U.S. April PPI - Worrying strength, even if surprise in part offset by March revision

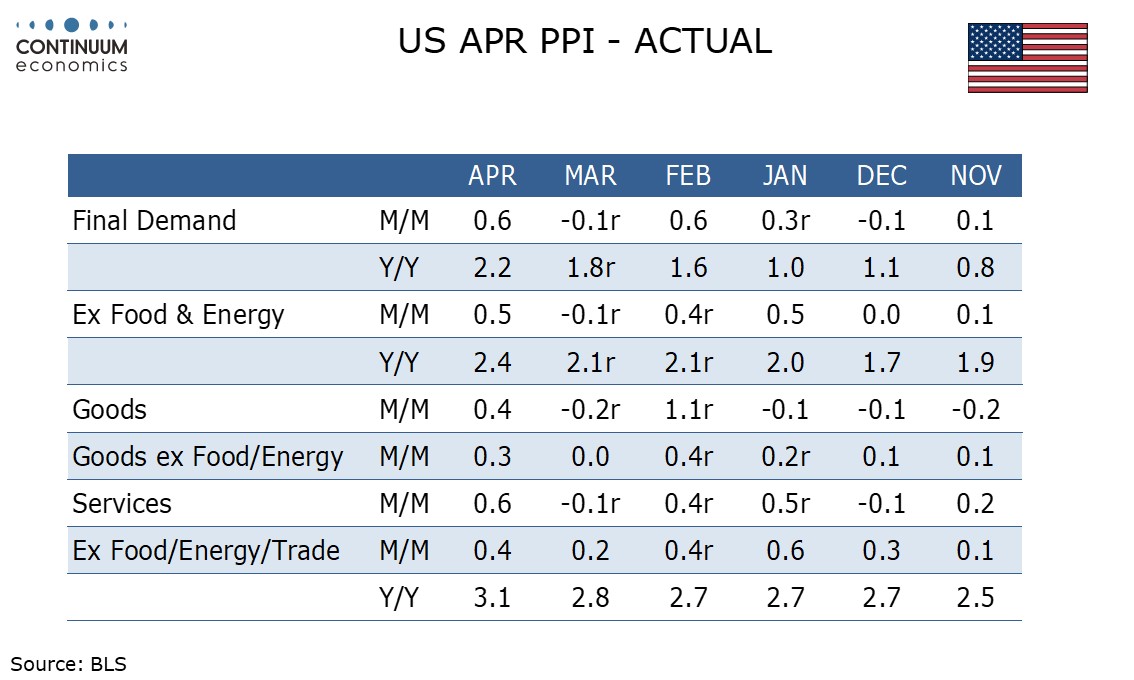

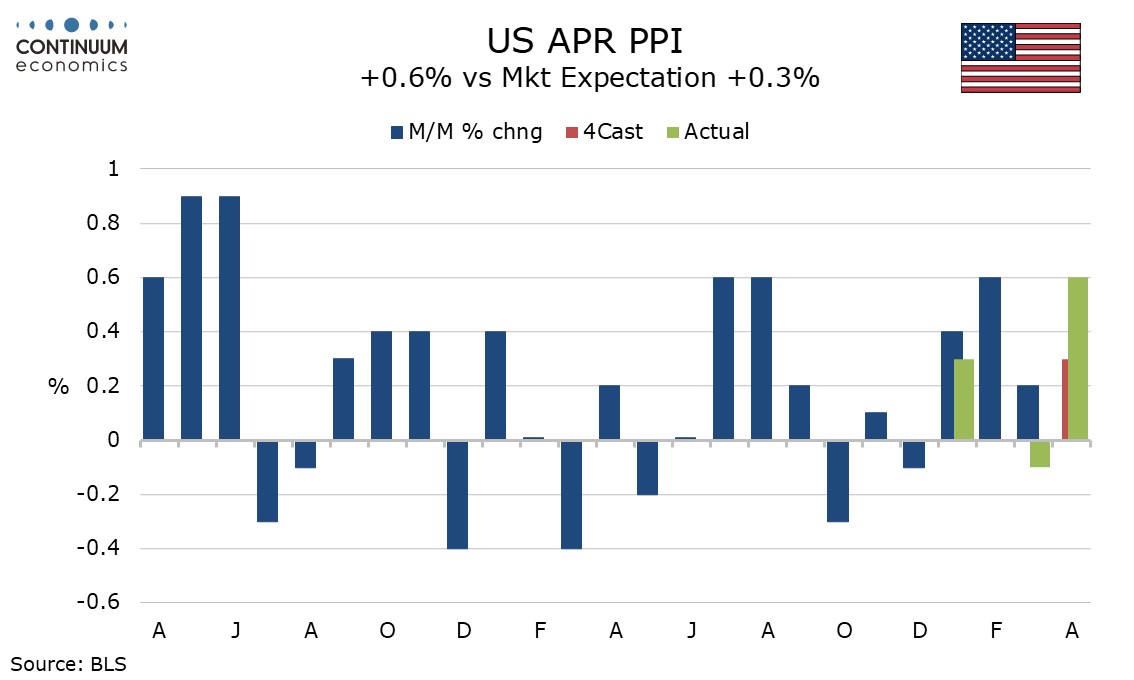

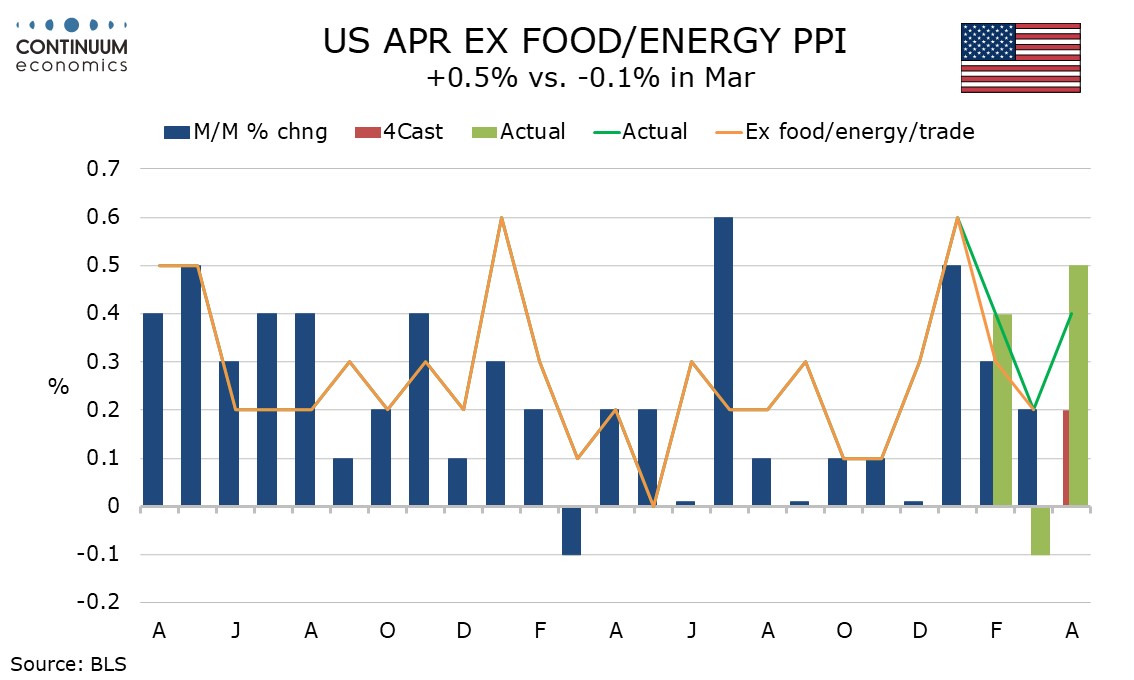

April PPI surprised on the upside with gains of 0.5% overall and ex food and energy, with ex food, energy and trade up by 0.4%. The upside surprise is however largely offset by downward revisions to March, both overall and ex food and energy to -0.1% from +0.2%, though March ex food, energy and trade remained unrevised at +0.2%.

