Preview: Due June 5 - U.S. May ADP Employment - Improvement in trend to start fading

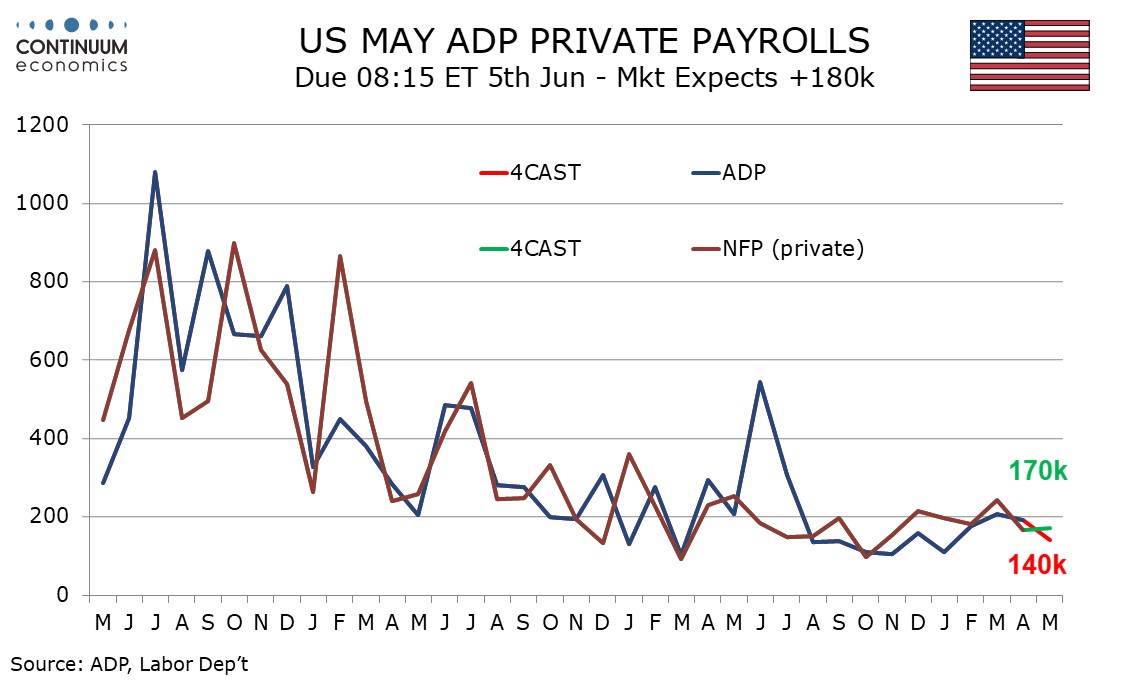

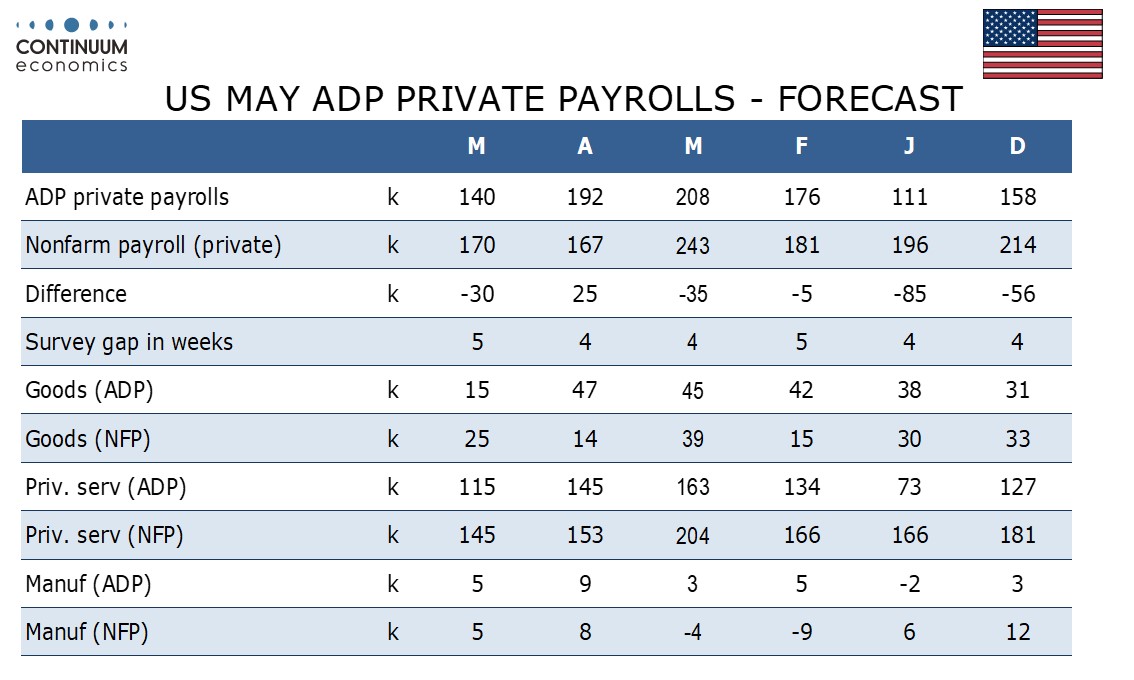

We expect a 140k increase in May’s ADP estimate for private sector employment growth, which would be the slowest since January and slightly softer than the 170k increase we expect for private sector non-farm payrolls. We expect overall payrolls including government to rise by 205k.

ADP data has seen some acceleration in recent months, the 3-month average increasing to 158k in April from 126k in January. However we believe the economy is starting to slow and while signals for labor market weakening are modest, cooler than usual weather in May could be an additional restraint.

