Canada January GDP - Looking healthy ahead of the trade war

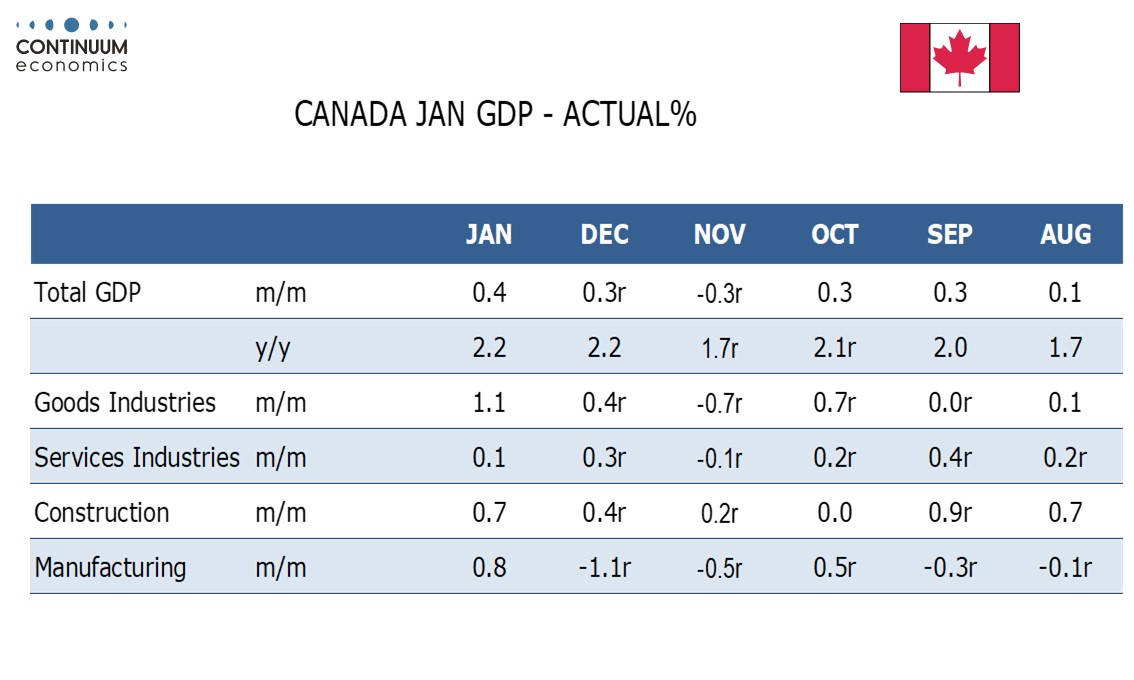

January Canadian GDP with a 0.4% increase was even stronger than the preliminary 0.3% estimate made with December’s report. Canada’s economy was clearly gaining momentum ahead of the emerging trade war. The preliminary estimate for February is unchanged. Negatives may follow as the trade war escalates.

If both February and March are unchanged that would see Q1 increase by a respectable 2.1% annualized, and March will have to be very weak indeed to produce a weak quarter. Before the trade war, Bank of Canada easing had clearly helped to revive what had been quite a subdued economy in early 2024.

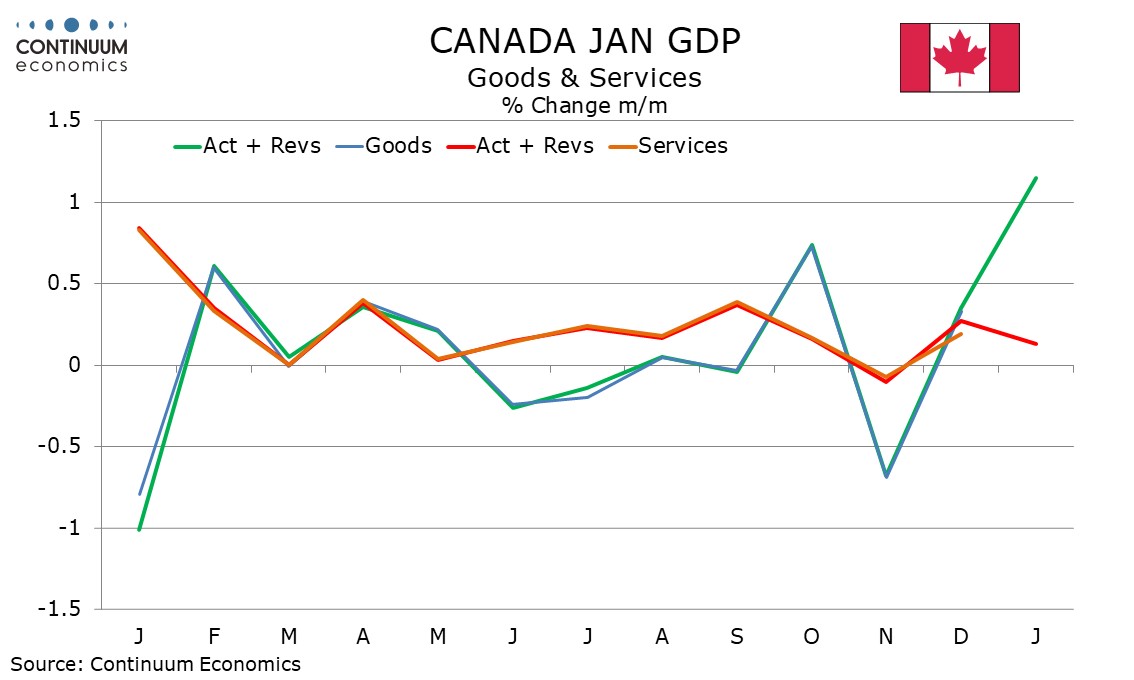

The January GDP gain was however less than broad based. Goods surged by 1.1% with utilities at 2.7% and mining at 1.8% particularly strong, though manufacturing at 0.8% and construction at 0.7% both saw solid gains. Services GDP rose by only 0.1%, though the main negative, a 0.9% drop in retail, followed a 2.8% rise in December. Yr/yr GDP was unchanged at 2.2%.

The preliminary estimates for February see gains in manufacturing and finance/insurance but weakness in real estate/rental/leasing, oil/gas and retail. Manufacturing may be accelerating output to beat tariffs.