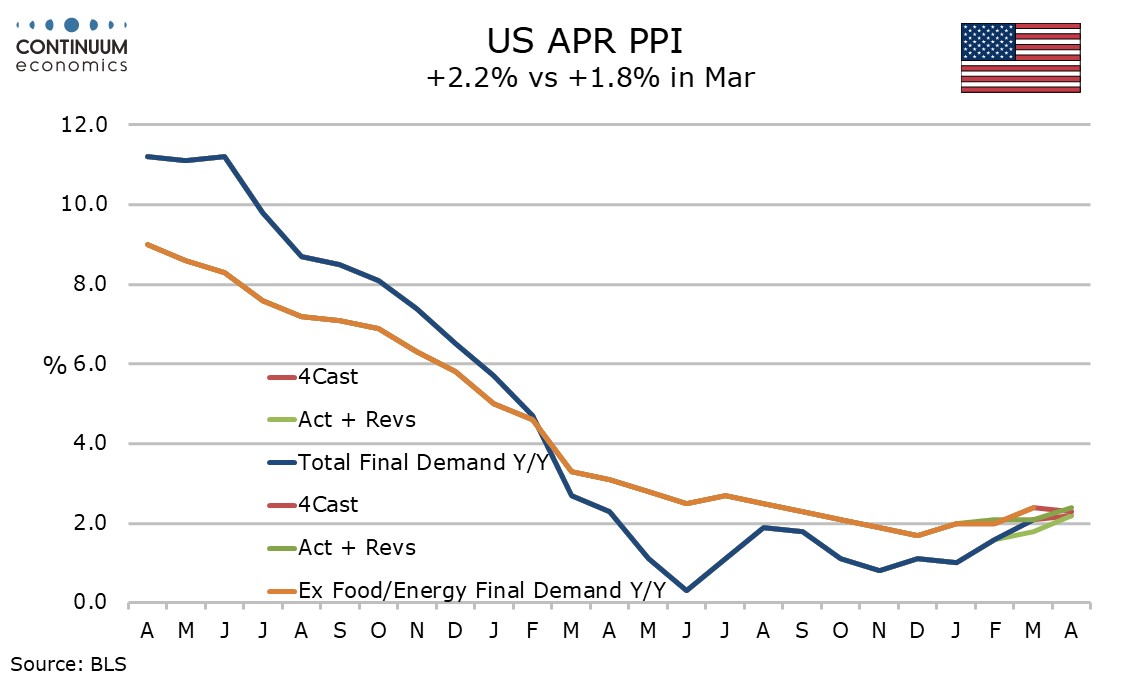

Yr/yr PPI at 2.2% was as the market expected with March revised down to 1.8% from 2.1%, while yr/yr ex food and energy at 2.4% was up from March’s 2.1% only because March was revised down from 2.4%. Ex food, energy and trade however the April gain of 3.1% versus 2.8% in March is a 12-month high.

Monthly detail shows a 2.0% rise in energy outweighing a 0.7% drop in food, while goods ex food and energy with a 0.3% rise rebounded from a flat April. Services with a 0.6% increase are the strongest since July 2023 but with mixed detail. Trade with a 0.8% increase corrected a 1.0% March decline but transport and warehousing at -0.6% was the weakest since May 2023. Other services were strong at +0.8%.

We have now seen three strong months out of four in 2024 to date, and the strength in April undermines our view that the strong January and, to a lesser extent, February data represented one-time New Year moves. Ex food, energy and trade PPI has increased by more than 0.3% in three of the last four months. In 2023 only January’s data managed such an increase. Even net of revisions, the data is worrying.

Intermediate PPI shows some strength in goods in April, processed goods up by 0.6% and 0.4% ex food and energy, and unprocessed goods up by 3.2% and 1.0% ex food and energy. Intermediate services with a 0.1% increase were however subdued and have been since a 0.8% surge in January.