EUR, CAD flows: EUR upside limited, CAD under threat

EUR upside limited by weak German data and political risk. CAD biased lower on weak GDP and tariff threat

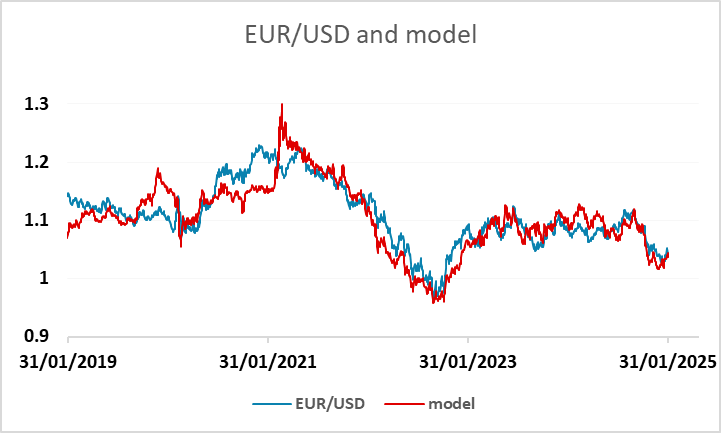

In the raft of data released in the last hour, most of it is in line with expectations. The German national CPI data came in much weaker than consensus at 2.3% y/y, as indicated by the state CPI data earlier, and although the HICP version was much higher and in line with expectations at 2.8%, hi looks likely to decline in coming months. This should mean EUR yields stay lower, maintaining some downward pressure on the EUR. However, the EUR continues to get some support from the solid equity market performance in Europe. This could come under threat with the German election next month, as well as potential tariff issues, so upside for the EUR looks quite limited.

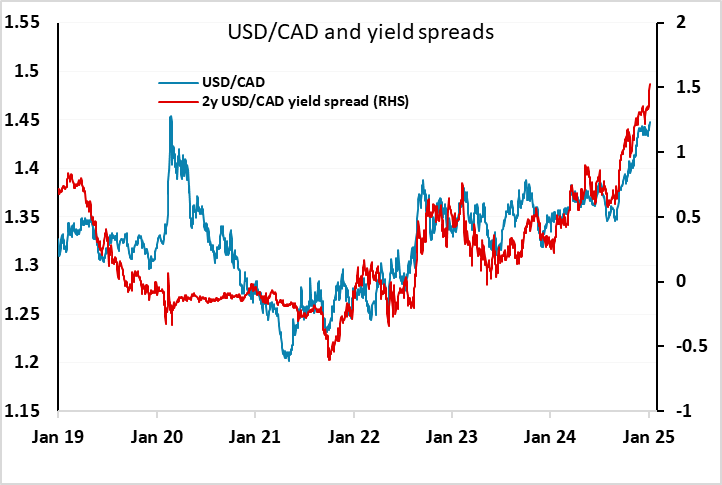

Otherwise, the US data was essentially as expected with most of the news already known after yesterday’s GDP data. But the weaker than expected November Canadian GDP data, showing a 0.2% decline, keeps the downward pressure on the CAD ahead of the tariff increase that is scheduled to come in on Saturday. If Trump goes ahead with this, there are further upside risks to USD/CAD, even if he excludes oil trade.