Preview: Due June 3 - U.S. May ISM Manufacturing - Neutral picture

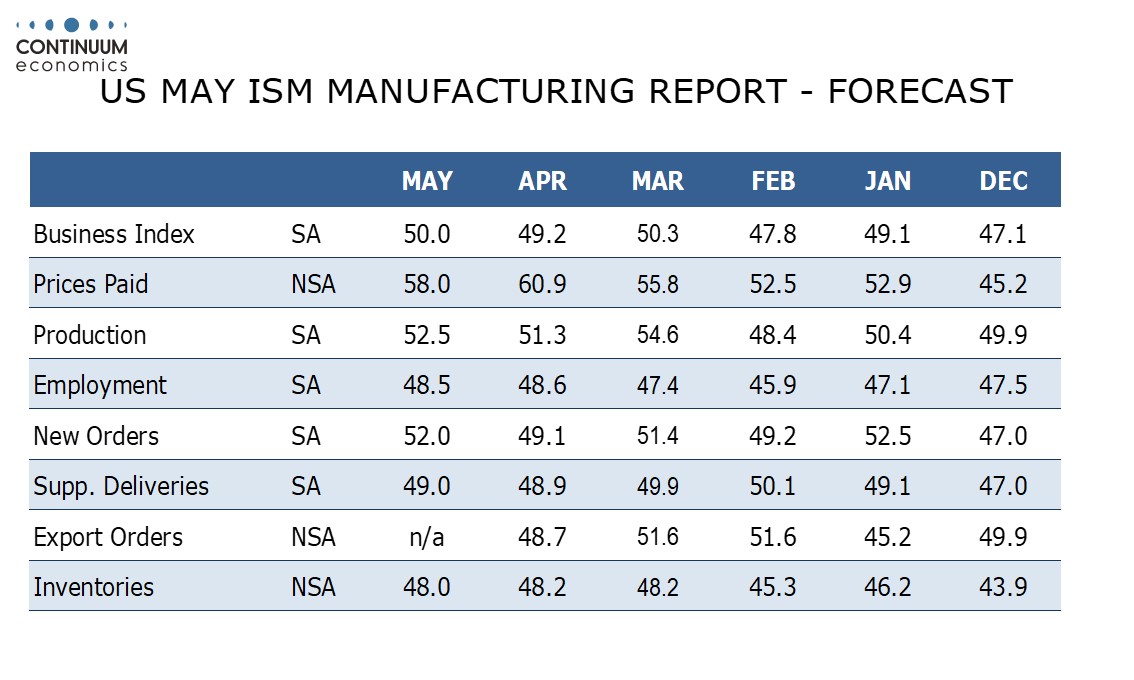

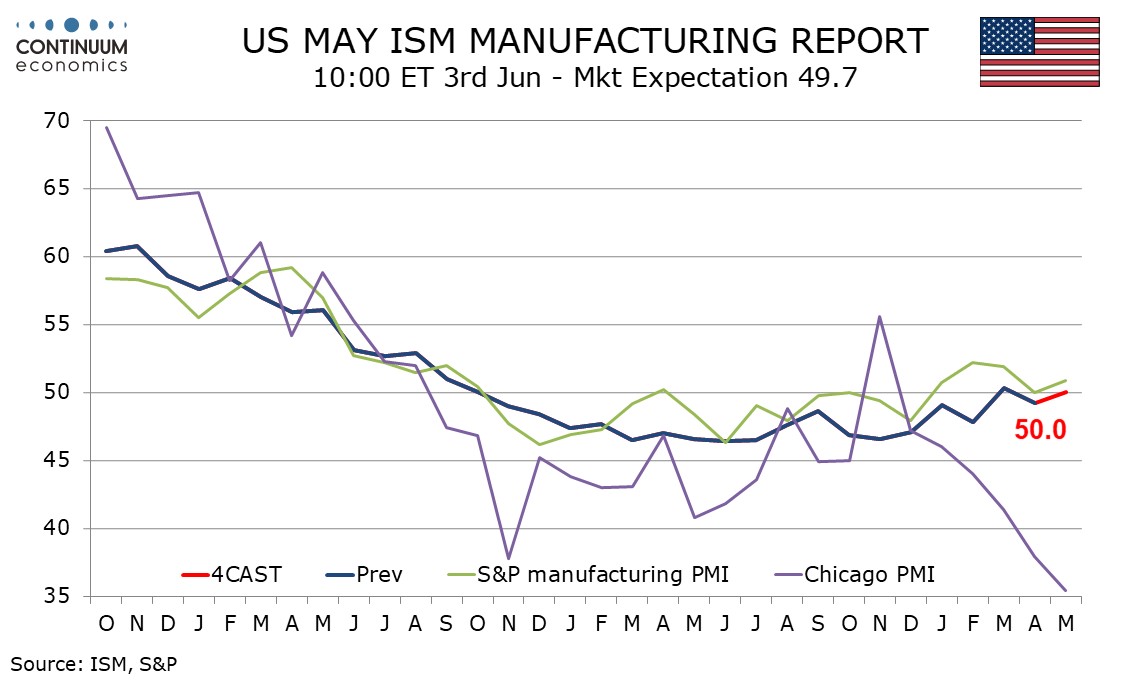

We expect a neutral May ISM manufacturing index of 50.0, up from 49.2 in April but below March’s 50.3, while maintaining an improved tone from the consistently moderately negative readings through 2023.

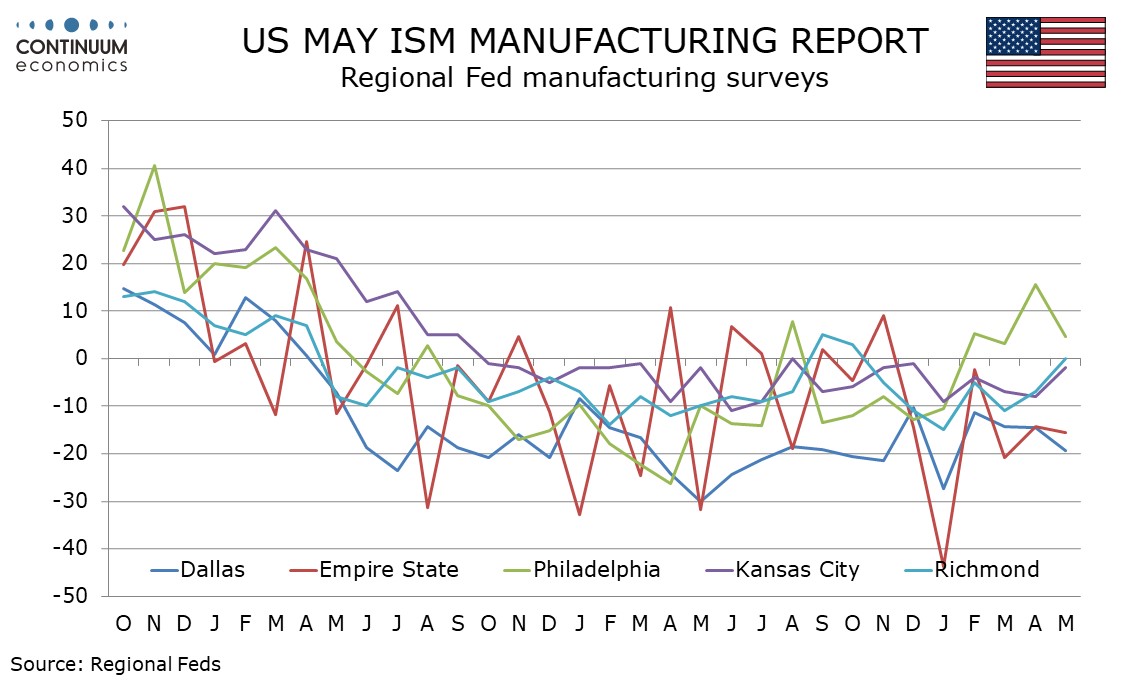

A slightly stronger reading would be consistent with the S and P manufacturing PMI. Regional Fed manufacturing surveys are mixed, with improved data from the Richmond and Kansas City Feds, weaker data from the Dallas Fed and Empire State survey, while the Philly Fed corrected from a sharp improvement in April. A very weak Chicago PMI looks like an exception.

We expect the ISM details to show modest improvements in new orders and production after slowings in April, but little change in the remaining contributors to the composite, employment, deliveries and inventories.

Prices paid do not contribute to the composite. Here we expect a correction lower to 58.0 after April at 60.9 versus 55.8 in March saw its highest reading since June 2022.