Published: 2024-03-14T14:14:55.000Z

Preview: Due March 15 - U.S. February Industrial Production - Manufacturing to rise, utilities to fall, as weather returns to normal

Senior Economist , North America

1

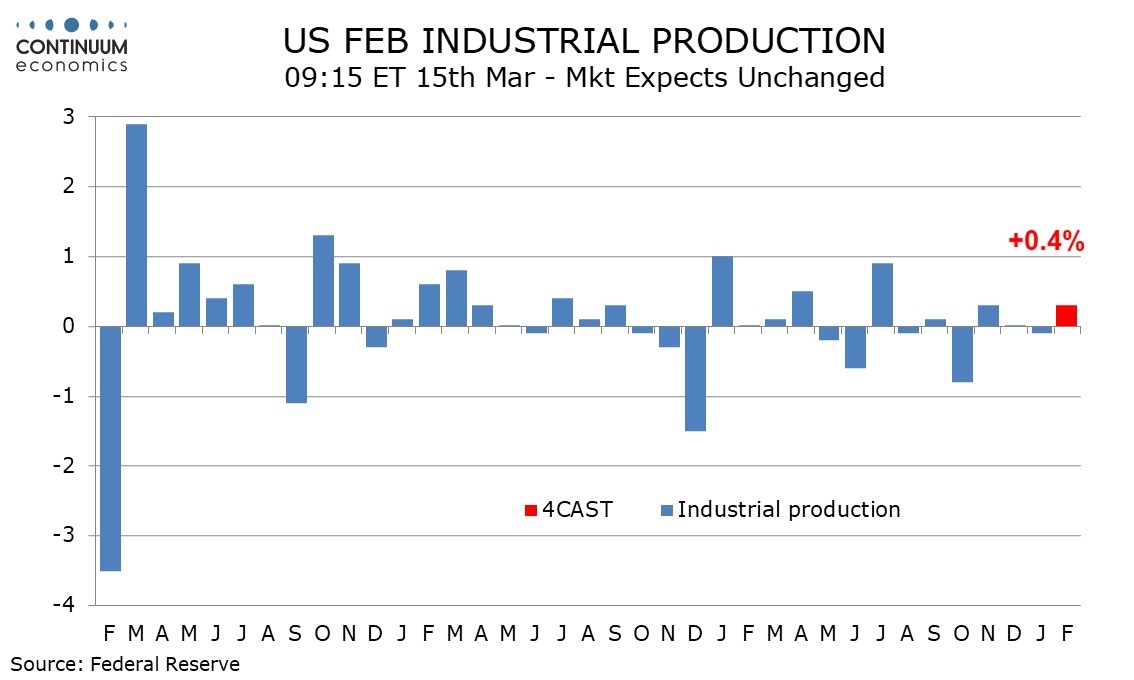

We expect February industrial production to rise by 0.3% after a 0.1% January decline with manufacturing up 0.7% after a 0.5% January decline. Bad weather depressed manufacturing and mining but inflated utilities in January.

February’s non-farm payroll shows a second straight modest increase in aggregate manufacturing hours worked but a strong rebound in production and non-supervisory after a modest January decline. This suggest a modestly positive underlying manufacturing picture and we expect January’s weather-induced dip in manufacturing output to be more than fully reversed.

This would hint at improvement in Q1 after Q4 data showed here straight declines in manufacturing output ex autos. In February we expect manufacturing ex autos to rise by 0.8% after a 0.6% January decline. Autos have now recovered from October’s strikes and are not likely to have a significant impact.

We expect mining to rise by 2.0% after a 2.3% January decline that was hit by weather, but we expect utilities to fall by 5.0% after a 6.0% January increase that was due to a mild December being followed by a cold January. February is likely to see a return to normal. We see capacity utilization rising to 78.7% from 78.5% in January with manufacturing at 77.1% from 76.6%, both returning to their December levels.