Our 170k forecast for private sector payrolls is marginally stronger than April’s outcome of 167k which saw ADP data with a 192k March increase outperform the non-farm payroll for the first time in six months. We expect ADP to resume underperformance in April, with ADP’s April data, unlike that of the non-farm payroll, not appearing to be below trend.

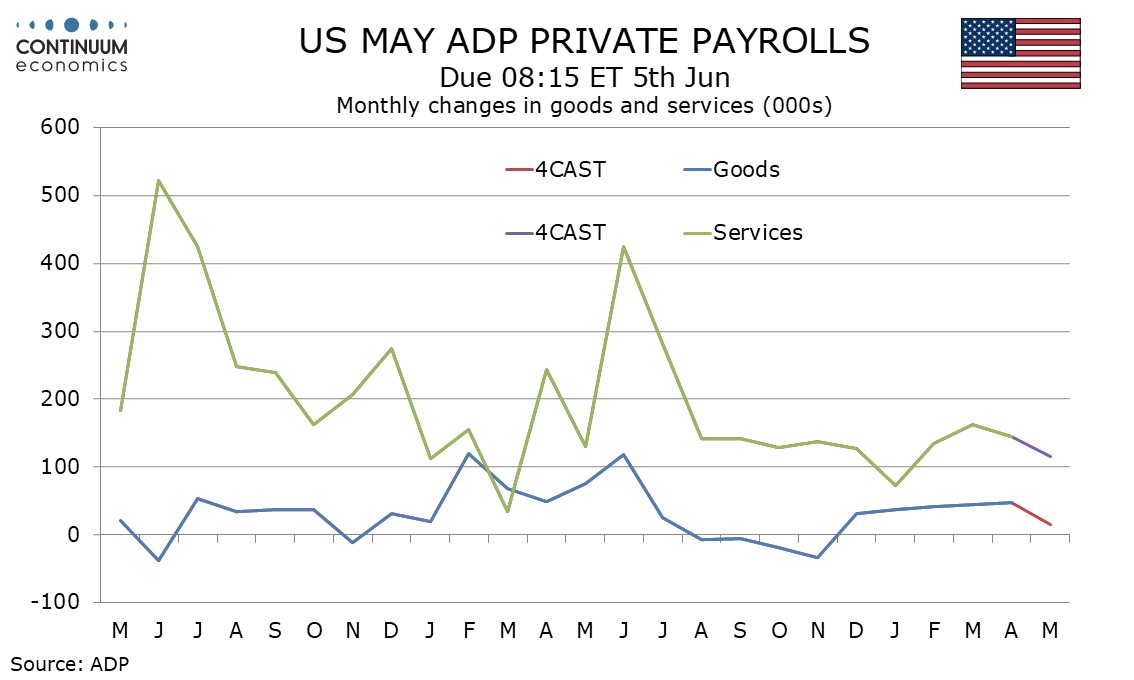

We expect May’s ADP detail to show slowing in two of the sectors that were strong in April, leisure and hospitality from 56k and construction from 35k. Both may be sensitive to weather. April’s ADP detail showed few clear signs of weakness and we expect that to remain the case in May.