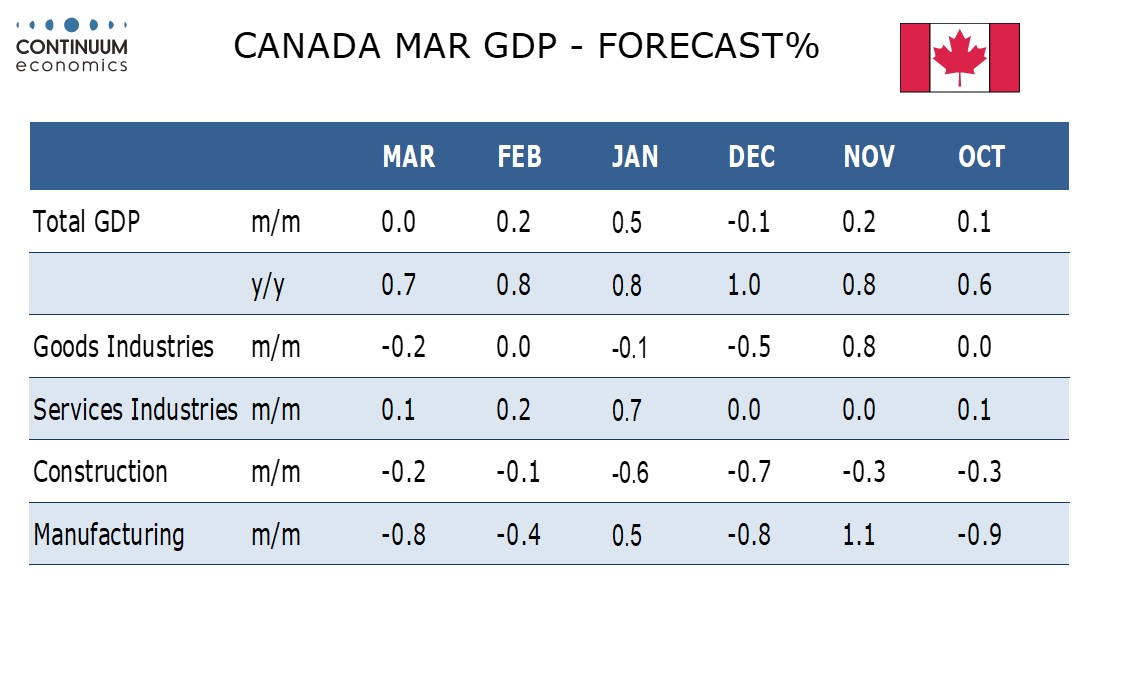

An unchanged March GDP would be consistent with the preliminary estimate made with February’s data. That would imply an annualized Q1 increase of 2.4% which is above our forecast, though modest downward revisions to February and/or the strong January could make the series consistent.

February’s report looked for March increases in utilities and real estate/retail/leasing and declines in manufacturing and retail trade. We expect a 0.2% decline in goods and a 0.1% increase in services.